Analyst unveils surprising Nvidia stock price target after nearing record high

Here’s what could be next for the AI chipmaker.

Just three months ago, some investors were ready to give up on Nvidia (NVDA) after an underwhelming Q4 report and rising macro uncertainties. But the mood has shifted quickly, as a bunch of good news has flooded in over the past weeks.

On June 16, the Senate Finance Committee approved an amendment in its section of the 2026 budget bill that increases the semiconductor investment tax credit from 25% to 30%.

The act would benefit chipmakers like Taiwan Semiconductor Manufacturing (TSM) and Micron (MU) , as it would boost the value of their subsidies.

Nvidia may indirectly benefit from better pricing if those crucial players in Nvidia’s supply chain stand to gain.

Nvidia was among the tech stocks hit hard in early April as tariff tensions flared and the U.S. tightened export restrictions on advanced chips. The company took a $4.5 billion charge in the April quarter and said it would have made an additional $2.5 billion in revenue without the restriction.

The stock later rebounded after the U.S. and China agreed to slash tariff rates on each other temporarily. Optimism also grew after the Trump administration scrapped the Biden-era AI diffusion rule, another export control on advanced AI chips.

News in May that Nvidia will supply AI chips to Humain, a rising tech firm in Saudi Arabia, also gave the stock a lift.

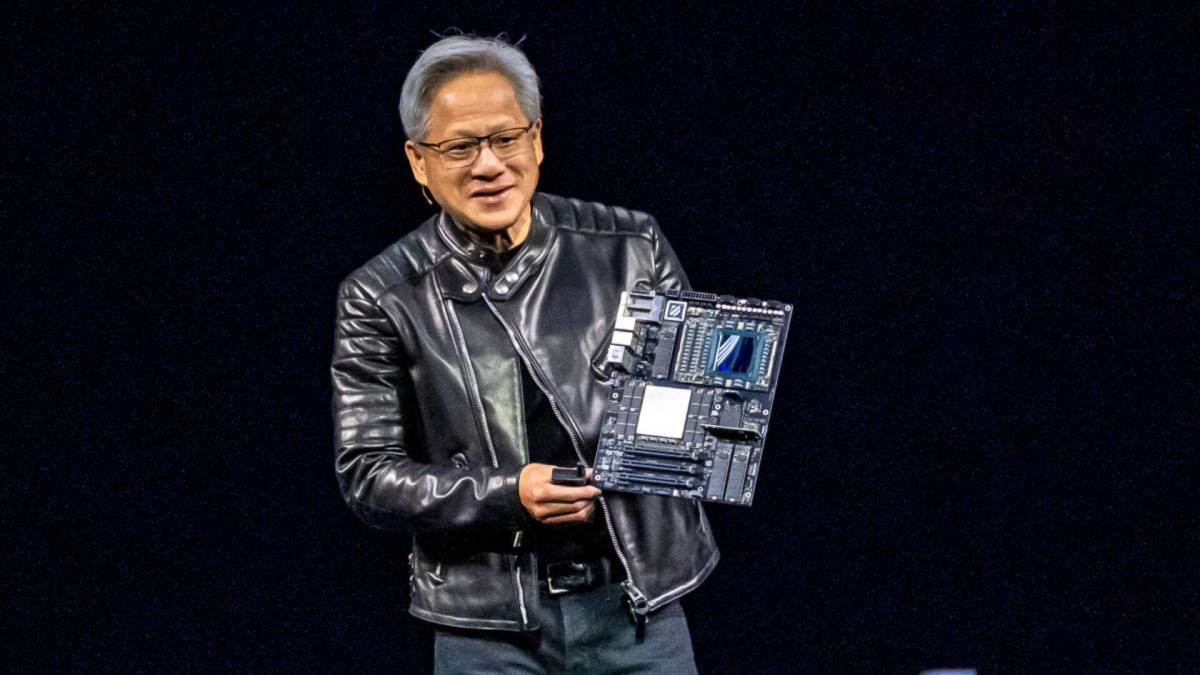

Nvidia stock closed at $144.12 on June 17, just shy of its all-time high of $149.41 posted in January. Image source: Morris/Bloomberg via Getty Images

U.S.-China tensions threaten Nvidia sales

On May 28, Nvidia reported strong fiscal first-quarter results. Adjusted earnings of 96 cents per share on $44.06 billion in revenue for its fiscal first quarter surpassed Wall Street’s expectations of 93 cents and $43.31 billion.

However, the company forecasts revenue of $45 billion in the July quarter, missing analysts’ projections by nearly $1 billion. The chipmaker noted that the figure would have been roughly $8 billion higher without the China export curbs.

Related: Nvidia stock could surge after surprising Taiwan Semi news

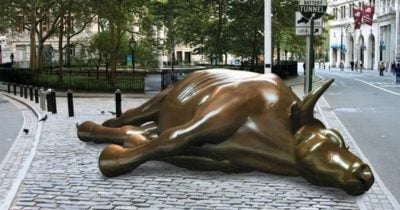

Tensions between China and the U.S. remain the Damocles’ sword hanging over Nvidia.

Reuters recently reported that U.S. officials have signaled they are looking to extend existing tariffs on China for a further 90 days beyond the August 10 deadline set in Geneva in May.

Still, a war of technology is continuing. According to the Wall Street Journal, U.S. Commerce Department officials are considering new restrictions on advanced technology exports to China, including broader limits on chip-making equipment sales.

China remains a key market for Nvidia, accounting for 13% of its sales in the past financial year. If the world’s two largest economies fail to reach a trade deal, it could hit Nvidia’s bottom line.

Nvidia's CEO Jensen Huang has long warned that export controls could hurt U.S. chipmakers and even threaten the country’s position as the global leader in technology.

“If we want the American technology stack to win around the world, then giving up 50% of the world’s AI researchers is not sensible," Huang recently said on CNBC. "So long as all the AI developers are in China, you know, I think [the] China stack is going to win.”

Barclays raises Nvidia stock price target by $30

Barclays analyst Tom O'Malley raised the firm's price target on Nvidia to $200 from $170 and keeps an overweight rating, according to a research report pulled by thefly.com on June 17. Given Nvidia's current stock price, the target implies an upside of 39%.

After checking in with the supply chain following Nvidia’s Q1 report, Barclays now sees $2 billion in upside for July revenue compared to Wall Street estimates. The firm raised its forecast for the Compute segment to $37 billion from $35.6 billion.

Blackwell capacity reached 30,000 wafers per month in June, short of Barclays’ earlier forecast of 40,000 wafers, the analyst said in a research note. Blackwell is Nvidia’s GPU architecture designed to power its most advanced AI chips for data centers.

More Nvidia:

- Analysts revamp forecast for Nvidia-backed AI stock

- Nvidia stock could surge after surprising Taiwan Semi news

- Nvidia CEO sends blunt 7-word message on quantum computin

Still, the firm says "despite the short blip," utilization remains strong, and the supply chain sounds positive in the second half of 2025, which lines up with growing demand from agentic AI applications.

According to TipRanks, Wall Street's average price target on Nvidia stock is $172.36, with a high forecast of $210.00 and a low forecast of $100.00.