Americans Now Have $1.21 Trillion of Credit Card Debt, the Highest on Record – 7 Ways to Make Sure You Don’t Take on Too Much

It’s a frightening reality about the state of American consumer debt that at the end of 2024, the Federal Reserve Bank of St. Louis indicated that Americans owe more than $1.21 trillion in credit card debt. This was up $45 billion from the third quarter of 2024 and was 7.3% higher than the same debt […] The post Americans Now Have $1.21 Trillion of Credit Card Debt, the Highest on Record – 7 Ways to Make Sure You Don’t Take on Too Much appeared first on 24/7 Wall St..

It’s a frightening reality about the state of American consumer debt that at the end of 2024, the Federal Reserve Bank of St. Louis indicated that Americans owe more than $1.21 trillion in credit card debt. This was up $45 billion from the third quarter of 2024 and was 7.3% higher than the same debt level in 2023.

Credit cards have quickly become one of the fastest ways to spend too much money.

The good news is that even if you are in debt, there are ways to get out of trouble.

With too many Americans struggling with credit card debt, this problem needs to be tackled immediately.

Earn up to 3.8% on your money today (and get a cash bonus); click here to see how. (Sponsored)

Key Points

Unsurprisingly, this means that many Americans are struggling with debt, and it begs the question of what can be done. Considering that the Federal Reserve Bank of New York indicates that over 10% of credit card accounts were more than 90 days delinquent, it’s time for new credit card strategies.

It’s Not Just Credit Cards

One of the most important things to remember is that Americans must contend with more than credit card debt. As of the end of 2024, there was over $1.804 trillion in outstanding mortgages, auto loans, and student loan debt in the wild as well.

Everything, including delinquency, went up between the third and fourth quarters of 2024, likely due to holiday spending, but it speaks directly to American spending being out of control. As far as credit cards go, what makes this frightening is that carrying the balance has to be looked at from the perspective of 60% of Americans holding a credit card balance, and the average interest rate is now topping 20%.

In other words, for every $100 an American owes on a credit card right now, it’s really $120, and this number just compounds every month, so the balance grows and grows. With this in mind, what can be done? First and foremost, there has to be something like the snowball method of tackling your balances, but also looking at how to keep your balance down once it is paid off.

Paying Off Credit Card Debt

The snowball method is arguably one of the most popular methods for paying off credit cards or any debt. Using this strategy, you’ll list your balances on paper from smallest to largest. Starting today, you’ll begin to make minimum payments on all credit card debts except for the smallest one.

You’ll now begin paying extra monthly on the smallest debt to pay it off as fast as possible. However much extra you can spare to pay, you should do so until it’s paid off. When the smallest card balance is finally paid off, you’ll now take the amount you were paying to this card and add it to the minimum payment you made with the next smallest debt.

You’ll continue this snowball process until all of your credit card debt is paid off. This method is simple but easy to follow, provides a psychological boost, and is very easy to implement immediately.

Steps to Avoid Taking On Future Debt

Don’t Buy It

One of the first and most important strategies to help you avoid getting into credit card debt or growing this debt is to stop buying things you can’t afford. Unfortunately, credit cards have created an illusion that we can keep buying even if we don’t have the money to afford it and pay it off over time.

However, as the 20% interest number shows, this is a terrible strategy that needs to be eliminated forever. One way to think about this is to only charge something on a credit card that you can also buy in cash. If you don’t have enough money in your bank account to pay for it, avoid buying it until you do.

Focus On Needs

It should go without saying, but credit cards help you purchase both your wants and needs, and in many cases, you need room to cut out the wants from your life until you can afford to pay for them. This could mean eliminating how many times a week you go out to eat or stopping going to the mall a few times a month and picking up new clothes when you already have a closet full of items.

Many people need to face the reality that they need things like food, housing, and clothing, but they only need so many to live comfortably. Going out to eat three or four times a week might be enjoyable, but this also quickly adds up and can lead directly to a level of debt that spirals out of control before someone knows it.

Balance Transfer

A brilliant but underutilized strategy that many people ignore is the ability to transfer balances to a credit card with a current 0% interest offer. Many new cards will offer 0% for anywhere between 12 to 18 months, and by doing so, you can at least eliminate the interest payment while you work on something like the snowball strategy to get rid of any existing debt. There is every reason to believe that with a 0% interest rate, you could pay off your debt faster than you might have imagined.

Cash or Debit

This step ties directly back to not buying something in the first place. Consider paying with cash or a debit card instead of relying on a credit card for all your purchases. While both methods come with less overall purchase security than a credit card, there is the immediate advantage of not buying something because you know you don’t have the money to pay for it. This will become a mindset in short order, and it will help you avoid overspending. You can also keep a credit card for emergencies like car trouble or medical expenses.

Limit Card Number

One of the reasons Americans have racked up so much credit card debt is that they have too many cards. Initially, card availability allowed you to spread out purchases so you didn’t see the balances running up as quickly as you would with one card. The best strategy here is now to stick to no more than two cards, and this way, you can easily track your balances. It’s okay to cancel unused cards, as the short-term credit hit is better than any impact of long-term debt.

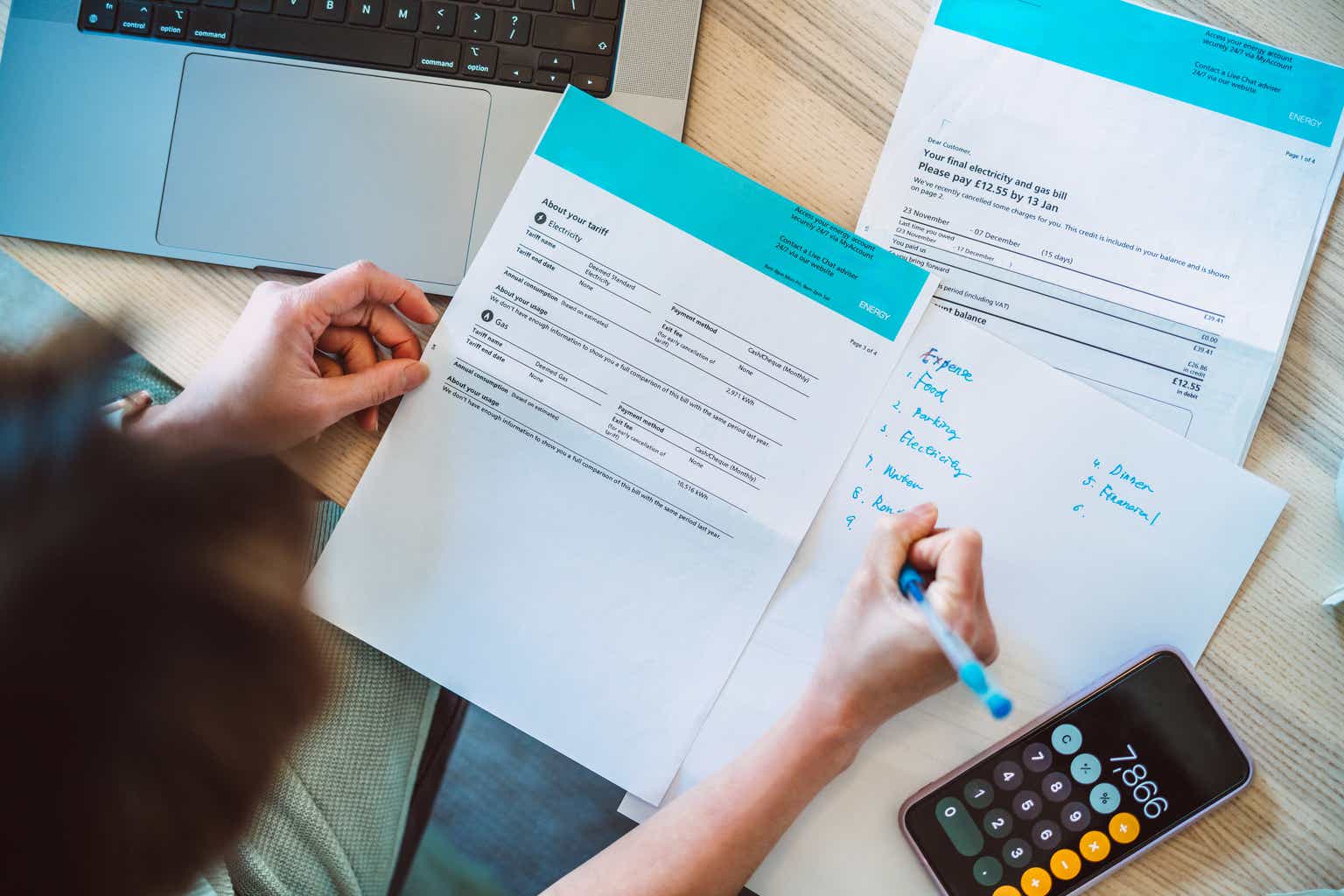

Track Your Spending

Not having a budget or tracking your spending is one of the fastest ways credit cards can spiral out of control, and you’ll have a sizable debt before you even know it. Set a monthly budget for all the fixed costs in your life, like a mortgage, car, insurance, HOA, food, utilities, etc., and then see whatever is left for you to go out and enjoy.

The most important thing is that you stick to this budget every month. Whether you use a spreadsheet or an app on your phone, having a set budget will help you see where you are overspending and will help you avoid doing so, which in turn will help keep you out of debt.

Just Say No

Subscriptions to gyms, streaming services, and apps you rarely use can add up far too fast, and these small costs can help drive you into debt. If you have something that you haven’t used in 60 or even 90 days, cancel it and get the money back. This money can then be put back into your budget to go toward your debt or something else you might enjoy.

The post Americans Now Have $1.21 Trillion of Credit Card Debt, the Highest on Record – 7 Ways to Make Sure You Don’t Take on Too Much appeared first on 24/7 Wall St..