AGG vs BND: Which Bond ETF Is a Better One to Buy?

Investors don’t have to accumulate stocks to generate returns. Bonds can provide stable income and less volatility than equities. These financial assets typically retain their value until maturity and pay coupons along the way. While you can buy individual bonds, it’s much easier to buy shares in a bond ETF. Two of the most reputable […] The post AGG vs BND: Which Bond ETF Is a Better One to Buy? appeared first on 24/7 Wall St..

Investors don’t have to accumulate stocks to generate returns. Bonds can provide stable income and less volatility than equities. These financial assets typically retain their value until maturity and pay coupons along the way.

While you can buy individual bonds, it’s much easier to buy shares in a bond ETF. Two of the most reputable bond ETFs are the iShares Core US Aggregate Bond ETF (NYSEARCA:AGG) and the Vanguard Total Bond Market Index Fund ETF (NASDAQ:BND). You can invest in both ETFs, but this guide will explore which bond ETF is more appealing for long-term investors.

Key Points

-

AGG and BND are two of the top bond ETFs available.

-

Discover which bond ETF is the better choice for long-term investors.

-

4 million Americans are set to retire this year. If you want to join them, click here now to see if you’re behind, or ahead. It only takes a minute. (Sponsor)

Long-Term Returns

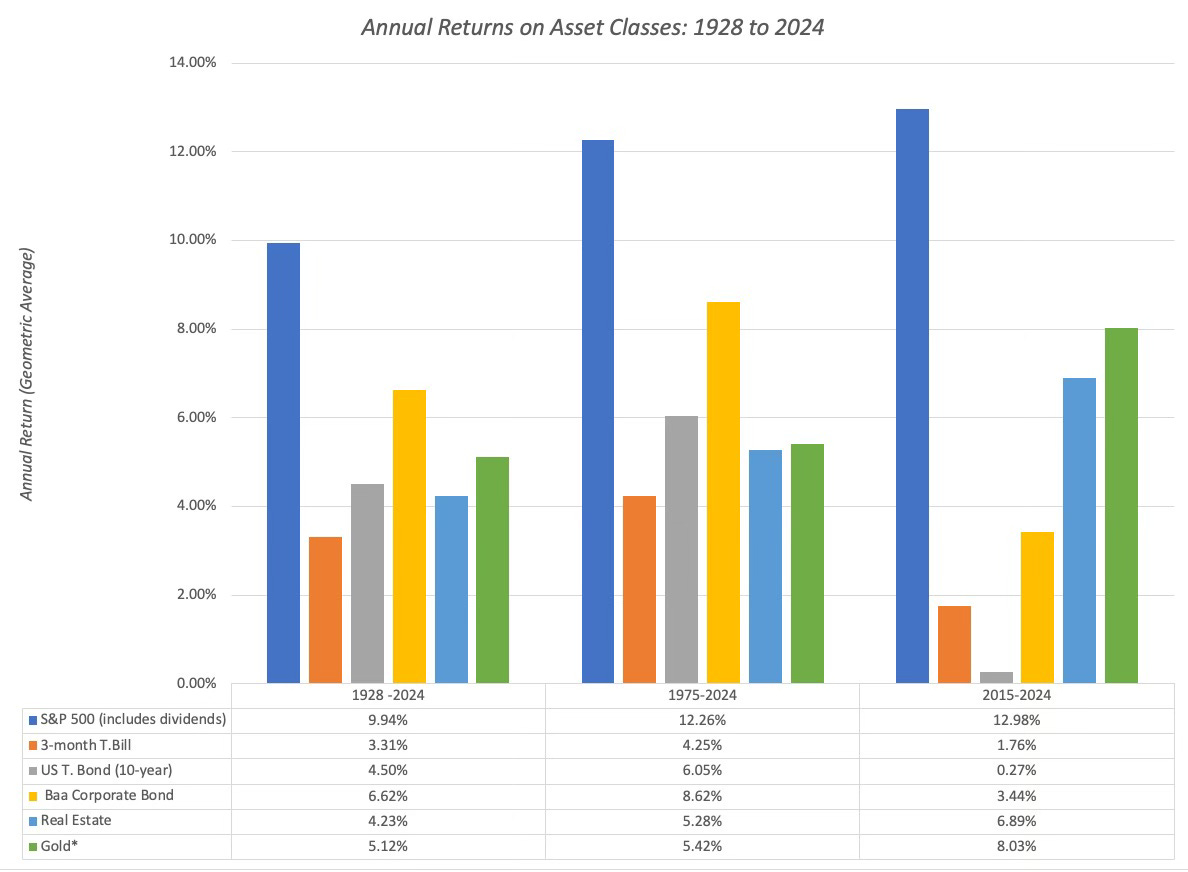

Both funds have produced similar long-term returns, but the Vanguard Total Bond Market Index Fund ETF has slightly higher returns. BND has delivered an annualized 1.42% return over the past decade, while AGG has produced an annualized 1.38% return during the same stretch.

It’s normal for bond ETFs to have low returns compared to growth ETFs. That’s because bond ETFs prioritize assets that offer fixed income instead of giving investors the potential to realize meaningful long-term gains.

Expense Ratio

The expense ratio measures the percentage of your portfolio that goes to the fund manager each year. A low expense ratio means you get to keep more of your capital, and both ETFs deliver with 0.03% expense ratios. You’ll barely notice when the expense ratio is applied to your account.

SEC Yields

While the expense ratio is a small number for both funds, the 30-day SEC yield is a key metric for bond ETFs. Many people gravitate toward bond ETFs for income, so investors are seeking high yields. AGG has a 4.60% yield, which is identical to BND’s 30-day SEC yield.

However, there is a slight gap if you zoom out to 12-month yields. AGG has a 3.72% yield, while BND has a lower 3.65% yield over the past 12 months.

Portfolio Allocation

Both funds prioritize government bonds, with each of them committing approximately half of their assets to this asset group. The ETFs also put about 25% of their holdings into corporate bonds. AGG and BND even have similar portfolio allocations across bond grades, but there is one notable difference.

BND allocates 71.7% of its assets to AAA-rated bonds and 3.1% of its assets to AA-rated bonds. However, the numbers are almost reversed for AGG. That ETF puts 2.7% of its assets into AAA-rated bonds and 73.0% of its assets into AA-rated bonds.

AA-rated bonds are riskier but are still generally safe. In exchange for the extra risk, bondholders typically get higher yields. That’s part of the reason why AGG has a slightly higher 12-month yield than BND.

Bond Duration

BND prioritizes 1-3 year bond terms, with 3-5 year bond terms being the second largest portion of BND’s maturity dates. The ETF also has 7-20 year terms. The fund has the smallest concentration in 7-10 year bond durations. AGG has a similar setup, but the margin between 1-3 year bonds and 3-5 year bonds is smaller. Both ETFs have almost all of their holdings in U.S. bonds.

Who Are Bond ETFs Best For?

Bond ETFs are best for risk-averse investors who want to collect passive income without worrying about their investment losing significant value. These bonds are less vulnerable during sharp market downturns and have higher yields than most stocks and ETFs.

Younger investors may want to choose other investments, such as growth stocks and ETFs. These investors have more time to wait for their positions to recover after market corrections.

If you have to pick between two bond ETFs, BND looks like the better pick. While both bond ETFs are very similar, BND narrowly beats AGG on its annualized returns. Their 30-day SEC yields are identical.

The post AGG vs BND: Which Bond ETF Is a Better One to Buy? appeared first on 24/7 Wall St..