7 Key Moments in the History of Social Security

One of the most important social programs in the United States, Social Security, is used by more than 71 million Americans annually. Whether for retirement, disability, survivor or spouse’s benefits, or some other aspect of the program, the Social Security Administration is there. Unfortunately, the program isn’t without its troubles, as it’s believed that it will only […] The post 7 Key Moments in the History of Social Security appeared first on 24/7 Wall St..

One of the most important social programs in the United States, Social Security, is used by more than 71 million Americans annually. Whether for retirement, disability, survivor or spouse’s benefits, or some other aspect of the program, the Social Security Administration is there.

The Social Security program is one of the nation’s most important.

There are some critical key moments in the history of the Social Security program.

Multiple presidents are to thank for giving the more program more purpose.

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. If you’ve saved and built a substantial nest egg for you and your family; get started by clicking here.(Sponsor)

Key Points

Unfortunately, the program isn’t without its troubles, as it’s believed that it will only last at 100% benefit coverage until 2035 when the CBO thinks it will lose as much as 20% of beneficiary payments. However, before jumping into the future, it’s important to look at Social Security’s past.

7. Healthcare and Medicare

President Lyndon B. Johnson signed into law in 1965 a program known as Medicare under Social Security. The belief was that providing health insurance for anyone 65 and older would no longer be a giant gap in retirement security. Funded mainly by payroll taxes, the Social Security program was now coming into its own as a fully rounded program focused on older Americans’ well-being.

Medicare Taxes

For today’s beneficiaries, it’s essential to know that Medicare payroll taxes are still here and that both employees and employers pay into this program. Today, the payroll tax for Medicare is 1.45% for the employee and 1.45% for the employer, or 2.9% in total. It goes without saying that Medicare is a hugely popular program that millions of Americans would like to expand beyond just older Americans.

6. Remaining Solvent

In 1983, President Ronald Reagan took action when he learned that the Social Security Trust Fund indicated a shortfall was coming. Due to high unemployment during the 1970s, more money was going out than coming in, and he created a bipartisan committee to make recommendations that would reform the Social Security system.

Increased Taxes

As a result of the looming shortfall, Regean worked with Congress to raise payroll taxes from 5.4% to 6.2% and raise the Full Retirement Age from 65 to 67. This is yet another indication that Social Security reform was possible without the entire program’s infrastructure breaking down.

5. Cost Of Living

Arguably, one of the most important key moments in Social Security history was its introduction in 1972. Signed by President Nixon into law, the 1972 changes to Social Security introduced the Cost-of-Living Adjustment, or COLA. Using numbers from the Consumer Price Index (CPI), this was designed to help retirees keep up with rising costs due to inflation.

Five Decades and Counting

More than five decades later, there have only been three years since COLA was introduced in 1972, when Social Security payments did not rise yearly. In 2024, the increase was 3.2%, and in 2025, it was 2.5%, and both years affected more than 71 million Americans currently receiving benefits from the Social Security Administration.

4. Disability Benefits

In 1956, President Eisenhower made a significant addition that culminated in the introduction of Social Security Disability Insurance. Any worker aged 50-64 could take part, which meant that the program was now, for the first time, open to individuals who were below the recommended retirement age at the time.

All Ages Update

Fast-forward to 1960, and SSDI was extended to cover all ages, not just those between 50 and 64. The changes were undoubtedly due to public demand, meaning Social Security now serves millions. This showed that the demand for government help changed significantly between 1956 and 1960.

3. 1950 Amendments

By the time 1950 rolled out, President Harry Truman had signed a new set of Social Security amendments into law. These amendments broadened the scope of the program and gave even more Americans, such as farmworkers, domestic employees, and self-employed individuals, a chance to participate in receiving (and paying into) benefits.

Raising Benefit Levels

At the time of Truman’s Amendments, benefit levels rose by around 77%, the first time a hike was introduced since 1935. In addition, it showed that more than 70 million people were being covered in some aspect of the Social Security program. These changes should be a lesson to those trying to reform Social Security today.

2. First Check Arrives

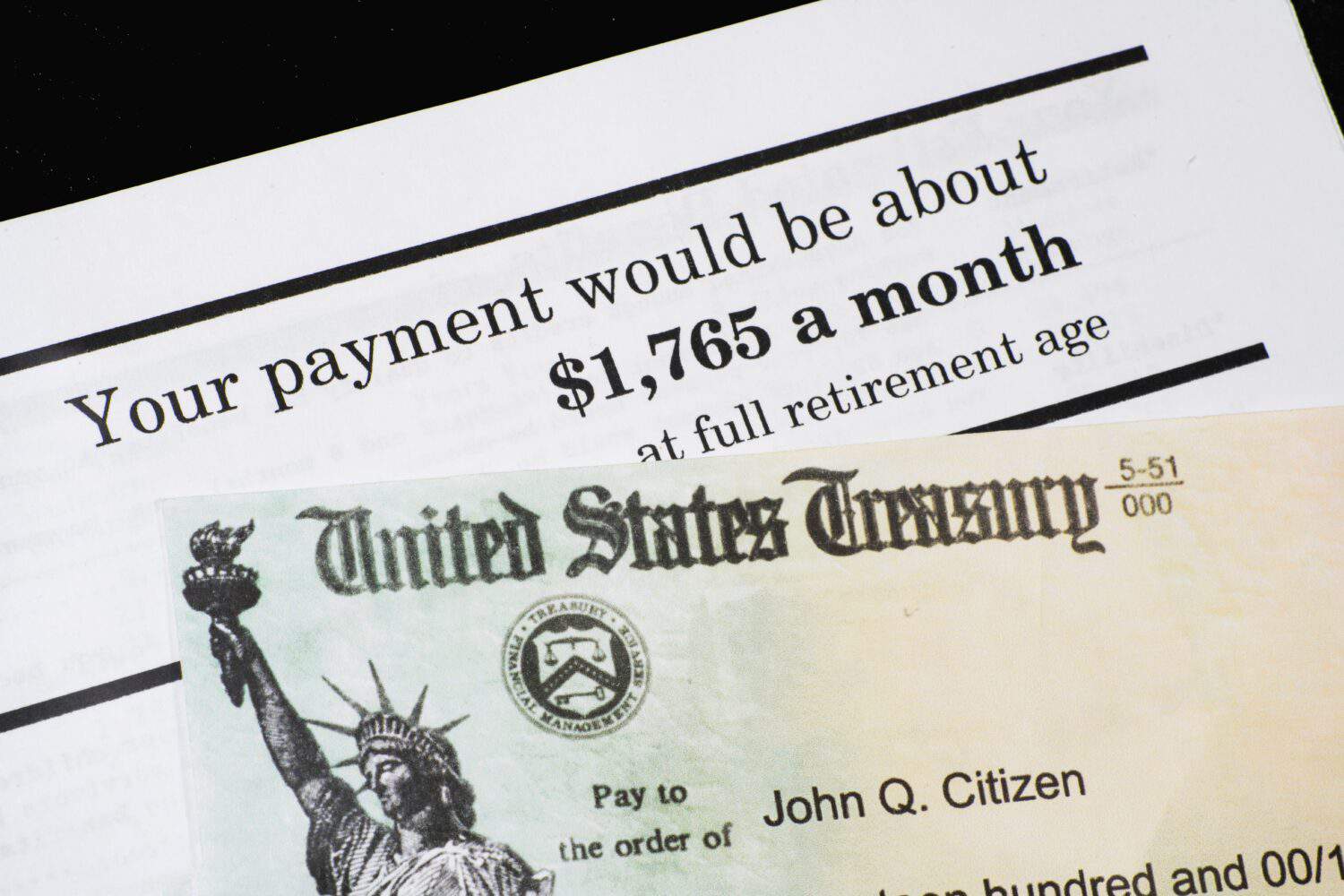

When Ida M. Fuller became the first American recipient of a check of $22.54 on January 31, 1940, from the new Social Security office, it was a milestone moment in the United States. Fuller, who retired after a lengthy career as a legal secretary, had already paid into the Social Security program for three years before she received her first check.

Thousands In Benefits

Throughout her life, Ida May Fuller received over $22,000 in Social Security benefits before passing away in 1975 at age 100. This is such a pivotal moment in the program because it showed the need for a program in the US that valued retirees, especially those who were living longer but still needed financial assistance.

1. Social Security Begins

The Social Security Act, signed into law by President Franklin D. Roosevelt on August 14, 1935, was meant to help Americans suffering during the Great Depression. Without a safety net, Americans were suffering, and poverty was rampant. The hope was that this act would help those too old to work. It was the first federal program to guarantee retirement security for Americans.

New Payroll Tax

As a result of the Act, a 1% payroll tax was levied on employees and employers, though it was capped at $3,000 of income annually. This tax was meant to be placed into a trust fund where it would grow and be used to pay future benefits, and the system hasn’t changed much in 90 years. However, between 1935 and 1940, Social Security was broadened to protect families by adding survivor and dependent benefits.

The post 7 Key Moments in the History of Social Security appeared first on 24/7 Wall St..