4 Changes Congress Should Make to Reform RMD Rules and Help Retirees

The Required Minimum Distribution is one of the most frustrating aspects in the financial arena and arguably one of the least liked. Better known as an RMD, it mainly applies to anyone, including retirees entering their 70s and contributing to tax-deferred retirement accounts. The reality is that RMDs are not only difficult to understand, but […] The post 4 Changes Congress Should Make to Reform RMD Rules and Help Retirees appeared first on 24/7 Wall St..

The Required Minimum Distribution is one of the most frustrating aspects in the financial arena and arguably one of the least liked. Better known as an RMD, it mainly applies to anyone, including retirees entering their 70s and contributing to tax-deferred retirement accounts.

A required minimum distribution is one of the least popular financial moves a retiree can make.

There is a growing voice about banning RMD requirements for those with accounts under a specific size.

The hope is that Congress will act better to recognize a more realistic view of age longevity.

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here here.(Sponsor)

Key Points

The reality is that RMDs are not only difficult to understand, but there is a lot of emphasis on penalties, which may scare people into not utilizing these types of accounts or just flat out miscalculating their financial responsibilities without truly understanding how they work.

Of course, the hope is that Congress can make some changes to make RMDs more attractive, which would not only reform and simplify the rules but also improve the overall situation for retirees.

Defining The RMD

First and foremost, it’s important to know the current requirements for an RMD today. As a mandatory annual withdrawal from a tax-deferred account, according to the SECURE 2.0 Act, retirees must begin taking money out of any tax-deferred accounts starting at 73.

Examples of tax-deferred accounts could include a 401(k), 403(b), SIMPLE IRAs, Traditional IRAs, and SEP IRAs. Calculating your RMD is pretty straightforward, and most people can do it on their own, but the public and many members of Congress strongly feel that the current method of calculating RMDs is outdated.

Current RMD Challenges

The biggest concern with RMDs is that they’re currently included as taxable income, which increases the tax burden for retirees. Depending on tax levels, this can be frustrating. For example, someone who has to take a $50,000 RMD at 75 years old based on a $1 million IRA could increase their taxable income just enough that they are now in a position where 85% of their Social Security benefit is being taxed.

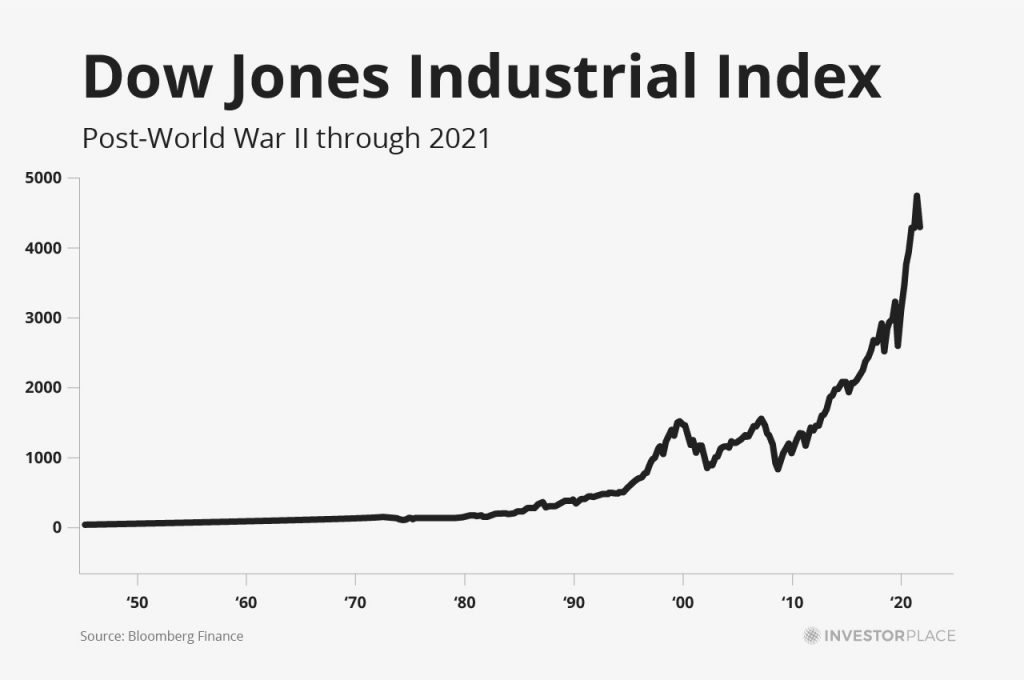

Separately, because the schedule for pulling out RMDs is pretty rigid, it doesn’t factor in anything like current market conditions. In other words, because you are forced to make these withdrawals, you might not be able to see your portfolio recover by whatever amount was pulled out because of market volatility.

Many people, including financial experts, consider withdrawal estimates to be outdated. The latest update indicates that a 73-year-old has 26.5 years left, but this doesn’t consider the reality that the Social Security Administration only anticipates 20% of 65-year-olds living past 90. This means withdrawals are bigger than necessary and deplete funds too early.

Another huge factor many people want to reconsider is the 25% excise tax (penalty) implemented by SECURE 2.0. While it was reduced from 50%, thankfully, this percentage applies to many missed RMDs. However, the number can drop by 10% if the distribution is corrected within 24 months. Still, the penalty is in place because of the frustratingly tight schedule that must be updated.

Changing Calculation Methods

One of the first changes Congress needs to make is updating the calculation method currently used to determine RMD amounts. At the very least, this method needs to revise life expectancy numbers to better reflect longevity data based on current estimates from the Social Security Administration. In addition, this calculation method should be personalized to include family history and other health factors that might play a role so it isn’t a one-size-fits-all approach.

For example, based on the current table, a 73 year old withdrawing $1 million would likely have an RMD of $36,496 annually based on 2025 estimates. However, if you tailored this table to be more personalized, perhaps this number could be reduced to an even $30,000, preserving $6,496 annually. Over 20 years, at 5% growth, that is an extra $150,000 in retirement funds.

Barbara O’Neill, author at Annuity.org, noted, “Updated tables could reduce forced withdrawals, giving retirees more control over their tax exposure and legacy planning. Adding fuel to this argument is a 2024 T. Rowe Price study that found 40% of retirees do not need to take out their full RMDs to cover their living expenses.

Greater Flexibility Around Timing

Another potential consideration is that instead of instituting a rigid policy that demands RMDs begin at 73, you could have Congress enact a change that allows a withdrawal period between 73 and 75. This could allow someone to avoid withdrawing during a market downturn, when they are less likely to replace any funds pulled out by this mandatory guideline.

Derek Munchow, founder of Augustus Wealth, indicates, “Flexibility lets retirees align withdrawals with low-income years or market recoveries, minimizing taxes and losses.”

Further evidence of the need for this change was in 2022, when you had a bear market. Vanguard analysis indicated that those who pulled out RMDs were losing 15-20% more value than if they had been able to delay their withdrawals to allow for a market recovery.

Eliminate RMDs for Smaller Accounts

There is a mounting voice in the financial world that RMDs should be eliminated for accounts under a specific size. While there is no agreed upon number, you could argue that between $150,000 and $250,000 is a great place to start. The Retirement Security and Savings Act, a proposed Congressional bill submitted in 2022, would have instituted a rule that any account under $150,000 was exempt from all required minimum distributions.

The hope is that such action by Congress would protect America’s most vulnerable retirees or those most likely to outlive their savings. As it stands today, there is a greater poverty risk for those in a position with smaller accounts who are still required to take RMDs. This action would give them a better cushion for a more stress-free retirement.

Qualified Charitable Distribution

One final Congressional change that could benefit retirees is increasing the Qualified Charitable Distribution amount. As of 2025, the current amount is $108,000 and requires an IRA owner to be at least 70.5 years old. A QCD is tax-free and can be made directly to a qualified charity. However, the biggest benefit is that it can help satisfy the required minimum distribution during any given year.

A potential change here is that an act of Congress could raise this limit from $108,000 to $150,000 or even $200,000 and allow more of a QCD to count toward any RMD taken from an IRA and, going one step further, from a 401(k) as well. The hope is that this would provide retirees with more of a tax-free giving option, as far too many people who want to make charitable donations don’t because they can’t afford to be without the funds.

According to Rita Assaf of Fidelity, “Expanding QCDs could turn a tax burden into a legacy tool, especially for charitably inclined retirees.” Such a step by Congress would encourage more philanthropy, which can only be a good thing, but it would also enhance the financial well-being of retirees, which is the whole ballgame.

The post 4 Changes Congress Should Make to Reform RMD Rules and Help Retirees appeared first on 24/7 Wall St..