3 Stocks to Buy As Tariff Turmoil Unfolds

Tariff turmoil has continued to provide intense volatility for the stock market, with certain sector seeing outsized losses as investors price in the risk of tariffs being put in place on a number of sectors and countries which export products to the U.S. Most investors ae well-aware that Trump has touted a 25% tariff on Canadian […] The post 3 Stocks to Buy As Tariff Turmoil Unfolds appeared first on 24/7 Wall St..

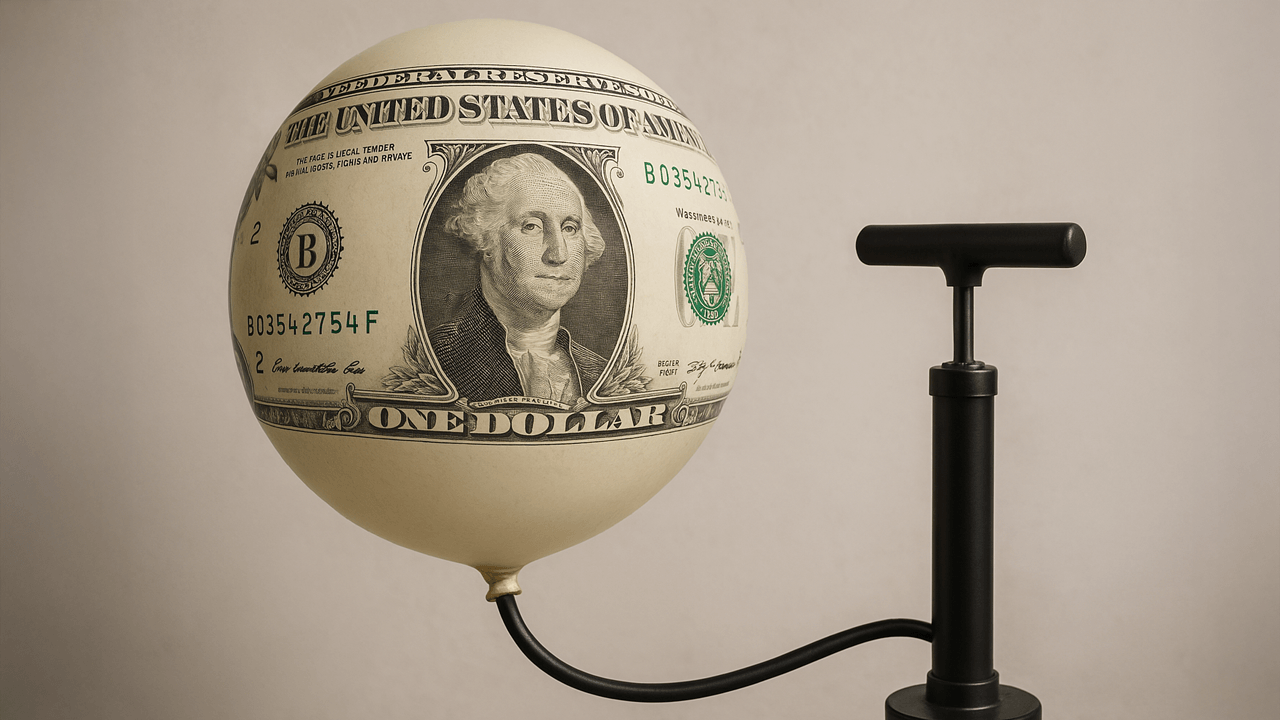

Tariff turmoil has continued to provide intense volatility for the stock market, with certain sector seeing outsized losses as investors price in the risk of tariffs being put in place on a number of sectors and countries which export products to the U.S.

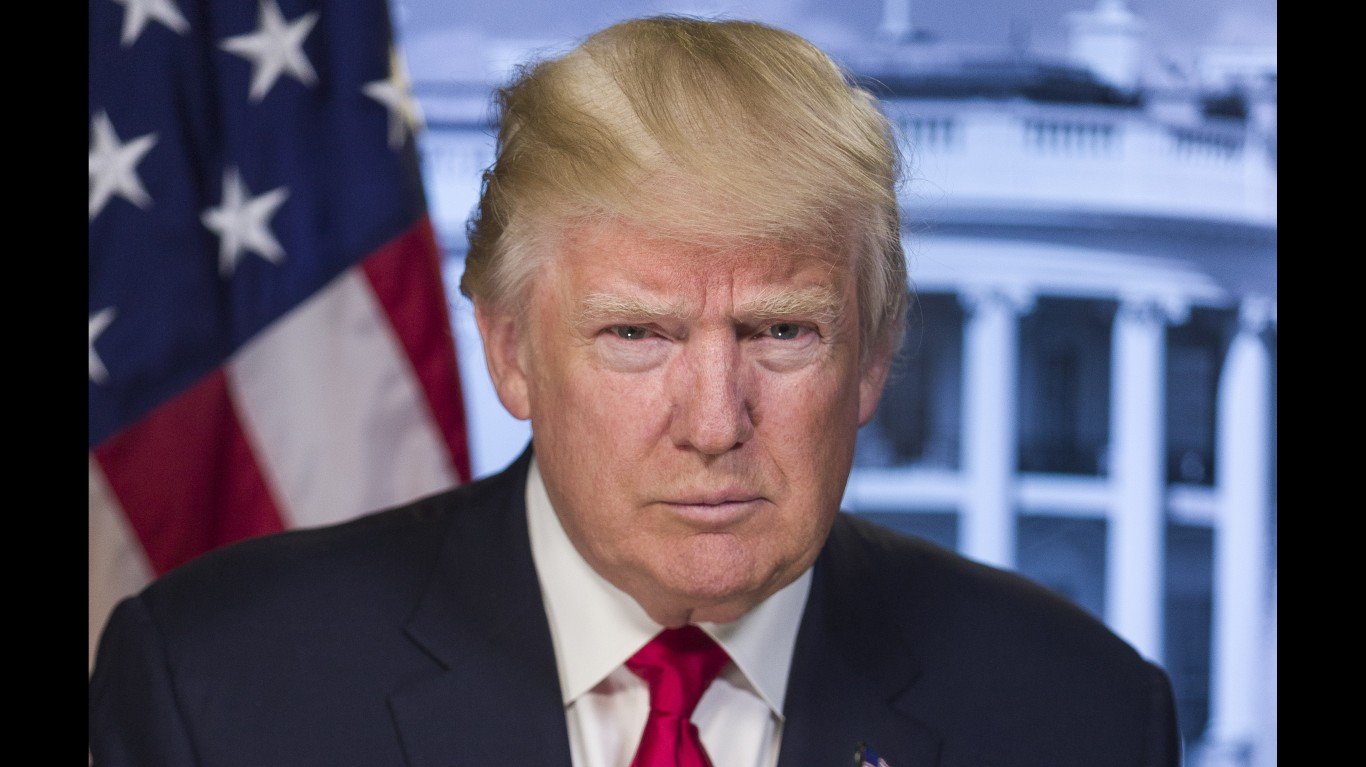

Most investors ae well-aware that Trump has touted a 25% tariff on Canadian and Mexican imports as a way to “level the playing field” when it comes to the country’s trade deficit with such nations. Additional tariffs aimed at further leveling the playing field (so-called retaliatory tariffs) are also being explored.

But, as many investors are also aware, Trump has since backed off on his plans to implement tariffs on Canada and Mexico, before choosing to indeed place these tariffs on the company’s closest trade partners. That’s to say nothing of the two doses of tariffs placed on China, and new steel and aluminum tariffs on Canada aimed at boosting the country’s domestic industry in these key areas.

With this tariff uncertainty creating big up and down days in the market of late, it can be hard for many investors to digest which stocks may be worth buying on recent dips. Here are three I’m considering right now as potential buying opportunities in the fray.

Key Points

-

- Tariff uncertainty has roiled the stock market, with various sectors seeing outsized declines as investors try to assess the impact of these new policies.

-

- That said, there may be some key buying opportunities within this fray – here are three stocks to consider as potential winners moving forward.

-

- If you’re looking for some stocks with huge potential, make sure to grab a free copy of our brand-new “The Next NVIDIA” report. It features a software stock we’re confident has 10X potential.

Chevron (CVX)

Trump’s tariffs have certainly impacted a number of sectors tied to imports from other countries, but the energy sector is one the Trump administration appears keen on steering clear of impacting, at least to an inordinate degree.

Among the leading energy majors I continue to be bullish on is Chevron (NYSE:CVX). The company remains an attractive investment due to its strong financials, dividend reliability, and strategic growth initiatives. Chevron reported solid Q4 2024 earnings, returning a record $27 billion to shareholders while increasing production levels. The company also raised its quarterly dividend by 5% to $1.71 per share, marking its 38th consecutive year of dividend growth, with a 4.51% yield. Analysts maintain a moderate buy rating, with price targets ranging from $185 to $238 for 2025.

Chevron’s integrated energy business spans upstream production, midstream infrastructure, and downstream refining, providing a hedge against commodity price swings. In 2023, the energy giant generated $31.5 billion in cash flow, covering $16.4 billion in capital spending and $11.8 billion in dividends. The company also repurchased $15.2 billion in shares, returning a record $27 billion to investors, partially funded by $7.7 billion in asset sales.

Chevron’s feat of extending its dividend growth streak to 38 years is a rare achievement in the volatile oil sector. Despite market swings, the company maintains a reliable, high-yield dividend at 4.5%, far above the S&P 500’s 1.2%. I think Chevron is likely to maintain a strong financial position makes future increases likely, keeping it attractive for income-focused investors.

Constellation Energy (CEG)

Constellation Energy (NASDAQ:CEG) has emerged as a dominant player in the energy sector, fueled by strategic acquisitions and strong market sentiment. The stock surged 25% following its $26.6 billion acquisition of Calpine, expanding its presence in Texas and California.

Over the past year, CEG has skyrocketed 147.6%, breaking key technical resistance levels. Analysts forecast an upside to $362 by March 2025, supported by bullish technical patterns. Additionally, Constellation’s push into nuclear energy for AI computing strengthens its long-term prospects.

Rising AI energy demands are driving a shift toward nuclear power. Even in a Trump America, it’s expected that alternative energy sources will likely remain key to the discussion around energy independence and dominance over the next few years. Goldman Sachs projects data center power needs to grow 15% annually through 2030, potentially reaching 8% of U.S. consumption. Notably, a number of tech firms are securing nuclear partnerships, with Microsoft signing a 20-year deal with Constellation Energy. This deal is expected to account for roughly 86% of Constellation 32,400-megawatt output from nuclear, freeing up the company to potentially ramp up production as its demand increases.

As demand for carbon-free power rises, Constellation stands out as a key player in this transition.

CVS Health (CVS)

CVS Health (NYSE:CVS) remains a key player in the healthcare sector, combining pharmacy services, insurance through Aetna, and retail operations. The stock has fluctuated, recently declining to $54.01, despite a 23% gain over the past month. Analysts expect Q4 earnings per share (EPS) of $0.89, a 58% year-over-year decline, while revenue is forecasted at $97.06 billion.

CVS Health has struggled with declining COVID-related sales and rising Medicare Advantage costs, limiting revenue and earnings growth. Q3 revenue rose 6.3% to $95.4 billion, but adjusted EPS fell to $1.09 from $2.21. To improve margins, the company plans cost-cutting measures in 2025, even if it means losing up to 10% of MA customers.

Despite liquidity concerns, CVS offers a 4.73% dividend yield, making it attractive for income-focused investors. Analysts remain cautiously optimistic, with price targets ranging from $63 to $80 by year-end, and I think this is one of those under-loved names that could make a nice rebound from here, if dividend investors step up to the plate.

The post 3 Stocks to Buy As Tariff Turmoil Unfolds appeared first on 24/7 Wall St..