Buy the Biggest S&P 500 Losers: 5 High-Yield Dividend Companies Are On Sale

These five S&P 500 stocks look like incredible contrarian ideas for growth and income investors. They pay dependable dividends, have Buy ratings, and are down handily over the past year. The post Buy the Biggest S&P 500 Losers: 5 High-Yield Dividend Companies Are On Sale appeared first on 24/7 Wall St..

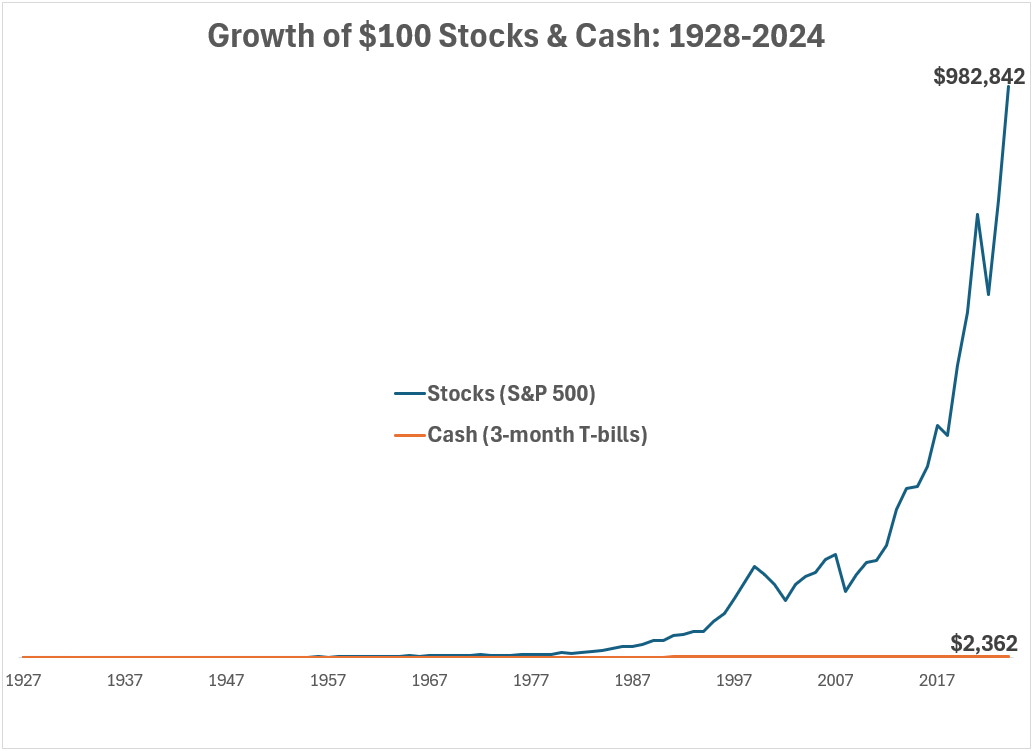

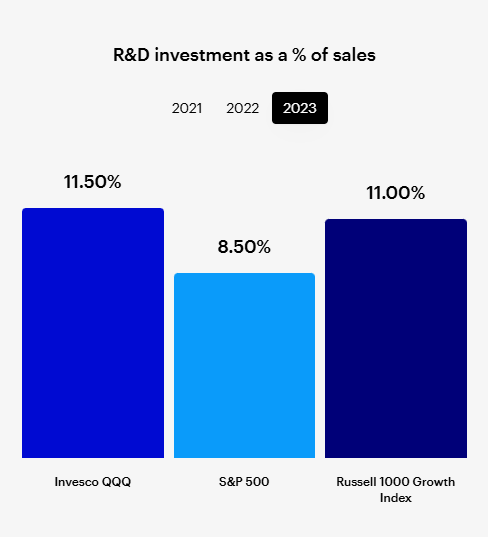

The S&P 500, or Standard & Poor’s 500, is a stock market index that tracks the performance of the 500 biggest companies in the United States. It is considered a top indicator of the U.S. stock market’s health. The venerable index is a market-capitalization-weighted index of the 500 leading publicly traded companies in the United States. Typically, larger companies significantly impact the index. The roaring success of the mega-cap Magnificent 7 stocks is a testament to that.

24/7 Wall St. Key Points:

-

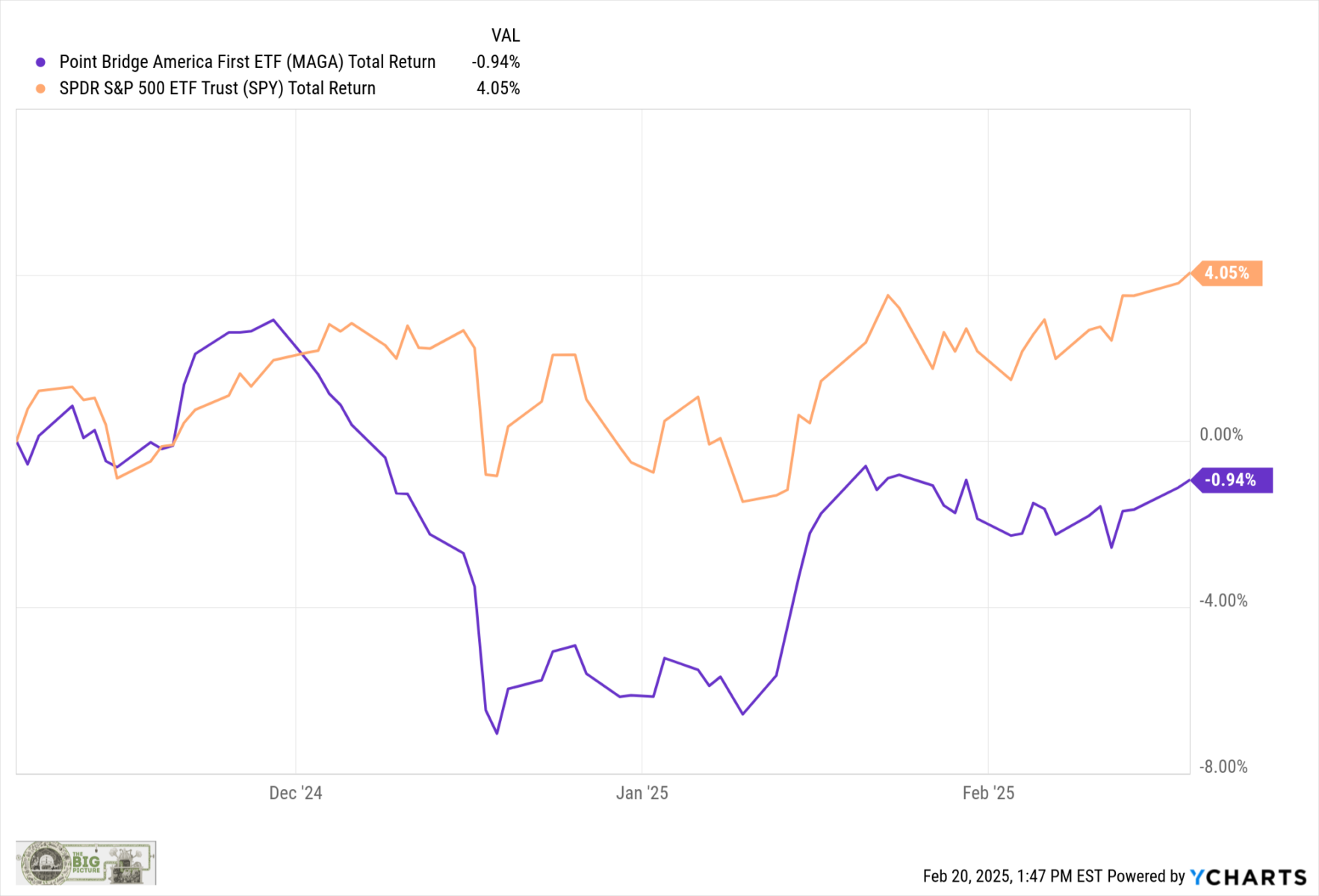

After back-to-back 20%+ gains in 2023 and 2024, the S&P 500 is off to a 2.9% gain in 2025.

-

Some of the Magnificent 7 have shown signs of slowing.

-

It makes sense to track the companies in the index down over the past year.

-

Do you have a spot for S&P 500 index funds in your portfolio? Why not set up a meeting with an experienced financial advisor near you and find out? Click here today and get started. (Sponsored)

While the Magnificent 7 have dominated the headlines and the investing world over the past two years, recent fourth-quarter earnings reports have shown slowing growth prospects for 2025. One word of advice for investors is that when stocks have been on a parabolic move higher for two years, they are the most vulnerable should a wave of selling start. We decided to screen the S&P 500 stocks that pay dependable dividends, have a Buy rating on Wall Street, and are down 30% or more over the past year. We found five that look like incredible contrarian ideas for growth and income investors.

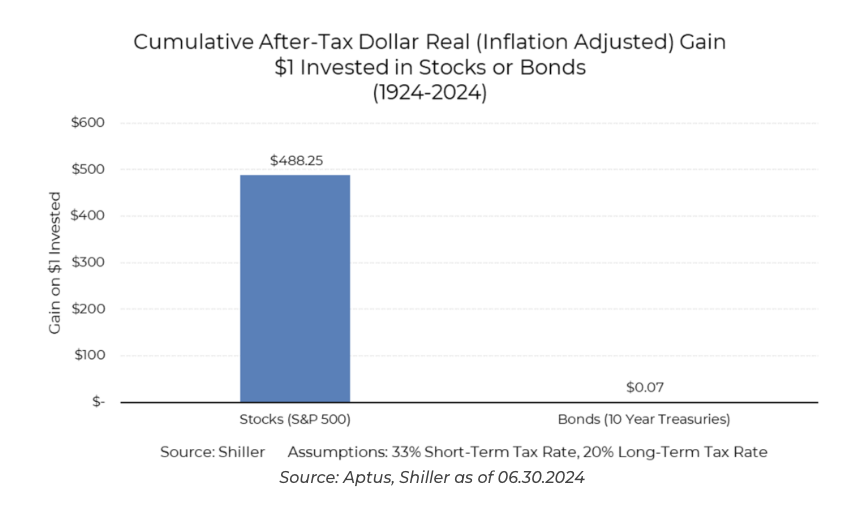

Why do we cover dividend stocks?

Dividend stocks provide investors with reliable streams of passive income. Passive income is characterized by its ability to generate revenue without requiring the earner’s continuous active effort, making it a desirable financial strategy for those seeking to diversify their income streams or achieve financial independence.

AES

This conservative utility stock offers a hefty 6.87% dividend and big upside potential considering it is down 36%. AES Corp. (NYSE: AES) and its subsidiaries operate as a diversified power generation and utility company in the United States and internationally.

The company owns and operates power plants to generate and sell power to customers, such as utilities, industrial users, and other intermediaries; owns and operates utilities to develop or purchase, distribute, transmit, and sell electricity to end-user customers in the residential, commercial, industrial, and governmental sectors; and generates and sells electricity on the wholesale market.

It uses various fuels and technologies to generate electricity, such as:

- Coal

- Gas

- Hydro

- Wind

- Solar

- Biomass

- Renewables comprising energy storage and landfill gas

The company owns and operates a generation portfolio of approximately 34,596 megawatts and distributes power to 2.6 million customers.

Barclays has an Overweight rating on the shares with a massive $23 price target.

Brown-Forman

This Biggest Loser is down 45.5% over the past year, pays a solid 2.25% dividend, and sells products that never go out of style. Brown-Forman Corp. (NYSE: BF-B) manufactures, distills, bottles, imports, exports, markets, and sells various alcoholic beverages.

Brown-Forman provides:

- Wines

- Whiskey spirits

- Whiskey-based flavored liqueurs

- Ready-to-drink cocktails

- Ready-to-pour products

- Vodkas

- Tequilas

- Gin

- Brandy

- Rum

- Bourbons

- Liqueurs

The company offers its products primarily under these famous brands:

- Jack Daniel’s

- Woodford Reserve

- Old Forester

- Coopers’ Craft

- Gentleman Jack

- Herradura

- el Jimador

- Korbel

- Sonoma-Cutrer

- Finlandia

- Chambord

- Gin Mare

- Diplomático

- Fords Gin

- The Glendronach

- Benriach

- Glenglassaugh

- Slane

The company also sells used barrels, bulk whiskey and wine, and contract bottling services. It serves retail customers and consumers directly through distributors or state governments and retailers, wholesalers, and provincial governments.

It operates in the United States, Germany, Australia, the United Kingdom, Spain, Canada, France, Mexico, Poland, Brazil, and Japan, as well as internationally.

Bernstein SocGen Group has an Outperform rating with a $57.50 target price.

Celanese

Down a stunning 54.3% over the last year and yielding a 4.22% dividend, this company is one of the Biggest Losers and is a steal at current levels. Celanese Corp. (NYSE: CE) is a chemical and specialty materials company that manufactures and sells high-performance engineered polymers in the United States and internationally.

It operates through these segments:

- The Engineered Materials segment develops, produces, and supplies specialty polymers for automotive and medical applications and for use in industrial products and consumer electronics.

- The Acetyl Chain segment produces and supplies acetyl products

Those products include:

- Acetic acid

- Vinyl acetate monomers

- Acetic anhydride and acetate esters that are used as starting materials for colorants, paints, adhesives, coatings, and pharmaceuticals; and

- Organic solvents and intermediates for pharmaceutical, agricultural, and chemical products

It also offers:

- Vinyl acetate-based emulsions for use in paints and coatings

- Adhesives

- Construction

- Glass fiber, textiles, and paper applications

- Ethylene vinyl acetate resins and compounds

- Low-density polyethylene for use in flexible packaging films

- Lamination film products

- Hot melt adhesives

- Automotive parts

- Carpeting applications

In addition, it provides re-dispersible powders (RDP) for use in construction applications, including flooring, plasters, insulation, tiling, and waterproofing.

Bank of America Securities has a Buy rating and a towering $88 target price.

FMC

While very off-the-radar, this Biggest Loser pays a hefty 4.22% dividend and, down 33.3%, offers solid total return potential. FMC Corp. (NYSE: FMC) is an agricultural sciences company that provides crop protection, plant health, and professional pest and turf management products.

It develops, markets, and sells crop protection chemical products that include:

- Insecticides

- Herbicides, and fungicides

- Biologicals

- Crop nutrition

- Seed treatment

These products are used in agriculture to enhance crop yield and quality by controlling a range of insects, weeds, and diseases and in non-agricultural markets for pest control.

The company markets its products through its sales organization, alliance partners, independent distributors, and sales representatives.

It operates in:

- North America

- Latin America

- Europe

- the Middle East

- Africa

- Asia

Barclays has an Overweight rating with a $48 price target.

Merck

Merck & Co. Inc. (NYSE: MRK) is not just a healthcare company but a global force in the industry. This Biggest Loser is a no-brainer, down over 30% over the last year while paying a solid 3.30% dividend. The company operates through two segments:

- Pharmaceutical

- Animal Health

The Pharmaceutical segment offers human health pharmaceutical products in:

- Oncology

- Hospital acute care

- Immunology

- Neuroscience

- Virology

- Cardiovascular

- Diabetes

- Vaccine products, such as preventive pediatric, adolescent, and adult vaccines

The Animal Health segment discovers, develops, manufactures, and markets veterinary pharmaceuticals, vaccines, health management solutions and services, and digitally connected identification, traceability, and monitoring products.

Merck serves:

- Drug wholesalers

- Retailers

- Hospitals

- Government agencies

- Managed healthcare providers, such as health maintenance organizations

- Pharmacy benefit managers and other institutions

- Physicians

- Physician distributors

- Veterinarians

- Animal producers

Merck’s growth is a result of its efforts and strategic collaborations. The company works with AstraZeneca, Bayer, Eisai, Ridgeback Biotherapeutics, and Gilead Sciences to jointly develop and commercialize long-acting treatments for HIV, demonstrating a commitment to innovation and growth.

Two Blue Chip Dividend Giants Make Up Almost 40% of Warren Buffett’s Portfolio

The post Buy the Biggest S&P 500 Losers: 5 High-Yield Dividend Companies Are On Sale appeared first on 24/7 Wall St..