3 Retirement Rules of Thumb You Need to Ignore

If you search the internet, you’ll come across a lot of advice about saving for retirement. And some of it is pretty good. But there are certain rules of thumb you’ll see all the time that may not apply to you. Here are three you may want to ignore. 1. The 4% rule It […] The post 3 Retirement Rules of Thumb You Need to Ignore appeared first on 24/7 Wall St..

Key Points

-

Don’t assume you should withdraw 4% of your savings each year.

-

Don’t assume you need 10x your salary banked for retirement.

-

Don’t assume you need to go light on stocks in your retirement portfolio.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

If you search the internet, you’ll come across a lot of advice about saving for retirement. And some of it is pretty good.

But there are certain rules of thumb you’ll see all the time that may not apply to you. Here are three you may want to ignore.

1. The 4% rule

It takes a lot of effort to build up a retirement nest egg. So once you amass savings for your senior years, you want that money to last as long as you need it to.

That’s why it’s important to come up with a withdrawal strategy for your nest egg. But that strategy doesn’t have to be the 4% rule.

The 4% rule says that if you withdraw 4% of your savings your first year of retirement and adjust future withdrawals for inflation, your nest egg should last 30 years. But there are some problems with the 4% rule that could make it a poor choice for you.

If you’re retiring early, you may need to limit yourself to a lower withdrawal rate. On the flipside, a late retirement might give you the option to go with a higher withdrawal rate.

The way your portfolio is invested should also be a factor in your withdrawal rate. So rather than follow the 4% rule because the internet tells you to, work with a financial advisor to come up with a strategy that addresses your needs and situation.

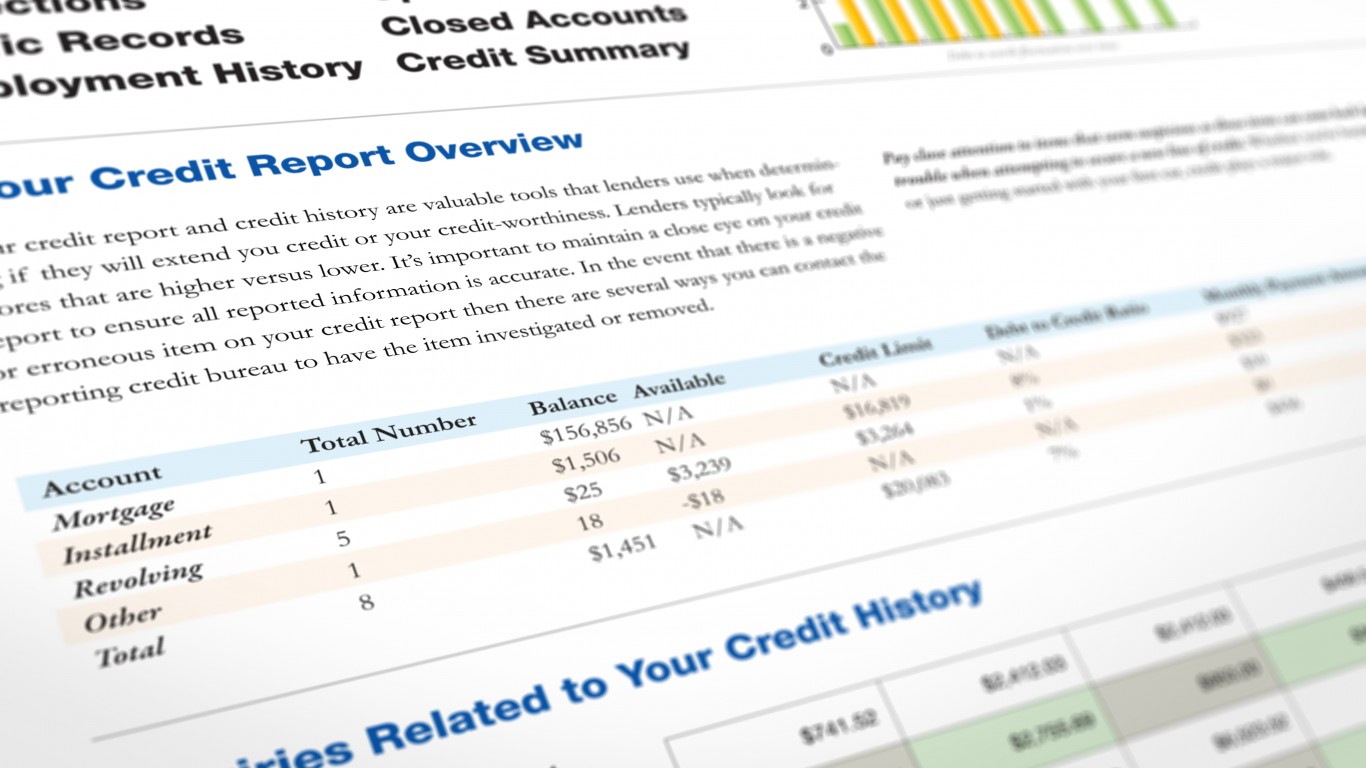

2. The 10x your income rule

You’ll often hear that it’s best to aim to retire with 10 times your income saved. But while that’s decent guidance, it may not apply to you.

It may be that you’re looking to downsize your entire lifestyle once you retire, and that you’re also retiring on the late side. In that case, you may do just fine having five or six times your salary saved.

Or, you might have big plans for retirement that involve a lot of travel. That could make the case for saving more than 10 times your salary.

So once again, this is a decision to make based on you. And it pays to work with a financial advisor to come up with a custom savings goal.

3. The 110 minus your age rule

Once you’re retired, it’s a good idea to scale back on stocks and maintain a good balance of stable assets in your portfolio. To that end, you may have read about the 110 minus your age rule. You can use this formula to see what percentage of your portfolio should be in stocks.

If you’re 70 years old, for example, subtracting your age from 110 puts you at 40 — meaning, you should have 40% of your retirement portfolio in stocks. But once again, this isn’t necessarily good advice.

It may be that you have a healthy appetite for risk and a variety of income streams in retirement. That could make the case to keep 50% or 60% of your portfolio in stocks for the added growth.

Or, it could be that keeping 40% of your assets in stocks is too stressful for you and will cause you to lose sleep. That’s reason enough to go with a smaller percentage.

It’s a good idea to work with a financial advisor to discuss your income goals for retirement as well as your investment strategy. They can help you come up with an asset allocation formula you’re comfortable with.

The post 3 Retirement Rules of Thumb You Need to Ignore appeared first on 24/7 Wall St..