2 Stock-Split Stocks to Buy in March

Always keep an eye on stock splits. While splits don’t change the value of a stock, they can serve as a positive signal. This can then lead to further liquidity and more investor interest. After all, if an attractive $500 stock were to split 10:1, bringing it to $50 a share, more investors are likely […] The post 2 Stock-Split Stocks to Buy in March appeared first on 24/7 Wall St..

Always keep an eye on stock splits.

While splits don’t change the value of a stock, they can serve as a positive signal. This can then lead to further liquidity and more investor interest. After all, if an attractive $500 stock were to split 10:1, bringing it to $50 a share, more investors are likely to jump in.

Key Points About This Article

- While splits won’t change the value of a stock, they can serve as a positive signal. This can lead to further liquidity and more investor interest.

- Cybersecurity giant Palo Alto Networks (PANW) split its $400 stock 2 to 1. That made it far more affordable and attractive to more investors.

- If you are looking to build a portfolio of AI stocks, grab a copy of our “The Next NVIDIA” report. It has one stock with 10x potential.

Plus, according to Morningstar.com, “Splits matter – because these stocks outperform after the announcement, by a lot. Average returns one year later are 25% vs. 12% for the S&P 500 SPX as a whole, say researchers at Bank of America. It’s worth brushing up on stock splits now, for two reasons. Stock splits are picking up again after a decade-long lull.”

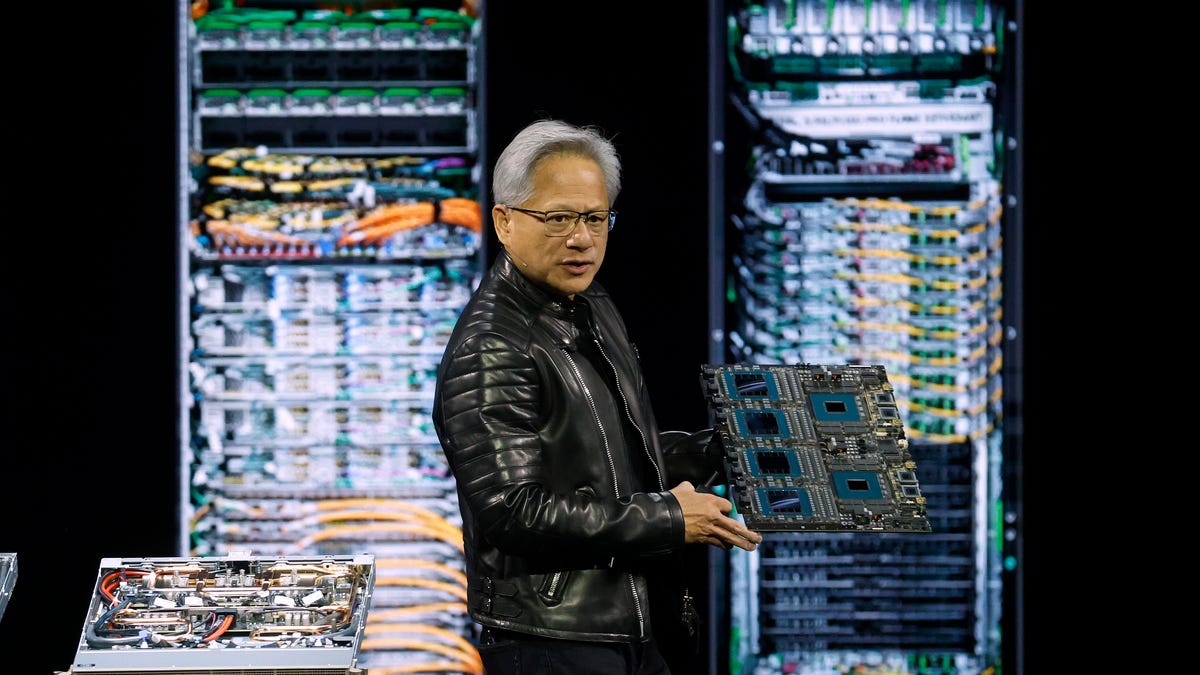

“There were 17 last year, the most since 2013. These included Nvidia (NVDA), Broadcom (AVGO), Walmart (WMT), and Chipotle (CMG). Stock-split outperformance has picked up, too, says Bank of America. On average, the shares of stocks that split in 2024 advanced 17% after six months,” they added.

That being said, we went hunting for some of the top stock splits to bet on today.

Palo Alto Networks

In December, cybersecurity giant Palo Alto Networks (NASDAQ:PANW) split its $400 stock 2 to 1, making it far more affordable and attractive to more investors. While it did sink shortly after that split, it’s now an even more attractive bet on cybersecurity at $185 a share.

Analysts at Citi say the company is expected to benefit from Cortex XSIAM, its artificial intelligence-driven security operations offering.

With a buy rating and a price target of $220, Citi added that “XSIAM is a machine learning platform (not rules-based/UI-based) and as a hub that collects AI-ready data (PANW ingests 80+ terabytes daily), the offering is well positioned to provide value to customers against the proliferation of AI,” as quoted by Seeking Alpha.

Recent earnings weren’t too shabby either.

In its second quarter, EPS of 81 cents beat by three cents. Revenue of $2.26 billion, up 14.3% year over year, beat by $17.58 million. Most of that was thanks to customer adoption of technology including cloud investing, artificial intelligence and infrastructure modernization.

Moving forward, the company expects to see total revenue in the range of $2.26 billion to $2.29 billion, representing year-over-year growth of between 14% and 15%.

Chipotle

Mid-2024, Chipotle (NYSE:CMG) split its shares 50 to 1, bringing its stock down to a more attractive buying price for retail investors. As of today, the now-oversold stock trades at around $50 a share over tariff concerns. However, with a good deal of negativity firmly priced into the stock we’d like to see CMG rally back to $58 initially.

Helping, Chipotle director Mauricio Gutierrez paid $500,000 on March 5 for 9,400 shares, an average price of $53 each. Two, the stock is now technically oversold on RSI, MACD, and Williams’ %R. Three, CMG is starting to bounce from triple bottom support.

And, analysts at Loop Capital just upgraded the beaten-down stock to a buy rating with a price target of $65 a share.

“Chipotle has a very manageable risk to the recent escalating tariff situation since CMG sources only ~2% of its total inputs from Mexico, mainly including avocados,” said the firm, as quoted by CNBC. “To this end, over the last couple of years the company shifted a significant portion of supply to other Latin American countries and currently sources approximately one-half of its avocados outside of Mexico.”

The post 2 Stock-Split Stocks to Buy in March appeared first on 24/7 Wall St..