2 Reasons to Buy UPRO and 3 Reasons Not To

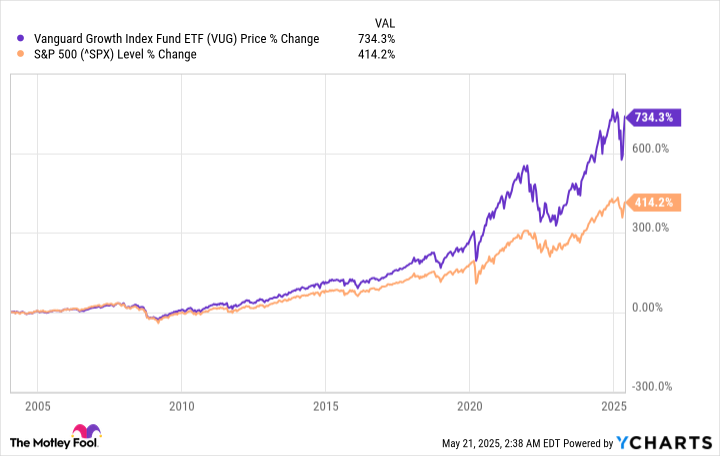

If the S&P 500 historically generates total returns of about 10% annually, wouldn't some investment vehicle that amplifies its returns be even better? That's exactly what the ProShares UltraPro S&P 500 ETF (NYSEMKT: UPRO) does.This ETF aims to triple the daily returns of the S&P 500, so if the benchmark index goes up 1% tomorrow, you can expect the ProShares UltraPro S&P 500 ETF to rise by about 3%. It achieves this by using financial derivative instruments such as futures contracts and stock options.However, it's important to mention that while this ETF is certainly capable of producing amplified returns in good times, it isn't even close to being a surefire way to get market-beating performance in your portfolio over the long run. In other words, if the S&P 500 goes up by 20% over the next two years, that doesn't necessarily mean you'll get a 60% return from this ETF.Continue reading

If the S&P 500 historically generates total returns of about 10% annually, wouldn't some investment vehicle that amplifies its returns be even better? That's exactly what the ProShares UltraPro S&P 500 ETF (NYSEMKT: UPRO) does.

This ETF aims to triple the daily returns of the S&P 500, so if the benchmark index goes up 1% tomorrow, you can expect the ProShares UltraPro S&P 500 ETF to rise by about 3%. It achieves this by using financial derivative instruments such as futures contracts and stock options.

However, it's important to mention that while this ETF is certainly capable of producing amplified returns in good times, it isn't even close to being a surefire way to get market-beating performance in your portfolio over the long run. In other words, if the S&P 500 goes up by 20% over the next two years, that doesn't necessarily mean you'll get a 60% return from this ETF.

4_M_1440049442.jpg?#)