2 Brain-Dead Simple Nuclear Stocks to Buy With $100 Today

Nuclear energy is experiencing a revival, fueled by global demand for clean, reliable power and supportive U.S. policies. President Donald Trump’s recent executive orders, signed on May 23, aim to quadruple U.S. nuclear capacity to 400 gigawatts by 2050, streamlining regulations, accelerating reactor approvals, and boosting domestic fuel supply chains. These orders provide a catalyst […] The post 2 Brain-Dead Simple Nuclear Stocks to Buy With $100 Today appeared first on 24/7 Wall St..

President Trump’s executive orders signal strong policy support for nuclear energy, aiming to quadruple U.S. capacity by 2050, driving industry growth.

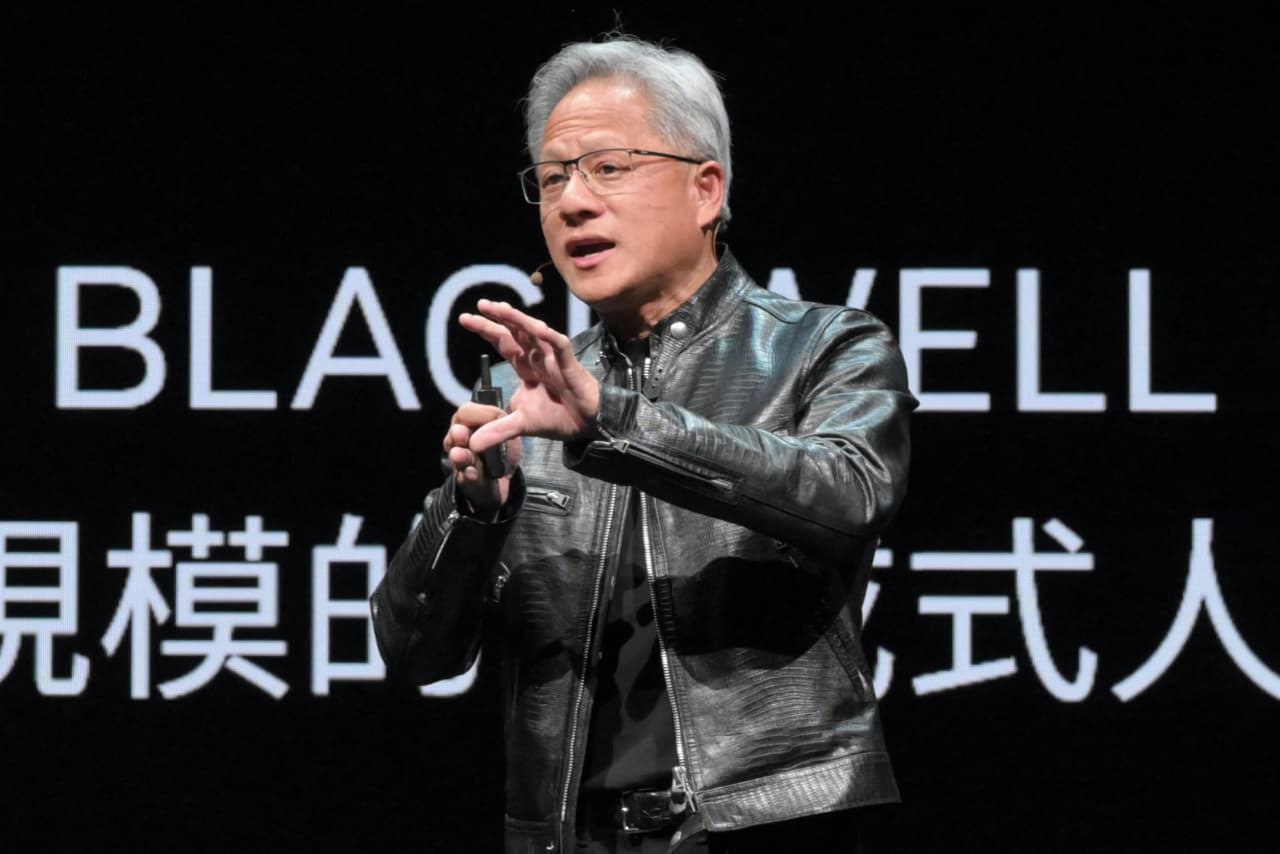

Nvidia made early investors rich, but there is a new class of ‘Next Nvidia Stocks’ that could be even better. Click here to learn more.

Key Points in This Article:

Nuclear energy is experiencing a revival, fueled by global demand for clean, reliable power and supportive U.S. policies. President Donald Trump’s recent executive orders, signed on May 23, aim to quadruple U.S. nuclear capacity to 400 gigawatts by 2050, streamlining regulations, accelerating reactor approvals, and boosting domestic fuel supply chains.

These orders provide a catalyst for industry growth, addressing surging electricity needs from AI data centers and national security priorities. The International Energy Agency projects a doubling of global nuclear capacity by 2050, underscoring its role in net-zero goals.

Yet, nuclear’s complexity — regulatory hurdles, high costs, and technical challenges — can intimidate investors. While nuclear energy itself isn’t a brain-dead simple concept, the following two stocks to buy are straightforward picks for investors with $100. These companies leverage solid financials and clear market positions to capitalize on nuclear’s bright future, offering growth potential without requiring deep industry expertise.

NuScale Power (SMR)

Nuclear energy’s revival, spurred by Trump’s executive orders, makes NuScale Power (NYSE:SMR) the first brain-dead simple investment to buy with $100. NuScale pioneers small modular reactors (SMRs), with its core NuScale Power Module design, a 77 megawatt reactor that can be deployed in clusters, are tailored for AI data centers and remote grids.

These scalable, factory-built reactors reduce construction costs and regulatory delays, aligning with Trump’s push for streamlined approvals. In the first quarter, NuScale’s revenue surged to $13.4 million from $1.4 million, backed by $521 million in cash and just $1 million in non-current liabilities, ensuring financial stability.

Its stock is up 69% after the executive orders, reflecting market enthusiasm. At almost $39 per share, $100 buys two shares, offering direct exposure to next-generation nuclear technology. While nuclear energy isn’t a simple concept, NuScale’s focused innovation makes it an easy pick for investors.

The global SMR market is projected to grow 3% annually through 2030, driven by clean energy demand. Its biggest risk is its pre-commercial status, as NuScale’s first projects are slated for 2029, but it is providing the reactors for Romania’s RoPower Nuclear project to deliver 462 MW of installed capacity. SMR’s first-mover advantage in the space, along with support from the Energy Department, helps mitigate these concerns.

For investors seeking growth without complexity, NuScale simplifies betting on nuclear’s future. With $100, you’re planting a seed in a transformative industry, leveraging policy tailwinds and technological disruption for potential long-term gains.

Cameco (CCJ)

Uranium miner Cameco (NYSE:CCJ) offers a straightforward way to invest in nuclear energy’s resurgence with just $100. As one of the industry’s global leaders, Cameco fuels nuclear reactors worldwide. First-quarter revenue rose 24% to $634 million Canadian while its $361 million in cash and equivalents ensures financial strength. Its stock rose as much as 6% post-executive orders, and Goldman Sachs projects 11% further upside with a $78 per share price target, reflecting confidence in rising uranium demand.

At $70 per share, $100 will buy you one share, making it accessible for retail investors. While nuclear energy’s technical and regulatory landscape isn’t simple, Cameco’s role as a stable uranium supplier is. The global nuclear renaissance, with 61 reactors under construction and AI data centers driving energy needs, supports uranium prices. Risks include price volatility and geopolitical supply disruptions, but Cameco’s diversified operations across Canada and Kazakhstan help lessen these concerns.

For investors, Cameco is a no-fuss entry into nuclear’s growth. It offers exposure to a critical resource without requiring deep industry knowledge. With Trump’s policy push and a projected nearly 30% increase in uranium demand by 2030, Cameco is a solid, simple choice for long-term portfolio growth.

The post 2 Brain-Dead Simple Nuclear Stocks to Buy With $100 Today appeared first on 24/7 Wall St..