Why SAIC Stock Is Up Today

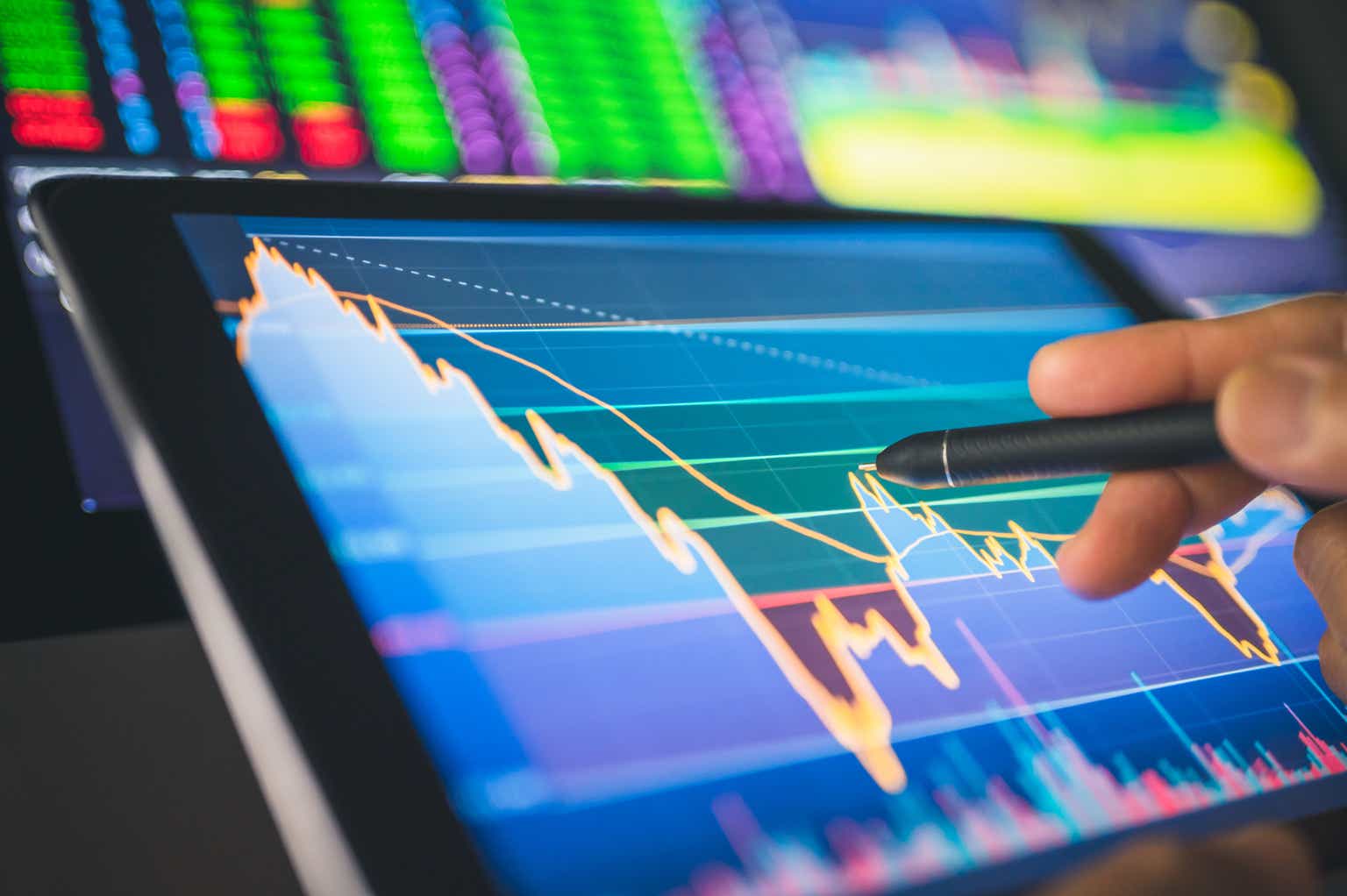

Defense IT specialist Science Applications International (NASDAQ: SAIC) delivered better-than-expected earnings, easing concerns about pullbacks as part of the government's efficiency push. Investors applauded the results, sending SAIC shares up 13% as of 10 a.m. ET.SAIC is one of several defense contractors focused on providing technical services to various military and civil government agencies. The company earned $2.57 per share in its fiscal fourth quarter ending Jan. 31 on revenue of $1.83 billion, topping Wall Street's $2.09 per share on revenue of $1.81 billion consensus estimate.Revenue was up 6% year over year, but net income jumped by 151%, fueled by a 250-basis point improvement in operating margin. The company also raised its guidance for the new fiscal year by $0.20 per share on the high and low end to between $9.10 and $9.30 per share.Continue reading

Defense IT specialist Science Applications International (NASDAQ: SAIC) delivered better-than-expected earnings, easing concerns about pullbacks as part of the government's efficiency push. Investors applauded the results, sending SAIC shares up 13% as of 10 a.m. ET.

SAIC is one of several defense contractors focused on providing technical services to various military and civil government agencies. The company earned $2.57 per share in its fiscal fourth quarter ending Jan. 31 on revenue of $1.83 billion, topping Wall Street's $2.09 per share on revenue of $1.81 billion consensus estimate.

Revenue was up 6% year over year, but net income jumped by 151%, fueled by a 250-basis point improvement in operating margin. The company also raised its guidance for the new fiscal year by $0.20 per share on the high and low end to between $9.10 and $9.30 per share.