Where Will AT&T Stock Be in 1 Year?

AT&T (NYSE: T) shareholders have plenty to celebrate, with the stock up 24% thus far in 2025. The telecommunications giant has presented robust earnings, reinforcing an optimistic long-term outlook. The stock's impressive performance is an outlier next to the 3% decline in the S&P 500 index year to date. As such, AT&T has emerged as a reliable source of stability amid the broader stock market volatility that's causing concern about the strength of the U.S. economy.Can AT&T's record-setting rally continue, or is it time to hang up the phone? Let's discuss where the stock could be headed one year from now.It's been nearly three years since AT&T completed one of the largest restructuring efforts in its history -- spinning off the WarnerMedia group in 2022. The deal marked a pivot away from the media and entertainment business, allowing the company to refocus efforts on its core telecom strengths. This strategic pivot has proven successful. Today, AT&T carries far less debt and generates more durable cash flow, gaining the flexibility to invest in growth areas like 5G and fiber optics infrastructure.Continue reading

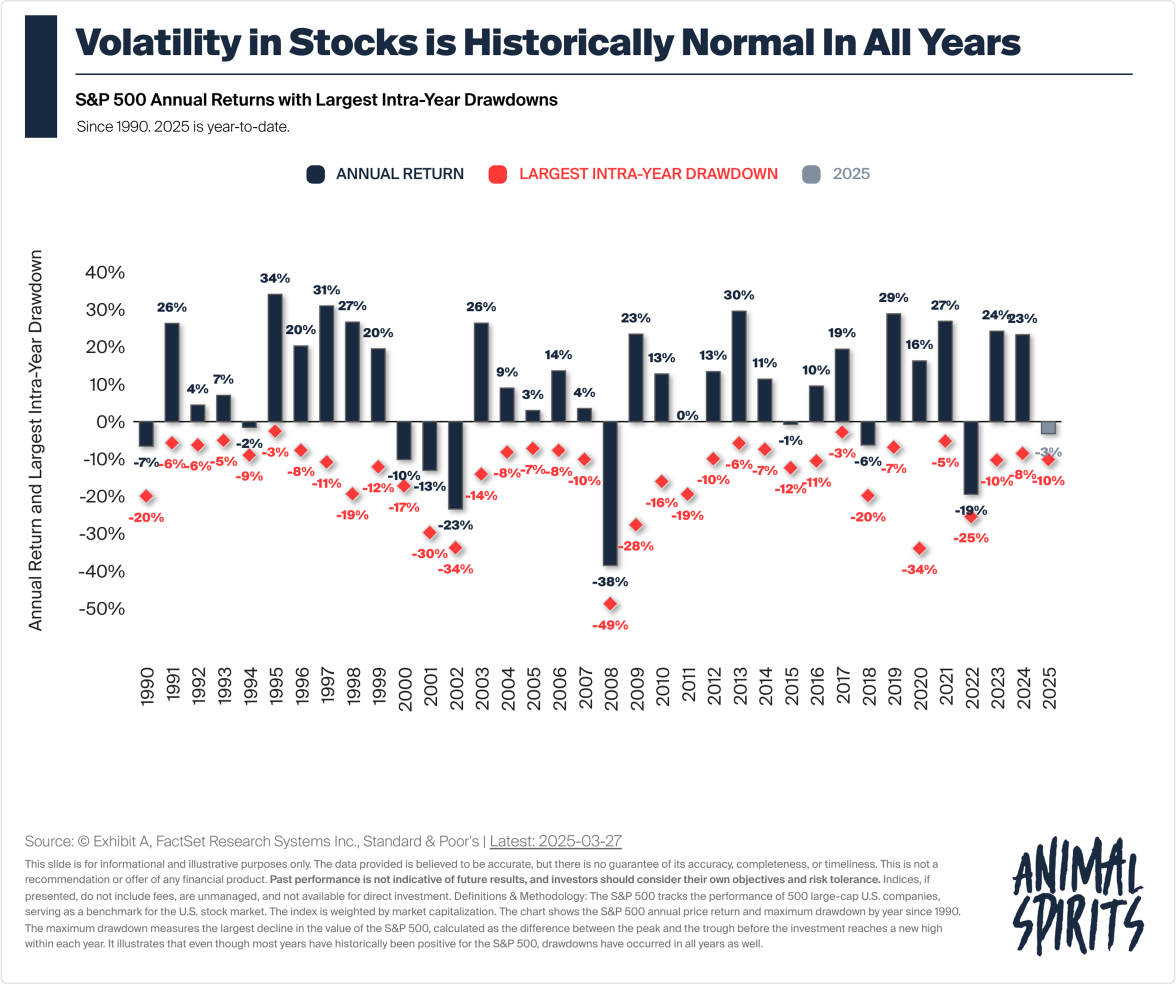

AT&T (NYSE: T) shareholders have plenty to celebrate, with the stock up 24% thus far in 2025. The telecommunications giant has presented robust earnings, reinforcing an optimistic long-term outlook. The stock's impressive performance is an outlier next to the 3% decline in the S&P 500 index year to date. As such, AT&T has emerged as a reliable source of stability amid the broader stock market volatility that's causing concern about the strength of the U.S. economy.

Can AT&T's record-setting rally continue, or is it time to hang up the phone? Let's discuss where the stock could be headed one year from now.

It's been nearly three years since AT&T completed one of the largest restructuring efforts in its history -- spinning off the WarnerMedia group in 2022. The deal marked a pivot away from the media and entertainment business, allowing the company to refocus efforts on its core telecom strengths. This strategic pivot has proven successful. Today, AT&T carries far less debt and generates more durable cash flow, gaining the flexibility to invest in growth areas like 5G and fiber optics infrastructure.