What Would You Do if Your Boomer Parents Ran Out of Money?

The most common financial family dynamics involve older generations having more money than younger generations. Our parents have had many more years to work and grow wealth. However, sometimes family patterns are reversed. What would you do if your Baby Boomer parents ran out of money? Would you be in a position to help? One […] The post What Would You Do if Your Boomer Parents Ran Out of Money? appeared first on 24/7 Wall St..

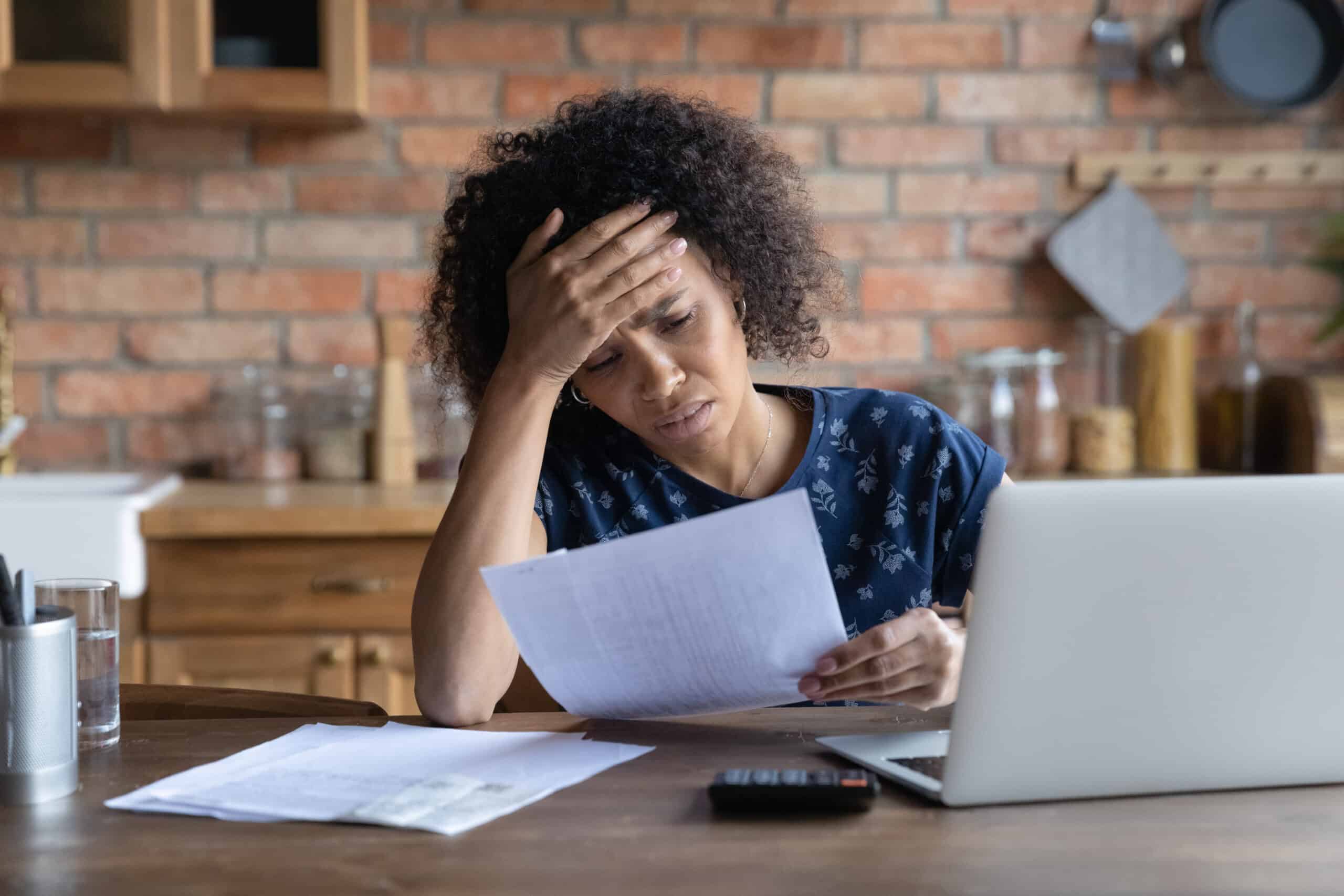

The most common financial family dynamics involve older generations having more money than younger generations. Our parents have had many more years to work and grow wealth. However, sometimes family patterns are reversed. What would you do if your Baby Boomer parents ran out of money? Would you be in a position to help? One Reddit user was forced to ask himself some tough questions when his aging parents came to him for support.

Unfortunately, this financial dilemma is becoming more common. A larger portion of today’s retiring Baby Boomers do not have enough savings to live comfortably when compared to aging citizens a few decades ago. Shockingly, recent data reveals that almost half of Americans aged 55-64 have no retirement savings at all. Children often step in to help, possibly at the cost of their own financial futures.

This slideshow details an anonymous Redditor’s experience, including how he handled this emotional and stressful terrain. We cover setting necessary financial boundaries, as well as how to support aging parents in a way that doesn’t enable them to continue poor money habits. You’ll also learn how to financially help your mom and day without jeopardizing your own savings.

When Your Parents Have No Retirement Savings

- A Reddit user shared a story about his Baby Boomer parents who ran out of money and nearly became homeless.

- He stepped in to help, having them sell their home and move closer so he could provide support.

Making Tough Financial Choices

- The Redditor works two jobs to support his parents while saving for his own retirement and helping his child.

- He bought his parents a small cottage that has since appreciated in value.

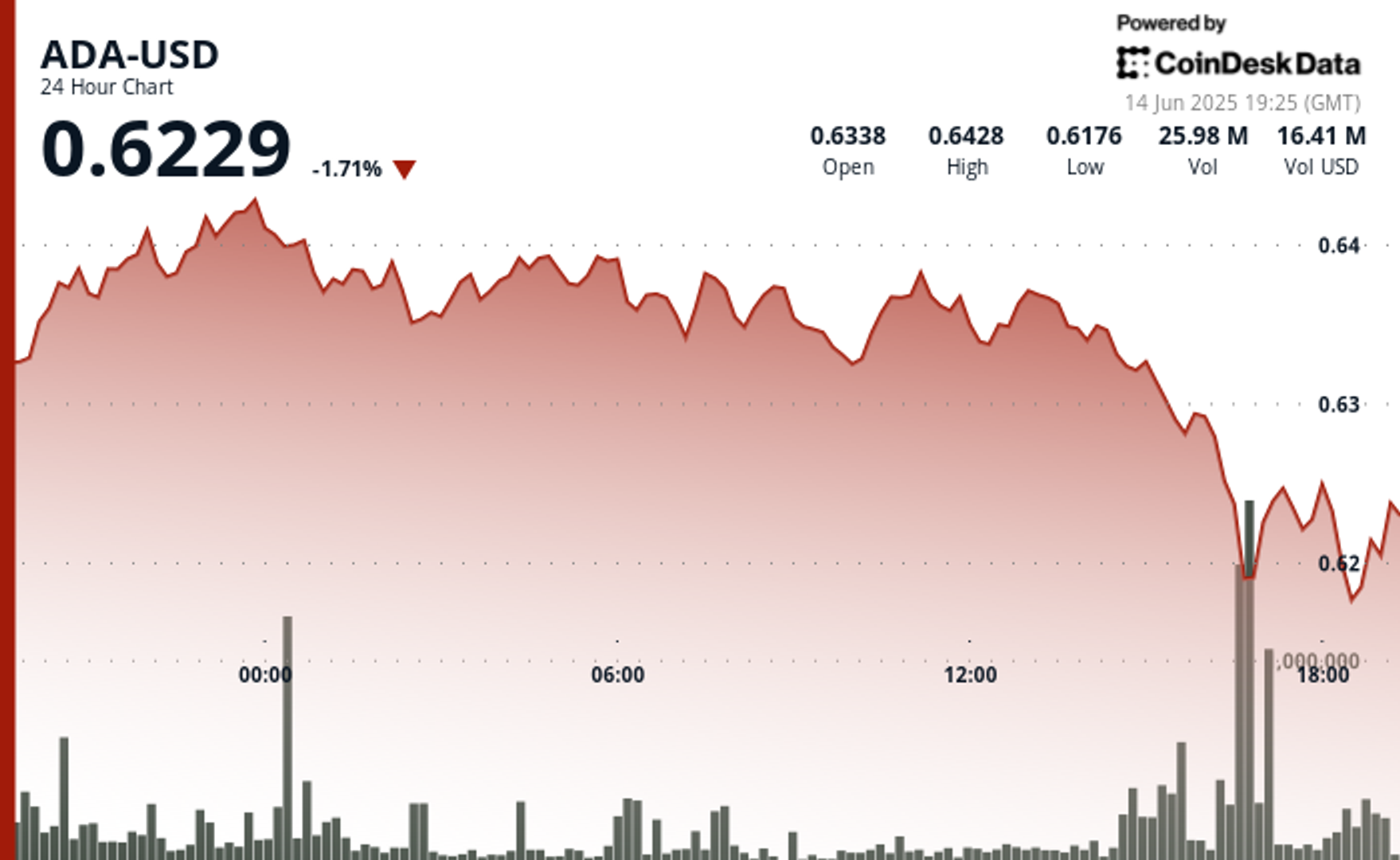

Boomers’ Retirement Crisis

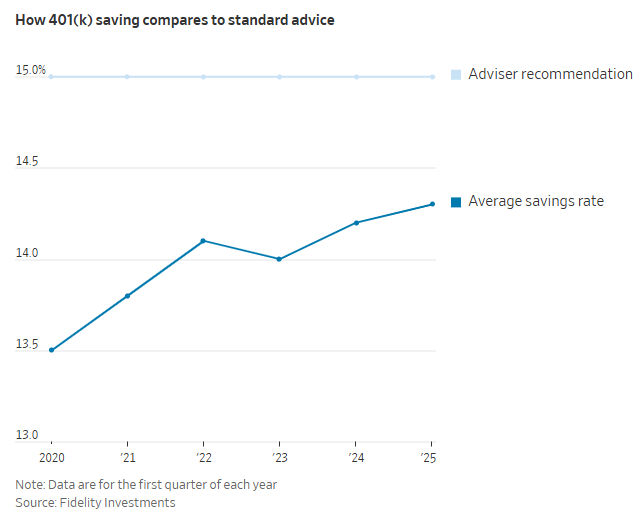

- A 2022 Federal Reserve report found 43% of Americans aged 55-64 had no retirement savings.

- This lack of preparation means many adult children are faced with financially supporting their parents.

Striking a Balance

- Adult children must balance helping their parents with maintaining their own financial security.

- Overextending to help could risk repeating the cycle and burdening future generations.

Prioritize Budget and Boundaries

- Support decisions should be based on both willingness and ability to help.

- Essential expenses and retirement savings should take priority in budgeting.

Smart Support Strategies

- The Reddit user required his parents to sell their expensive home and move to a more affordable location.

- He retained ownership of the new house to maintain control over the situation.

Setting Limits with Parents

- Helping doesn’t mean enabling bad financial habits or unsustainable lifestyles.

- Conditions and boundaries can ensure that financial aid is effective and responsible.

Avoiding Financial Burnout

- Without limits, adult children risk damaging their own financial future.

- It’s crucial to help in a way that doesn’t jeopardize one’s own stability.

Promoting Long-Term Sustainability

- Financial help should include plans to promote better habits in parents.

- Teaching financial responsibility can prevent future crises.

Seeking Professional Advice

- Consulting a financial advisor can help ensure wise and sustainable support.

- Advisors can guide gifting strategies and long-term planning.

The post What Would You Do if Your Boomer Parents Ran Out of Money? appeared first on 24/7 Wall St..