What Fed Chair Jerome Powell really should say this week

The Federal Reserve's meeting is the week's most biggest economic event.

A Federal Reserve meeting generates lots of scrutiny before a decision is announced.

The scrutiny usually revolves around some core questions such as:

- Will the central bank cuts its key interest rate?

- How does the central bank look at the condition of the economy now?

- How does it look at the economy's prospects over the next few years?

- How worried is the Fed about the current state of inflation?

The statement that ends the Fed's meeting tries to come up with answers to those questions, often in the most obtuse phrasing possible.

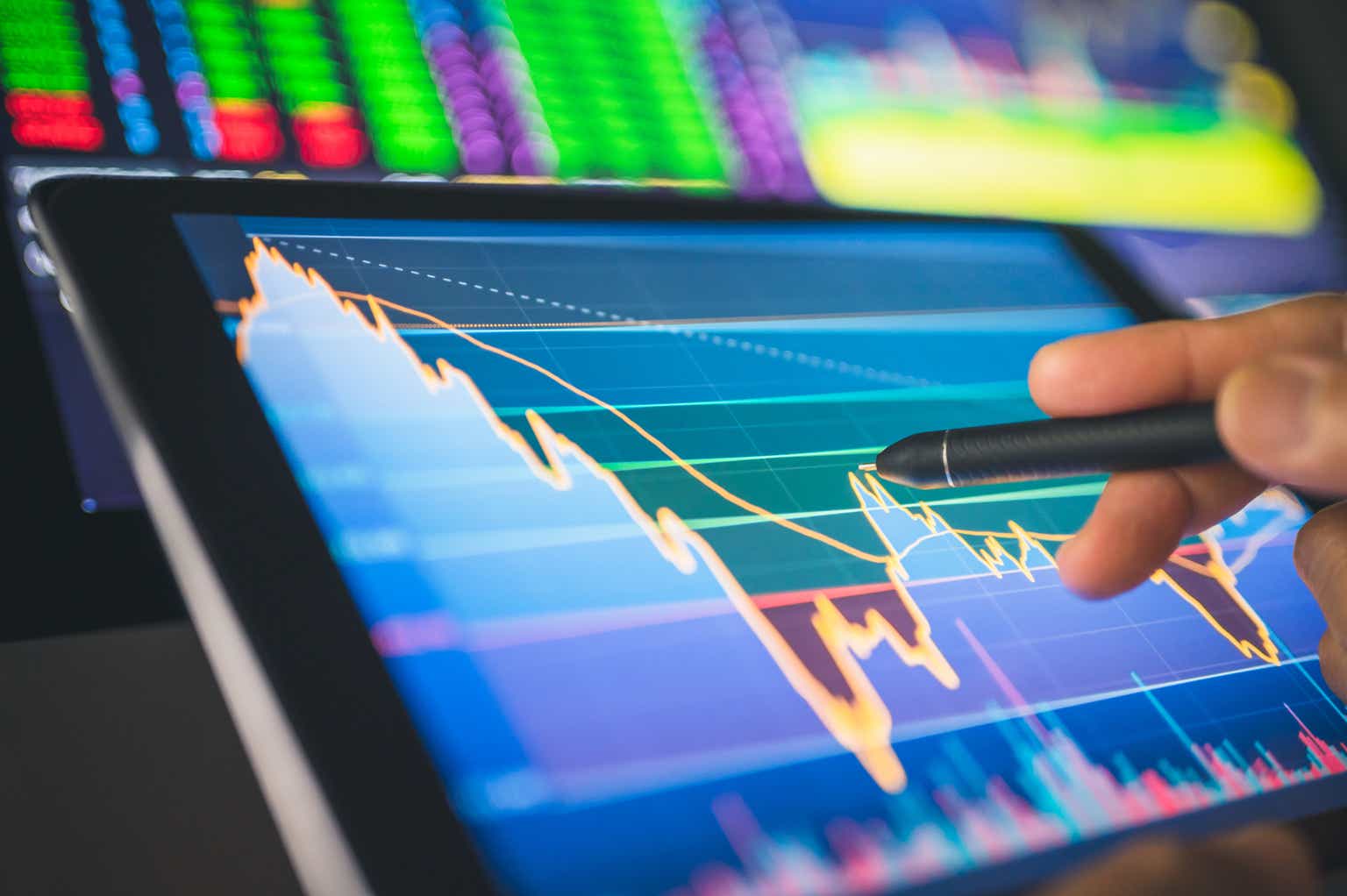

It's now the news conference after the meeting when actual news occurs that moves markets.

Related: Tesla sends dire warning about escalating the trade war

This will be true at about 2:30 p.m. ET on Wednesday when Fed Chairman Jerome Powell starts his post-meeting news conference.

His prepared remarks will be similar to the Fed decision text. But Powell will take questions, and he may well be asked about when or whether the Fed will react to all the market gyrations since the Standard & Poor's 500 Index peaked in mid-February.

Powell might say, as he did recently in New York, that the economy is in a good place and strong enough that the central bank doesn't need to act too quickly.

But should he? Futures trading late Sunday suggested the 2025 stock-market slump is still on. Stocks hit correction levels on Thursday, rebounded Friday and are wavering on Monday.

There were reports of deportations of people out of the U.S. over the weekend. Airlines have reported that flight bookings are falling. Home sales seem stalled. Restaurants are seeing declines in customers and smaller checks. Families worried about the economy are curtailing spending.

It will take time before the anecdotes will translate into hard data. But someone might ask Powell two questions:

- Has he seen these reports?

- Do the reports match up with indicators the Fed is watching?

Related: Nvidia's giant tech conference will show off AI's future

If the answer to Question 2 is yes, how does the Fed react because it operates with a dual mandate: to promote full employment and promote price stability?

Here is a chance for the Fed chairman to be blunt about whether the current economic situation is working. Maybe he just says: "We're not getting good vibes out of the economy and we want to be sure you know it."

The Fed is not expected to change its key Federal Funds Rate, now at 4.25% to 4.5%, at Wednesday's meeting. Futures trading on CME Group doesn't see a rate cut until June and twice after that.

These are guesses and many market analysts still see no rate cuts at all because inflation is still well above the Fed's 2% per year target.

So, the practical effect for anyone buying a house or thinking of buying a car?

For some time, you may be able to get a $250,000 mortgage at 6.65%, which would mean a monthly payment of about $1,600 (plus taxes and insurance). A 60-month loan on a new car might produce a $390-a-month payment.

Many borrowers might balk at either loan rate or the payments because they're worried about the economy.

Powell should be talking about it.

Retail sales report may offer hints of unease

An early statistical sign of the reality will come Monday morning when the Commerce Department issues its report on February retail sales.

Most economists see a small gain, but weak consumer confidence numbers may depress the numbers. So, too, will bad winter weather and the Los Angeles fires.

Related: UAW President Shawn Fain made a case in support of tariffs

Housing reports also shed light on consumer moods

A second hint about how consumers view the economy will come Monday from the National Association of Home Builders with its monthly home builders index. A reading above 50 overall means builders are optimistic.

The index nationally has been under 50 since May 2024, but it just hadn't been doing much since September 2023 when the 30-year mortgage was flirting with 8%.

The problems on home buying and selling include:

- Prices are high in many markets.

- Mortgage rates have been dropped close to 6%, a level that should boost sales.

- Many homeowners have low-rate mortgages and can't afford to move.

On Tuesday, the Commerce Department releases its February report on housing starts and building permits. Don't expect big gains.

Homebuilders that can have been buying down initial payments to close a deal. But, ultimately, that means a hit to profits.

More Economic Analysis:

- U.S. consumers are wilting under renewed stagflation risks

- Jobs reports provide critical look at economy, could roil markets

- Fed inflation gauge indicates big changes in key economic driver

The National Association of Realtors also reports Tuesday on existing-home sales in February. The estimate is a sales rate of 4 million, up slightly from a year ago but down 35% from January 2022.

Lennar (LEN) , one of the biggest homebuilders, saw sales fall last fall as interest rates rose. If rates will remain stable, the company thinks its own sales could rise from 80,210 homes in 2024 to 86,000 this year.

Lennar reports quarterly reports after Thursday's close, with an analyst call on Friday. The company's thoughts on tariffs, trade disputes, deportations should be interesting.

Watch leading economic indicators

The Conference Board will release the only forward-looking report, on Thursday morning, the Index of Leading Economic Indicators. Its December and January reports have suggested the economy has been weakening.

The estimate for the February report is for a small gain.

Related: Veteran fund manager unveils eye-popping S&P 500 forecast