Want a $1 Million Retirement Portfolio? Invest $100,000 in These 3 Stocks and Wait 10 Years

Retirement dreams often hinge on a robust portfolio, with $1 million as a coveted benchmark for financial security. Achieving this is daunting, though, requiring disciplined investing, time, and high-growth opportunities. Turning $100,000 into $1 million in 10 years requires a compound annual growth rate (CAGR) of about 25.9% — a challenging goal that depends on […] The post Want a $1 Million Retirement Portfolio? Invest $100,000 in These 3 Stocks and Wait 10 Years appeared first on 24/7 Wall St..

Diversifying across innovative sectors mitigates risks while pursuing ambitious returns in a volatile market.

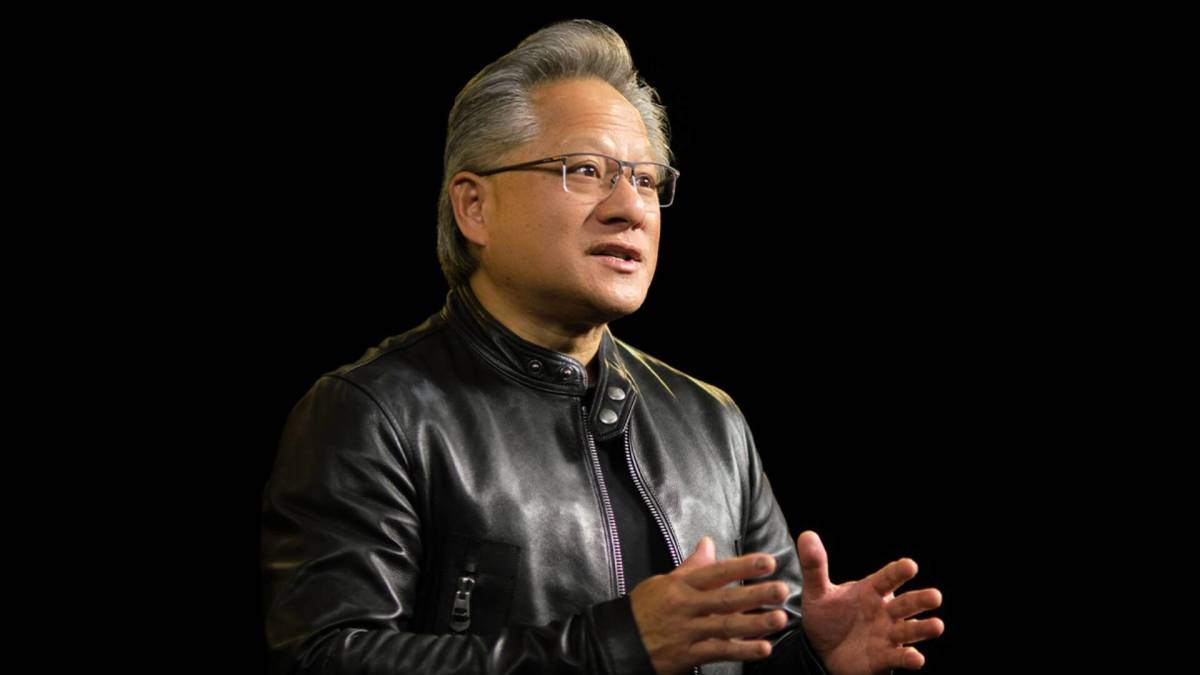

Nvidia made early investors rich, but there is a new class of ‘Next Nvidia Stocks’ that could be even better. Click here to learn more.

Key Points in This Article:

Retirement dreams often hinge on a robust portfolio, with $1 million as a coveted benchmark for financial security. Achieving this is daunting, though, requiring disciplined investing, time, and high-growth opportunities.

Turning $100,000 into $1 million in 10 years requires a compound annual growth rate (CAGR) of about 25.9% — a challenging goal that depends on investing in high-growth stocks. While these stocks are promising, they are also volatile and risky, so choosing companies with strong financials, innovation, and market leadership is important.

The three stocks below stand out as candidates, each thriving in booming sectors: e-commerce, AI analytics, and pharmaceuticals. Their success depends on sustaining rapid growth, staying ahead of competitors, and taking advantage of global trends. Diversifying across these three stocks helps reduce risk, but economic changes or company missteps could still impact returns. Careful stock selection and resilience are essential to achieving this ambitious goal.

Shopify: Powering the E-Commerce Revolution

Shopify (NASDAQ:SHOP), a leader in e-commerce platforms, is a compelling choice for a $1 million portfolio. With $33,333 invested, Shopify’s 27% revenue growth in the first quarter ($2.36 billion) and 50% gross margin signal financial strength. Its subscription model ensures steady cash flow, while AI-driven tools like Shopify Magic enhance merchant offerings, fueling growth. Holding $5.5 billion in cash, equivalents, and short-term investments with minimal debt, mostly operating leases, Shopify is poised to weather economic storms.

In March, SHOP stock switched from the NYSE to the Nasdaq exchange, and just last month its shares were included in the Nasdaq 100 Index and the Nasdaq 100 Equal Weighted Index.

To reach $333,000 in 10 years, it needs a 25% CAGR, a plausible outcome given its 22% five-year revenue growth and expanding global reach. E-commerce is projected to grow 10% annually, and Shopify’s small-business focus captures this wave. However, competition from Amazon (NASDAQ:AMZN) and economic slowdowns pose risks. If Shopify sustains its trajectory, leveraging innovation and market tailwinds, it could be a cornerstone of a million-dollar retirement, blending growth with resilience.

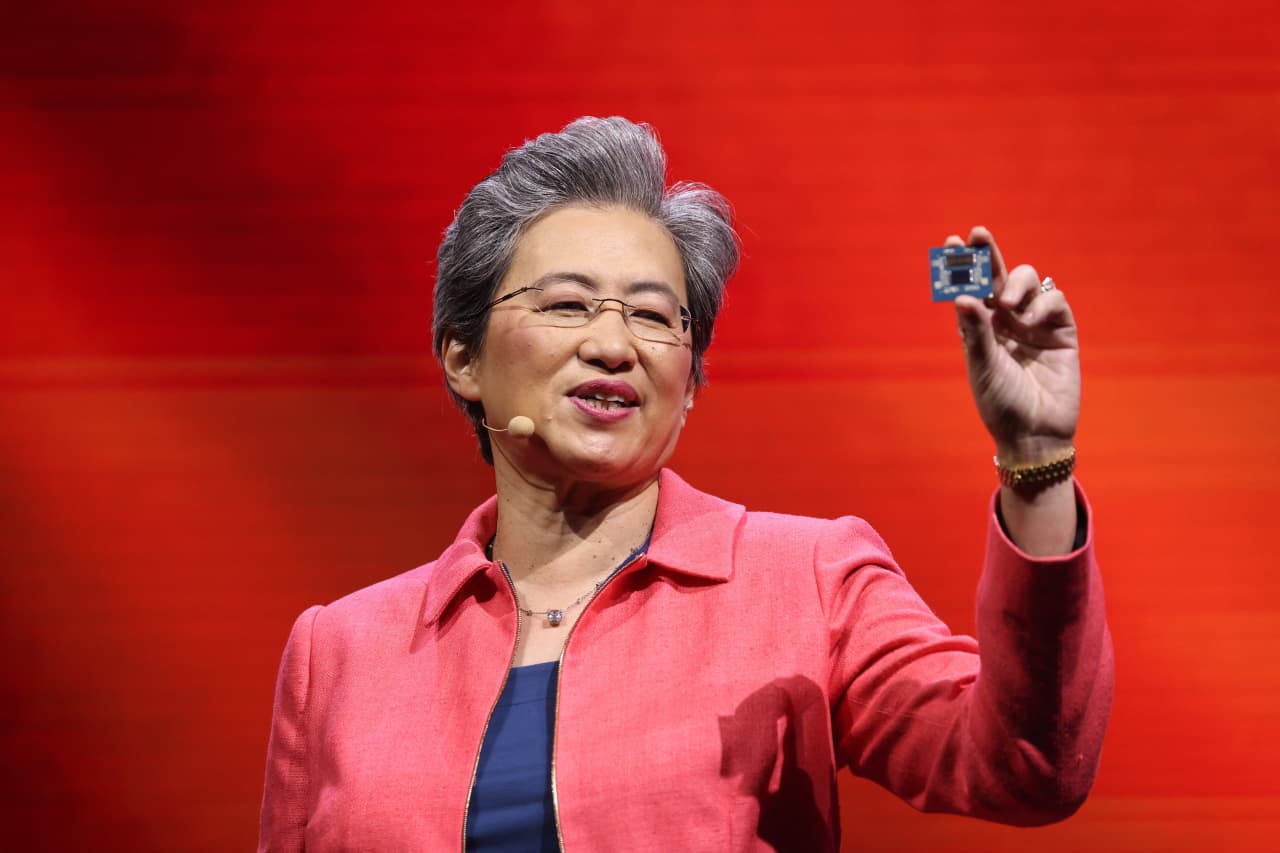

Palantir Technologies: Betting on AI-Driven Data

Data analytics powerhouse Palantir Technologies (NASDAQ:PLTR) offers high-growth potential for a $33,333 investment. Its AI platforms serve governments and corporations, driving 39% revenue growth ($884 million) and positive net income ($214 million, up 24% year-over-year) in the first quarter. With $5.4 billion in cash and investments, Palantir’s financials are rock-solid.

Its U.S. commercial segment surged 71%, diversifying beyond government contracts. The stock’s 476% rise in the past year shows strong investor confidence, but achieving a 25% CAGR over 10 years — which is needed to reach $333,000 — will require continued widespread adoption of AI.

As AI spending is forecast to double by 2028, Palantir’s growth path looks promising. If it navigates valuation concerns and scales commercially, Palantir could propel a portfolio toward $1 million, embodying high-risk, high-reward potential.

Eli Lilly: Riding the Pharmaceutical Wave

Pharmaceutical giant Eli Lilly (NYSE:LLY) is a strong contender for a $33,333 stake in a million-dollar portfolio. Its obesity and diabetes drugs, Mounjaro and Zepbound, fueled 45% first-quarter revenue growth to $12.7 billion. They also increased 23% increase in earnings to $3.03 per share. With a pipeline targeting Alzheimer’s and cancer, Lilly’s innovation drives its 19% five-year revenue growth.

Eli Lilly has $3.2 billion in cash and manageable, though elevated, debt, making it financially stable and well-positioned for expansion. Its planned $50 billion U.S. manufacturing investment since 2020 has strengthened supply chains, supporting global drug demand.

A 25% CAGR to reach $333,000 in 10 years is ambitious but feasible. Given LLY’s 41% five-year earnings growth and growing demand for weight-loss drugs. Risks include patent expirations and regulatory hurdles, but Lilly’s diversified portfolio mitigates these. As global healthcare spending rises, Lilly’s market leadership and R&D strength make it a reliable growth engine. For retirement investors seeking balance between innovation and stability, LLY stock could be a vital piece of the $1 million puzzle.

The post Want a $1 Million Retirement Portfolio? Invest $100,000 in These 3 Stocks and Wait 10 Years appeared first on 24/7 Wall St..