Wall Street analyst overhauls S&P 500 price target as markets gyrate

Stocks rebounded from correction last week.

U.S stocks are set for only a modest recovery from their slump over the remainder of the year, a top Wall Street investment bank indicated Monday, as investors continue to count the cost of President Donald Trump's tariff and budget-cutting policies to the world's biggest economy.

The S&P 500 fell into correction territory last week, after a 10% slide from its mid-February peak dragged the benchmark to its lowest levels since September. The market move came amid a global market selloff tied to the uncertainty surrounding Trump's on-again, off-again tariff threats.

Stocks rebounded firmly on Friday, with the S&P 500 recording its strongest gain of the year, but they remain firmly in the red since early January and around 2.5% south of their Election Day close.

Lori Calvasina, head U.S. strategist at RBC Capital Markets, added to a chorus of analysts who have trimmed their end-of-year forecasts for the benchmark in a note published Monday. She cited the prospect that slower domestic growth and quickening inflation would weigh on earnings growth.

Calvasina cut her year-end S&P 500 price target by 6%, to 6,200 points, while lowering her collective earnings forecast by around 2.6% to $264 a share.

"We’ve also removed the modest [profit-margin] expansion that we had been forecasting," Calvasina said. “This is a move that we think is prudent as we suspect it will be difficult for management teams to plan around the new trade policy, which has been in flux.”

LSEG data, published Friday, show analysts are expecting full-year profit growth for the S&P 500 of around 10.6%, down from the 14% forecast that held at the start of the year.

RBC's bear-case price target in play?

Calvasina also noted that should the S&P 500 retest, or trade through, the lows of last week, her bear-case price target of 5,550 points, a 4% reduction from her previous forecast, could be back in play.

“Our base-case price target of 6,200 assumes that the March 13th low holds, or that the index won’t break much farther below it. If it does, we think our bear case likely kicks in,” she said.

Late last week, veteran Wall Street forecaster Ed Yarndei trimmed his S&P 500 price target for this year and next, citing increased recession odds and the lack of a move by Trump to tame the market selloff.

Richard Saperstein, chief investment officer at New York-based Treasury Partners, sees markets remaining volatile into early April, when new tariffs on goods from Canada and Mexico, as well as reciprocal levies on other U.S. trading partners, kick in.

Related: Stock vigilantes do the bond market's work in testing economy

"Markets are gyrating from the potential recessionary impacts of tariffs and uncertain trade policy," he said. "The reflects maximum volatility as earnings estimates begin to come down and consumer and business confidence declines."

CBOE Group's VIX index, which hit a year-to-date high last week, was marked at $21.87 in early Monday trading, a level that suggests daily swings of around 1.37%, or 76 points, for the S&P 500.

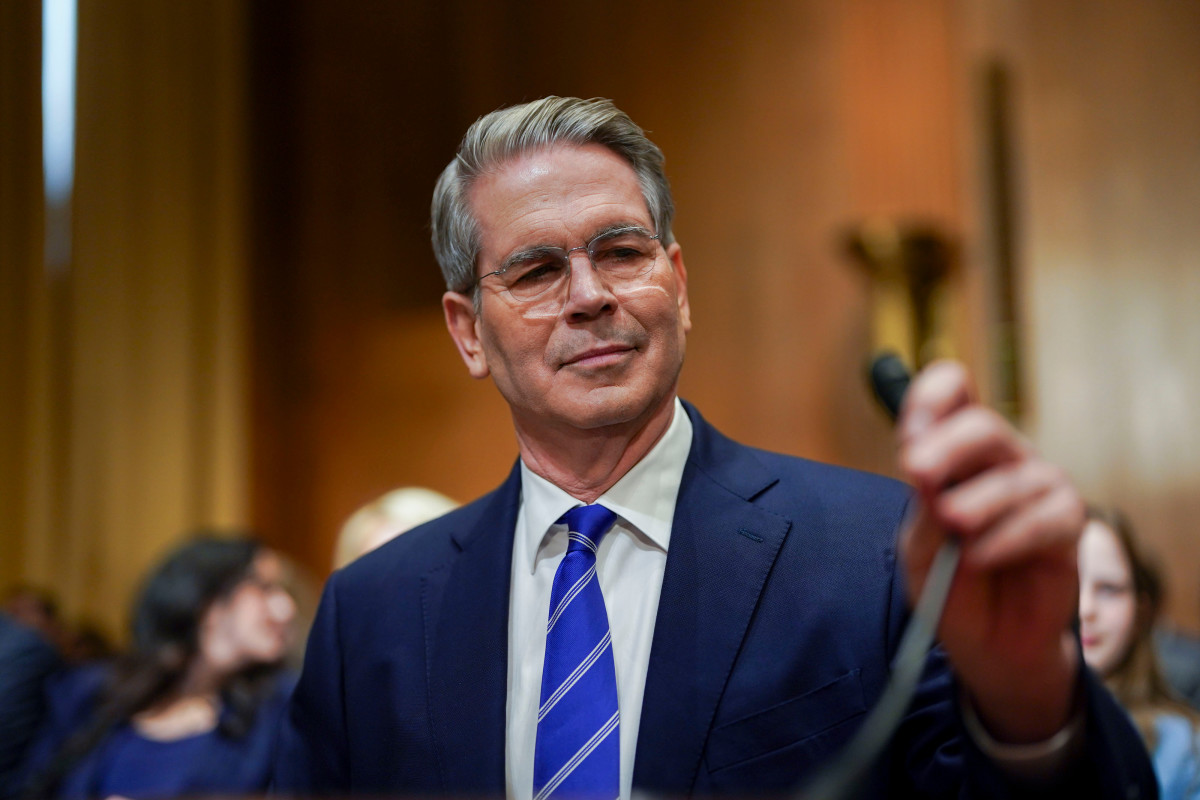

Market corrections 'healthy': Treasury's Bessent

Treasury Secretary Scott Bessent appeared to confirm that suspicion during a weekend interview with NBC's "Meet the Press," during which he dismissed the notion that markets were signaling concern about the president's economic policies.

“I’ve been in the investment business for 35 years, and I can tell you that corrections are healthy, they are normal,” Bessent said. “I‘m not worried about the markets. "

"Over the long term, if we put good tax policy in place, deregulation and energy security, the markets will do great,” he added.

More Economic Analysis:

- U.S. consumers are wilting under renewed stagflation risks

- Jobs reports provide critical look at economy, could roil markets

- Fed inflation gauge indicates big changes in key economic driver

JP Morgan analysts, however, noted that while Friday's S&P 500 rally could offer some technical support to the market, "our view remains that the growth scare risks will keep returning, resulting in renewed pressure on equities, capping bond yields and driving another leg in defensive stock leadership.

"We do recognize that in the very short term the market could recover somewhat, as the S&P 500 is down 10% from highs, many cyclical stocks such as airlines, [capital] goods, banks and also [semiconductors], are down 20% to 30%, and the Bull-Bear has entered oversold territory," Mislav Matejka and his team said in a note published Monday.

"Having said that, we do not think the air-pocket scare will be fully complete until potentially softer payrolls push the Fed into more significant accommodation."

Related: Veteran fund manager unveils eye-popping S&P 500 forecast