Veteran analyst has blunt response to AI-spending worry

Artificial intelligence budgets have surged in the past two years, but concerns are mounting.

It's been a great run for technology stocks.

Since the massively successful launch of OpenAI's ChatGPT in 2022, companies, including Google's Gemini, have ramped up spending to develop their own large language models.

The spending surge has been most evident within network infrastructure, mainly servers and the powerful chips powering them.

The hyperscalers, including Amazon, Microsoft and Alphabet, have plowed tens of billions of dollars into revamping their cloud networks to handle the crushing workloads of AI chatbots and agentic AI programs.

Related: Veteran analyst sounds alarm on Amazon, Microsoft stock

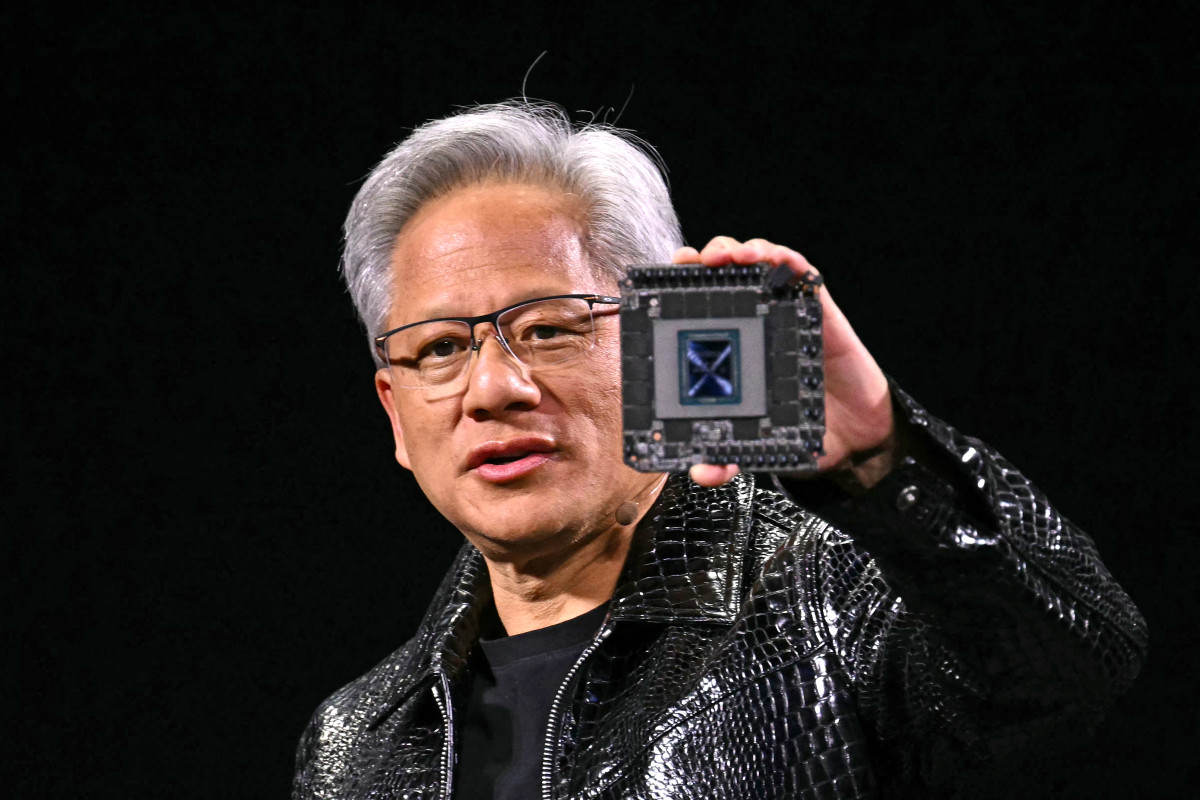

This AI gold rush has been a boon to many stocks, including Nvidia, which is up about 676% since the end of 2022 and gained 171% in 2024.

The Santa Clara, Calif., group is the biggest producer of next-generation graphics processing units and software specially designed to manage AI efforts.

The flurry of activity has also been a boon to shareholders — but worries that IT budgets could be due for a reset are mounting.

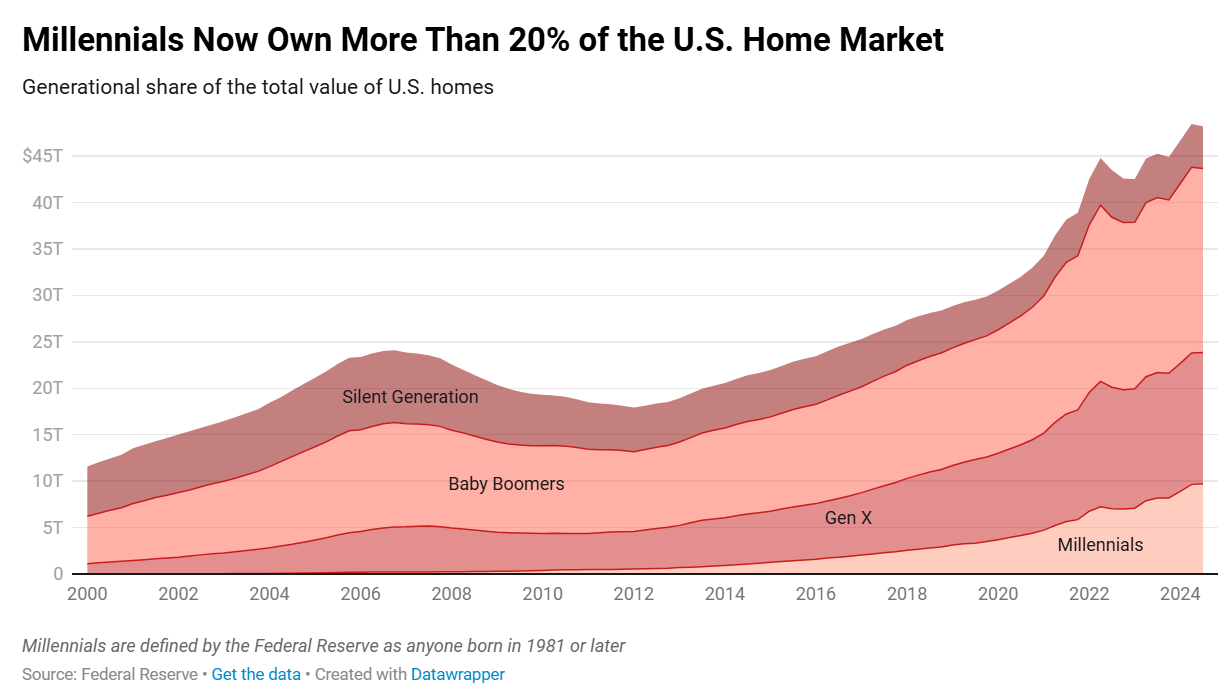

IT spending is soaring because of AI investments

Make no mistake, the money we're talking about here is massive.

Even if you consider just the major AI players, Meta, Alphabet, Microsoft, and Amazon, the numbers are hard to wrap your mind around.

Related: Fund manager who predicted Nvidia rally revamps stock forecast

In 2024, capital expenditures at those four companies swelled to $230 billion (yes, with a "b"), up 60% from $144 billion in 2023. For 2025, those companies have said they expect to shell out a whopping $325 billion.

The surge in spending means a tremendous tidal wave of demand flowing to the likes of Nvidia (NVDA) .

Nvidia's revenue annual revenue was $27 billion in 2023. It exceeded $130 billion last year as cloud data companies have gobbled up NVDA's H100, H200, and next-gen GB200 AI chips.

Given the big increase in demand and the potential for R&D to produce AI solutions that pay off down the road, it's little wonder that tech stocks have been stock market darlings.

The Technology Select Sector SPDR Fund (XLK) was up 56% in 2023 and tacked on another 22% last year.

Individual technology stocks have done even better. For example, recent AI high-flyer Palantir (PLTR) is up nearly 250% in the past year, while Soundhound AI (SOUN) is up 84%.

Palantir is a data analytics company that helps government and enterprises secure and manage data. It's enjoyed increasing demand for its Artificial Intelligence Platform from companies looking to turn their data into AI programs and AI automations.

Soundhound AI markets AI-enabled voice solutions for restaurants, including drive-throughs and automakers.

The impact of the technology stocks rally on the broader stock market has been substantial. Tech stocks account for about one-third of the S&P 500 index. If you exclude them from the calculation, the S&P 500 would have risen only 11% in 2024 rather than 24%, according to S&P Dow Jones Indices.

Is an AI spending reckoning looming?

Technology stocks have led the stock market's recent swoon as investors pocket profit in high-flyers, including Nvidia and Palantir, which have tumbled by about 20% and 35% from recent mid-month peaks.

Related: Analyst who forecast stocks rally resets outlook after tumble

The selloff across the sector is explained partly by rising worry that technology companies will ratchet back their spending pace.

The concerns stem from the release of DeepSeek last month. A Chinese large-language model that competes against ChatGPT and Gemini, DeepSeek was reportedly created for about $6 million using prior-generation AI chips.

If the company's claims prove out, U.S. technology companies have overmodeled the likely costs of creating AI solutions, potentially meaning less need for hyperpowered new AI technology.

The risk to IT budgets is compounded by growing concern about the health of the U.S. economy. Weakening consumer confidence, resurgent inflation, growing job losses, and a Federal Reserve less inclined to lower interest rates might mean companies go from growth at any cost to austerity.

All these worries are understandably making tech-stock investors a bit wobbly, but for now much of the concern is speculation.

If budgets don't collapse and AI activity remains strong, the recent downturn in these stocks could create an opportunity for risk-tolerant buyers.

More Tech Stocks:

- Nvidia-backed startup could be hottest tech IPO of the year

- Sorry Elon, most Americans are uneasy with this Tesla technology

- Cathie Wood unveils 5 crucial technology trends

That's not lost on longtime Wall Street veteran analyst Tom Lee. Lee has been navigating the markets since the 1990s, so he had a front-row seat to the dot-com bust and the Great Recession.

In a recent CNBC interview, Lee was asked about the IT-spending risk.

“I don’t think AI spending is really going to weaken," said Lee.

If he's right, that's good news, but it doesn't necessarily mean that we will get the same eye-popping returns from these stocks.

"The visibility for #AI spending remains high," said Lee in a post on X. "A lot of good news 'priced in' but this doesn't mean they have topped. Long-term positive thesis intact."

Related: Popular analyst makes shocking stock market prediction