US Wage Growth Was the Absolute Worst Under This President

Stagnating US wage growth can lead to a faltering economy. There are a few presidents throughout history who have been over some sharp declines in wage growth. President Jimmy Carter is one such example, which coincided with an economic crisis in the form of the 1979 Oil Crisis. The early 1990s recession saw it falter […] The post US Wage Growth Was the Absolute Worst Under This President appeared first on 24/7 Wall St..

Stagnating US wage growth can lead to a faltering economy. There are a few presidents throughout history who have been over some sharp declines in wage growth. President Jimmy Carter is one such example, which coincided with an economic crisis in the form of the 1979 Oil Crisis. The early 1990s recession saw it falter under George H.W. Bush, which ultimately may have contributed to his loss to Bill Clinton in the 42nd presidential election. Today, we’re looking at someone who perhaps had the worst of it when it came to overall wage growth during his presidency.

Key Points

-

Some keypoint here

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

Herbert Hoover

Serving from 1929 to 1933, Hoover’s presidency directly lined up with the circumstances behind one of the worst periods of wage growth in American history. Well, that’s an understatement, honestly. However, the economic circumstances of the late 1920s and early 1930s were a tough time for the average American worker. It would take years before the United States could crawl out of this economic hole and get on the path to recovery. Now, it isn’t necessarily fair to blame things entirely on Hoover. Presidents are seldom responsible solely for what happens during an economic crisis. Hoover inherited a tough situation, but his failure to act promptly is perhaps what led to FDR taking office in the 1933 Presidential Election.

The Great Depression

The Great Depression is one of those once-in-a-lifetime events that affects the entire globe. Lasting from 1929 to 1939, the world suffered at large throughout the decade. Wage growth wasn’t just on the decline in the United States, it was elsewhere across the rest of the world. As such, it can perhaps seem a bit unfair to solely point toward Hoover’s actions during his presidency as a contributing factor to the United States’ fortunes during the early years of the Depression. That said, a lack of understanding of the circumstances surrounding the Great Depression is what ultimately made Hoover such an ineffectual leader during the early years of the economic downturn.

Rugged Individualism

Hoover was a big believer in rugged individualism. He figured that a person is self-reliant, independent of the outside factors in the world. Now, philosophically, this is a fine idea. We’ve had concepts like this introduced with the likes of laissez-faire economics. When the rubber meets the road, however, this leads to a far worse response. As such, this same belief in rugged individualism would prove to be part of Hoover’s marred legacy in the wake of his presidency. A lagged response would mean effective measures against the brunt of the Great Depression wouldn’t be immediately seen, nor felt, for years to come. By the time Hoover started getting the wheels in motion, much of the damage had been done.

The Smoot-Hawley Tariff Act

Signed in 1930, the Smoot-Hawley Tariff Act was designed to bolster the American economy and prevent foreign competition in the wake of the Great Depression’s start. In reality, this had the opposite effect. Wage growth would continue to stagnate, and now it would affect other fields like agriculture. Global trade was already suffering quite a bit under the effects of the Great Depression. The Smoot-Hawley Tariff Act was an ill-advised piece of policy that Hoover was warned against signing. Pressure from both his party and the American population would prove to do quite a bit of damage.

Retaliatory Tariffs

The immediate aftermath of the Smoot-Hawley Tariff Act saw countries across the world start to enact retaliatory tariffs against the United States. This had a domino effect for industries like agriculture, which can rely on foreign exports to make the lion’s share of their profits for the year. Stock would be left to flounder or rot in the fields in some cases. This drove the cost of imported goods up substantially as well, which meant American households had to make do with what was on hand rather than continue their usual purchasing practices.

The Banking Crisis

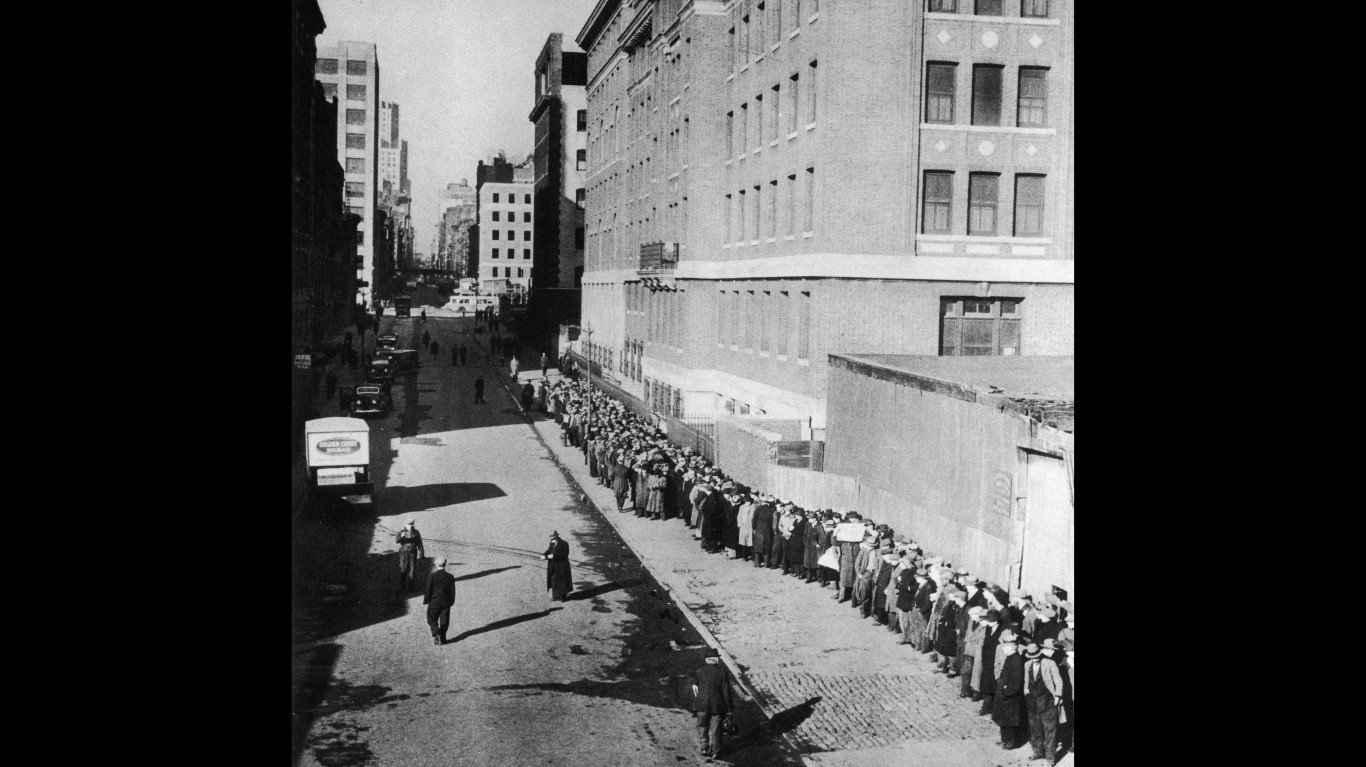

There are quite a few contributing factors to the Great Depression, and conversely, the decline of wage growth throughout the 1930s. However, all institutional trust in banks and lending facilities outright collapsed seemingly overnight. Nearly a third of American banks across the country would go under, and many citizens would go for a run on the banks to get what money they could out before everything disappeared into the ether.

Revenue Act of 1932

On paper, raising taxes to increase revenue makes some sense, I suppose. However, the Revenue Act of 1932 had the opposite effect of its intended purpose. With Americans spending even more on common goods, they simply bought less. What was taxed was well and good, but it didn’t make enough of a difference to drag the United States out of the Depression just yet.

The Effects on Wage Growth

The Great Depression curtailed wage growth for nearly a decade. Now, we’ve seen the same sort of stagnation in more recent memory, usually signaled by larger recessions or economic depressions. However, the Great Depression is unique for a few factors that we’ll look at a little further in detail.

Decreased Purchasing Power

The dollar was worth less, goods cost more, and people weren’t getting paid as much. This is a perfect storm of sorts when it comes to contributing factors that can curtail spending. Americans simply didn’t have the same level of purchasing power they had during the 1910s and the earlier part of the 1920s, and it showed. When presented with fewer overall economic opportunities, the average citizen is more likely to just do their best to hold on to what they can.

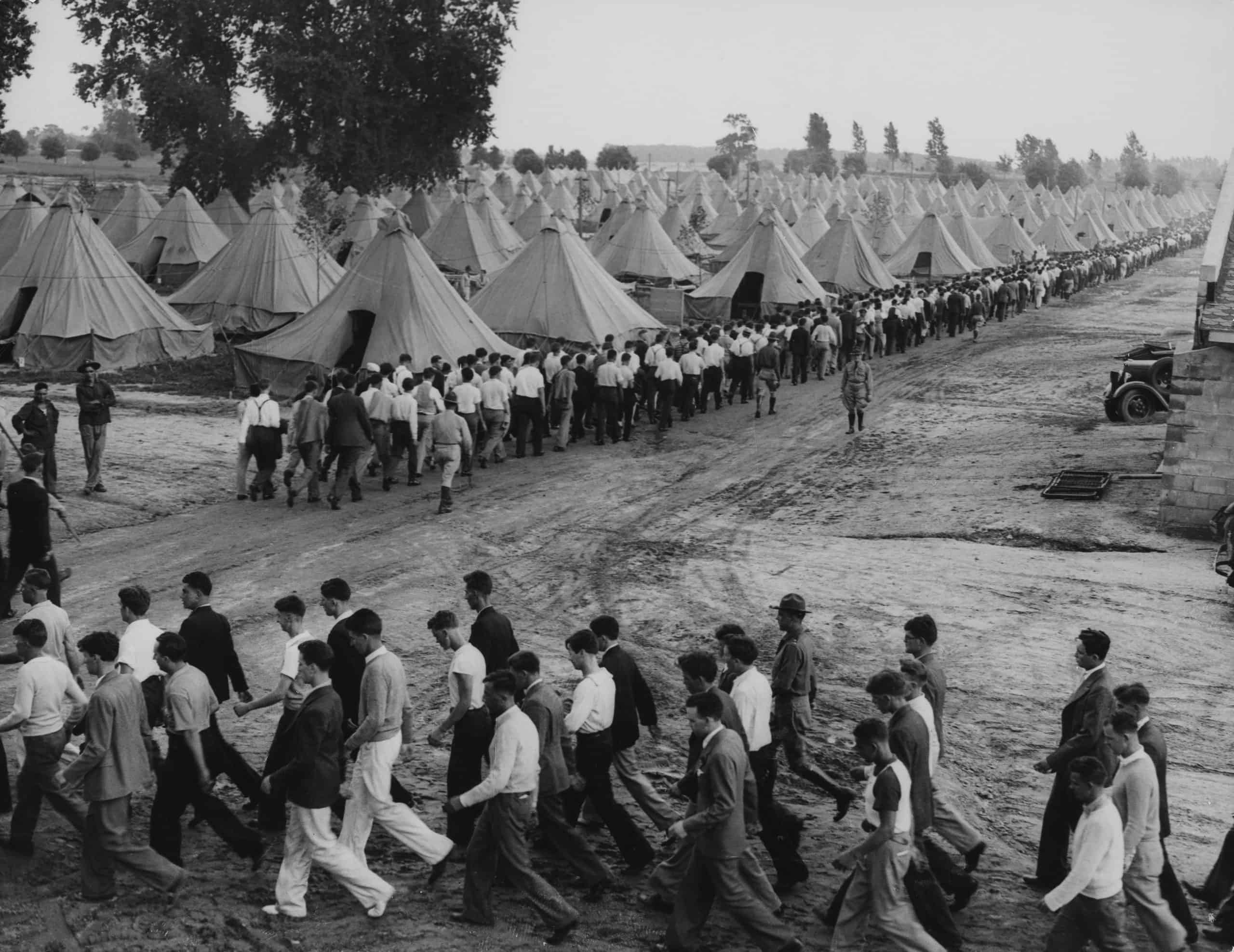

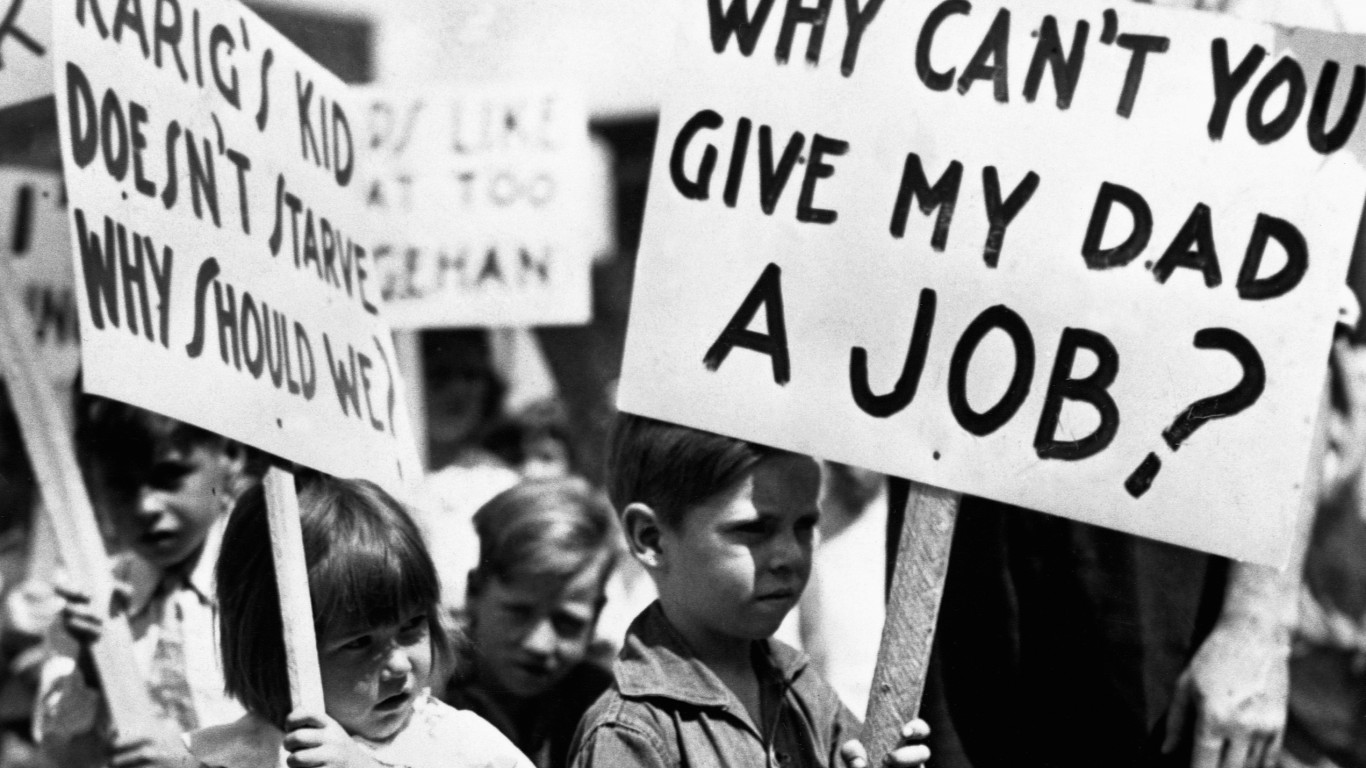

Layoffs

The average citizen wasn’t the only one suffering through the effects of the Great Depression. Many businesses would continue operations as usual throughout the decade. However, this also came with the caveat of layoffs. The cost of doing business had gone up, and it could be foolhardy to hold on to a workforce you could seldom afford to pay at the time.

Businesses Failing

If businesses weren’t having difficulty holding on to employees, they were likely outright failing. I couldn’t find a solid estimate of how many businesses went under during the Great Depression, but a lack of investment opportunities is going to be a contributing factor to a lack of wage growth for workers. You need competition in the market to drive wages up, and that simply wasn’t happening.

Wage Cuts

As you might imagine, a lack of economic growth is going to make it substantially more difficult to invest in businesses. In some cases, this caused wages to decline for some workers. This is an unusual scenario, but any cash flow is better than no cash flow. Declining wages would reverse as a matter of the recovery process from the Great Depression, but that was still years out from Hoover’s presidency.

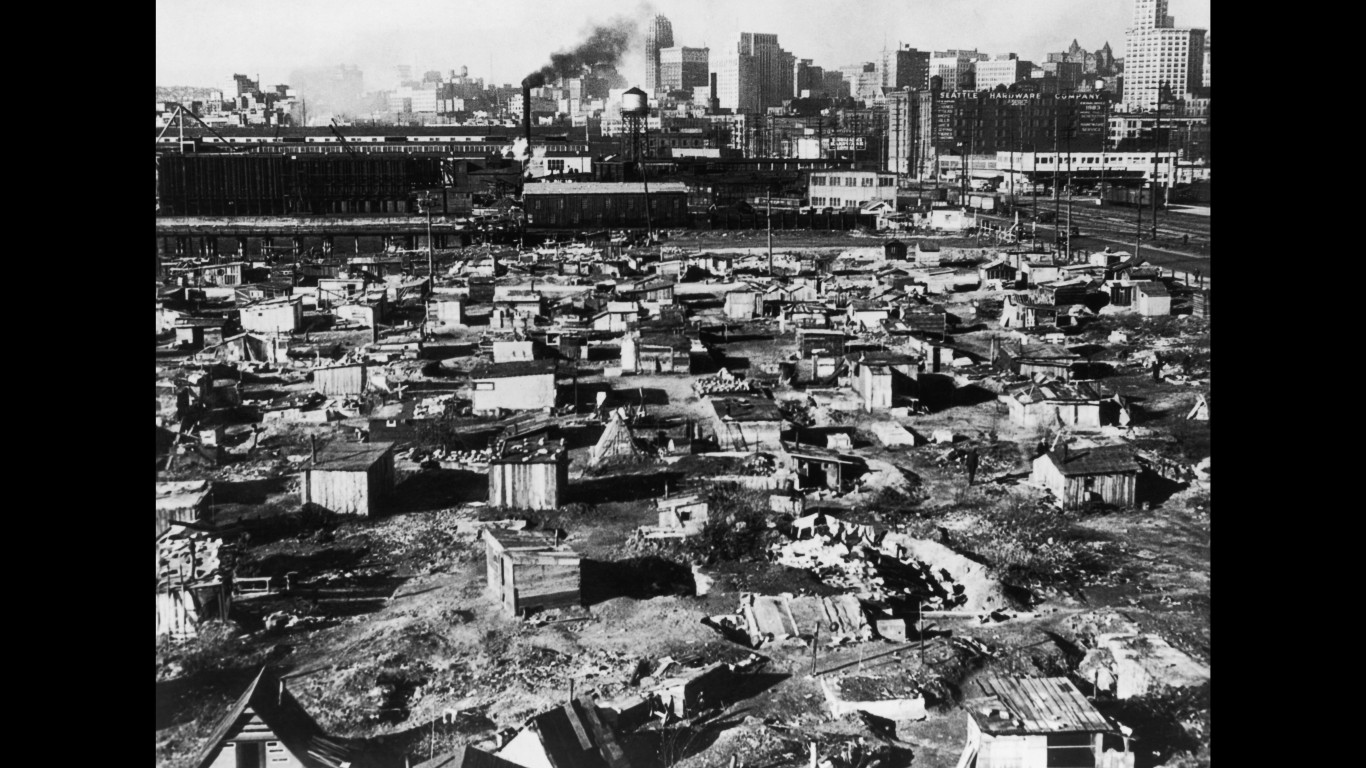

Foreclosures

A natural byproduct of a lack of wage growth, declining economic opportunities, and fewer investments meant that some Americans simply lost their homes. Foreclosures were at an all-time high during the Great Depression, something not seen again until the Great Recession. Many homeowners would end up on the streets, despite working full-time hours in some cases. The purchasing power of the dollar simply wasn’t there at the time.

Widening Class Divide

Wealth is a factor in how a household can weather something like a financial crisis. The Great Depression saw the class divide begin to widen. The rich got richer, the poor got poorer, and wage growth didn’t keep in step. This is something we see from time to time, but it leaves a sour taste in the mouth either way.

Increased Value of Debt

Despite a lack of funds, the value of debt rose throughout the Great Depression. We’ll discuss the deflationary spiral that started during the Great Depression a little further on. It is important to note that despite deflation occurring, the overall value of debt remained static. Your money was worth less than it was at the start of the decade, but the debt didn’t change.

Public Confidence

It doesn’t come as much of a surprise, but throughout Hoover’s presidency, the American population’s confidence in both businesses and the government was shaken substantially. If the government couldn’t provide a means to protect the citizens’ funds, who could? Hoover’s initial hands-off approach was something seared into the public consciousness as well, alongside the rather counter-productive legislation signed to combat the Depression. American confidence wouldn’t return until FDR took office and began enacting parts of the New Deal.

Unwillingness to Invest

When the value of the dollar is plunging, this results in some nasty side effects, as you can imagine. A lack of power behind the dollar invariably resulted in businesses and people alike refusing to invest. If values were going to the floor, it’s better to wait for things to spiral downward.

Deflationary Spiral

That brings us to one of the larger underlying issues behind declining wage growth under Hoover’s presidency: the deflationary spiral. Deflationary spirals are rather uncommon, but happen during major recessions. In the case of the Great Depression, this was a direct result of American production ramping up without the demand to match it. Prices dropped, inventory was liquidated, and deflation signaled a fatal blow of sorts to the Hoover administration.

A Lack of Immediate Federal Response

In most administrations, the president and their cabinet are fairly swift in response. Take things like the economic stimulus during the Great Recession, or the Cash for Clunkers program, as an example. Federal response would be coming under Hoover, but the measures taken were later than anticipated, with things like the Smoot-Hawley Tariff Act only going into action in 1930. The Revenue Act was later in Hoover’s administration, being signed in 1932. A lack of immediate response from the federal government led to businesses collapsing, people going hungry, and homes getting foreclosed.

Too Little, Too Late

Wage growth stagnated and declined throughout the Great Depression. While Hoover’s administration would start making the right steps to course correct, by then, it was too little, too late. The damage done to both American confidence in Hoover’s leadership and the primary financial institutions of the United States had been done. Depending on your age, you’ve likely heard the horror stories from a parent or grandparent about the hardships that occurred due to a lack of wage growth during the decade.

The post US Wage Growth Was the Absolute Worst Under This President appeared first on 24/7 Wall St..