Buying Apple Stock Isn't Worth the Risk

Shares of Apple (NASDAQ: AAPL) slumped on Friday in response to a new tariff threat from President Donald Trump. In a post on Truth Social, Trump threatened a tariff of at least 25% on all iPhones manufactured outside of the United States. Apple has been shifting some production from China to India, reportedly planning to make most of its U.S.-bound iPhones in India by the end of 2026.While it's unclear whether the Trump administration has the authority to impose tariffs on individual companies, Apple is in a lose-lose situation. Manufacturing iPhones in the U.S. would likely be prohibitively expensive, leading to prices that are well out of reach for many iPhone users. Alternatively, sticking with the plan to use Indian manufacturers risks substantial tariffs that would also force significant price increases and dull demand.There's no telling how all this will end, but Apple stock is looking like an especially risky proposition for multiple reasons.Continue reading

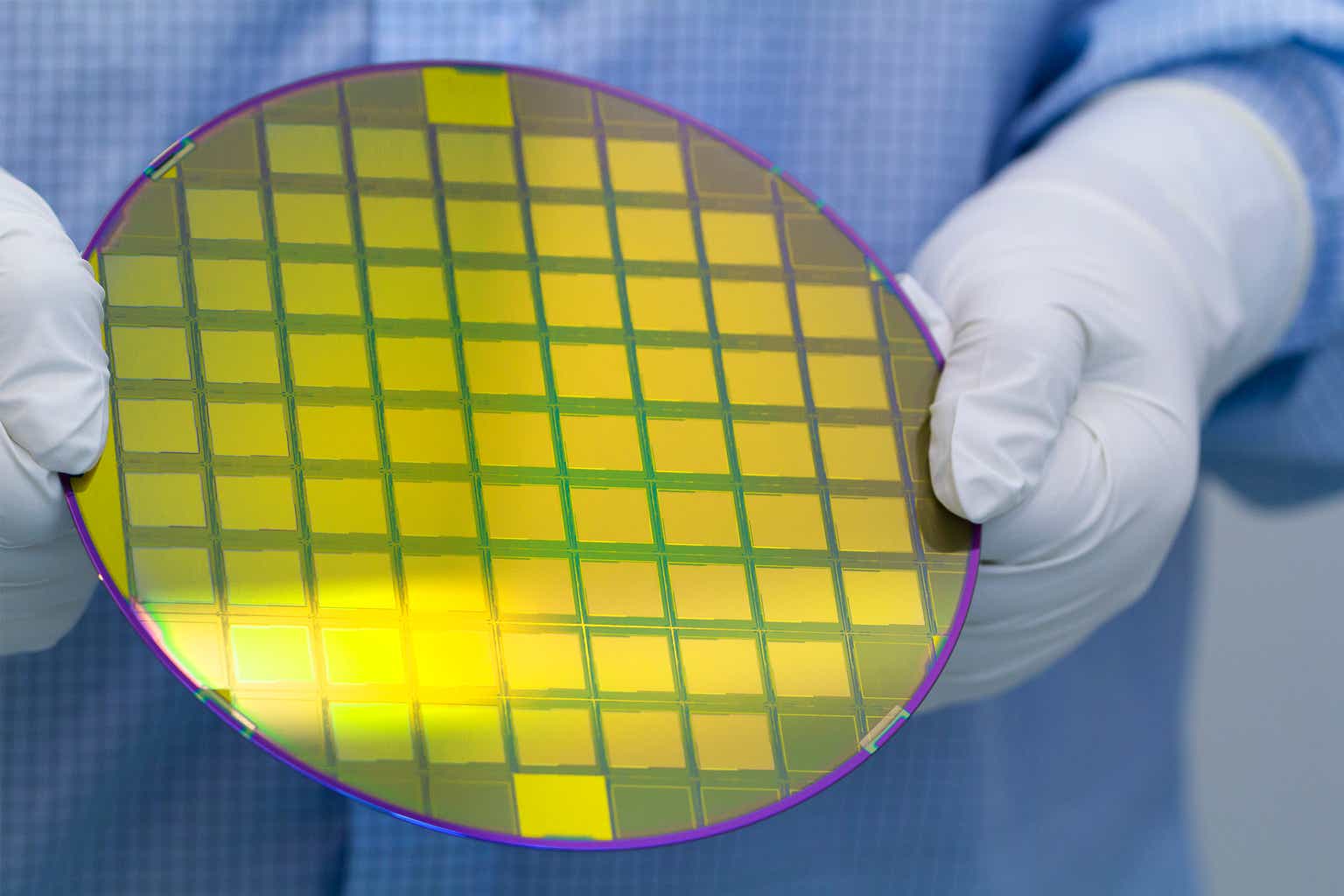

Shares of Apple (NASDAQ: AAPL) slumped on Friday in response to a new tariff threat from President Donald Trump. In a post on Truth Social, Trump threatened a tariff of at least 25% on all iPhones manufactured outside of the United States. Apple has been shifting some production from China to India, reportedly planning to make most of its U.S.-bound iPhones in India by the end of 2026.

While it's unclear whether the Trump administration has the authority to impose tariffs on individual companies, Apple is in a lose-lose situation. Manufacturing iPhones in the U.S. would likely be prohibitively expensive, leading to prices that are well out of reach for many iPhone users. Alternatively, sticking with the plan to use Indian manufacturers risks substantial tariffs that would also force significant price increases and dull demand.

There's no telling how all this will end, but Apple stock is looking like an especially risky proposition for multiple reasons.