$ULTY is Crushing It – Here’s Why I Can’t Stop Buying More

ULTY’s Sky-High Yield: Dividend Dream or Risky Rocket Ride? The YieldMax Ultra Option Income Strategy ETF (NYSEARCA:ULTY), launched in February 2024, is an actively managed exchange-traded fund (ETF) designed to deliver jaw-dropping monthly income through a portfolio of covered call strategies on select U.S.-listed securities. With a staggering distribution rate of 80.19%, ULTY has caught […] The post $ULTY is Crushing It – Here’s Why I Can’t Stop Buying More appeared first on 24/7 Wall St..

Key Points in This Article:

-

YieldMax Ultra Option Income Strategy ETF (ULTY) and covered call option ETFs like it offer sky-high yields, often exceeding 50%, attracting income-focused investors betting on volatile markets.

-

These ETFs cap upside potential and risk NAV erosion, as their distributions may include return of capital, threatening long-term value.

-

ULTY’s strategy of selling options on high-volatility stocks thrives in turbulent markets but demands careful monitoring due to high expenses and turnover.

-

Sit back and let dividends do the heavy lifting for a simple, steady path to serious wealth creation over time. Grab a free copy of “2 Legendary High-Yield Dividend Stocks” now.

ULTY’s Sky-High Yield: Dividend Dream or Risky Rocket Ride?

The YieldMax Ultra Option Income Strategy ETF (NYSEARCA:ULTY), launched in February 2024, is an actively managed exchange-traded fund (ETF) designed to deliver jaw-dropping monthly income through a portfolio of covered call strategies on select U.S.-listed securities.

With a staggering distribution rate of 80.19%, ULTY has caught the eye of income-hungry investors, like a Redditor on the r/YieldMaxETFs subreddit who gushed, “ULTY is proving why this new strategy is king, I can’t help but add more. What a great dividend for this week!”

This enthusiasm stems from ULTY’s ability to generate weekly payouts by selling options on volatile stocks like Applied Digital (NASDAQ:APLD) and AST SpaceMobile (NASDAQ:ASTS), alongside holdings in U.S. Treasuries for stability. Its sub-adviser, ZEGA Financial, cherry-picks 15 to 30 high-volatility securities to maximize option premiums, making ULTY a go-to for those chasing yield in a low-rate world.

ULTY: An Income Machine

ULTY’s strategy is a high-octane blend of traditional and synthetic covered calls, capitalizing on volatile stocks to rake in premium income. When markets swing, option premiums soar, boosting ULTY’s payouts. The fund also holds short-term U.S. Treasuries, which provide collateral for its options strategies and add a layer of income stability.

Unlike direct stock investments, ULTY doesn’t grant shareholders dividend rights from underlying securities like Microsoft (NASDAQ:MSFT) or Nvidia (NASDAQ:NVDA). Instead, it offers indirect exposure to their price movements — allowing for some gains (which are capped) but also exposing investors to potential losses. With $491.4 million in assets under management and a 1.30% expense ratio, ULTY’s high turnover and active management amplify both its income potential but also its complexity.

Why Investors Love ULTY’s Fundamentals

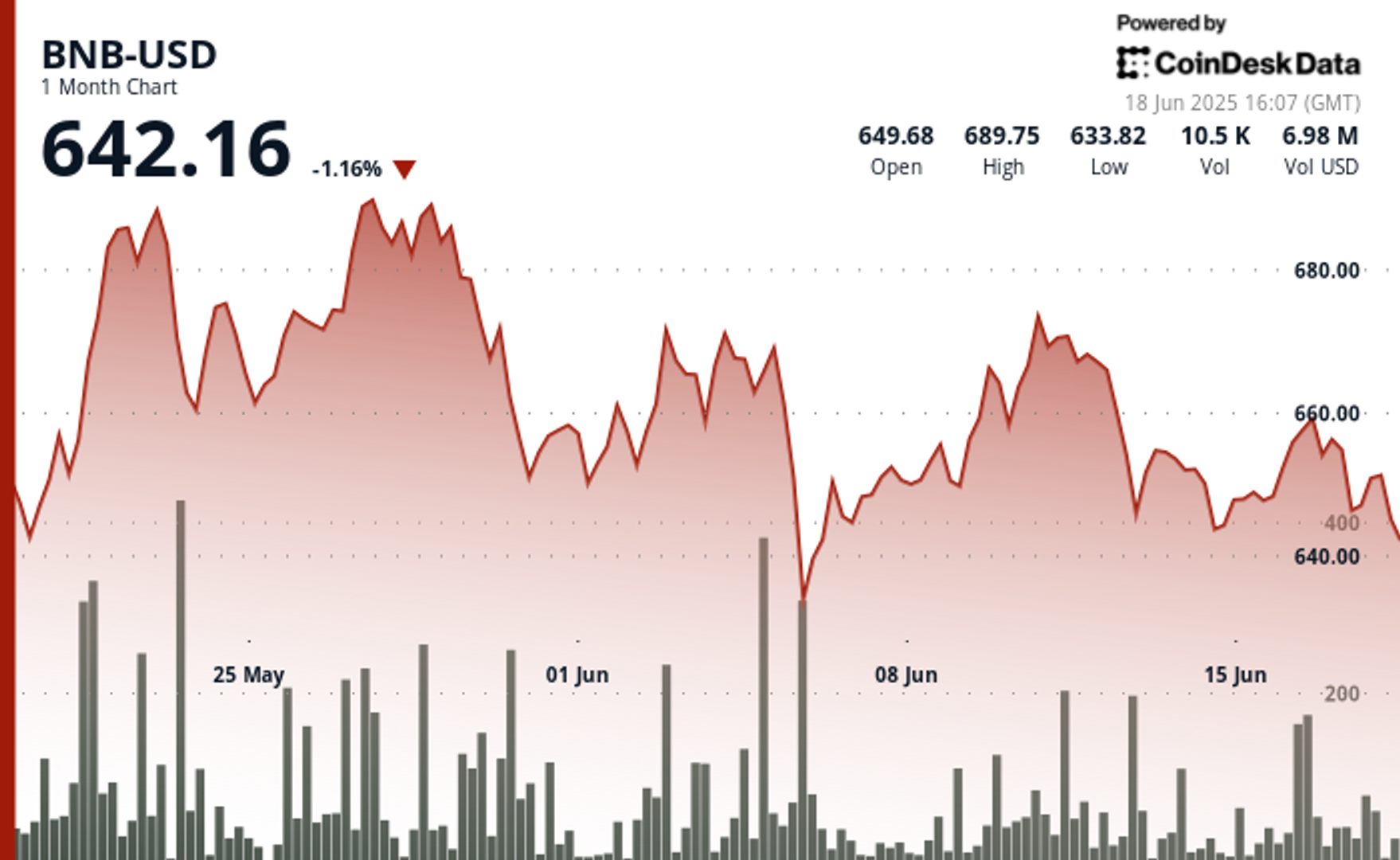

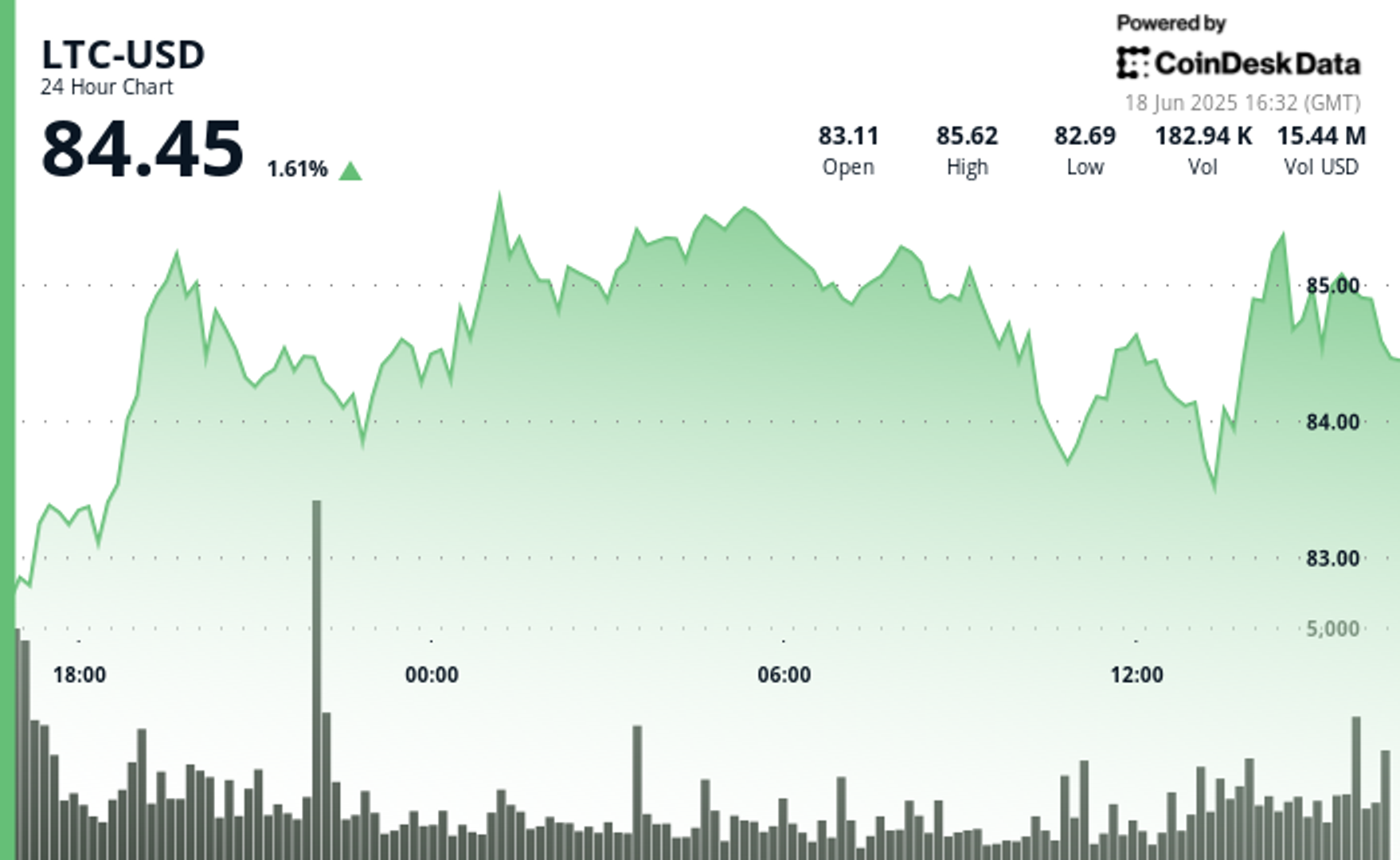

Fans on platforms like Reddit see ULTY as a cash cow, with its lofty annualized distribution rate dwarfing traditional dividend ETFs. The fund’s diversified basket of high-growth, high-volatility stocks taps into sectors like tech and crypto, aligning with the AI and digital transformation boom.

Recent improvements in payout stability, driven by strategic shifts in fund management, have bolstered confidence. ULTY’s focus on volatile securities allows it to capture higher premiums during market turbulence, like the current Middle East tensions, where stocks remained resilient. Some view its weekly payouts as a “business” for income-focused portfolios, that offers more consistency compared to other YieldMax ETFs like YieldMax MSTR Option Income Strategy ETF (NYSEARCA:MSTY).

Analysts note ULTY’s undervaluation, suggesting its $6.18 per share price is a bargain compared to its $14.40 per share 12-month high.

Not All That Glitters Is Gold

But ULTY’s glitter comes with grit. Its 130% trailing 12-month yield is misleading, as distributions often include return of capital, eroding the fund’s net asset value (NAV). Over the past year, ULTY’s NAV plummeted nearly 58%, signaling principal erosion that could wipe out long-term gains.

The fund’s covered call strategy caps upside potential, meaning investors miss out if underlying stocks like ASTS skyrocket. High portfolio turnover and expense ratio eat into returns, while its non-diversified nature — focusing on volatile securities — amplifies the risk.

Advice for Investors Eyeing ULTY

I’m not a financial advisor, so these are only my opinions. For those tempted by ULTY’s siren song, caution is key.

- Set a target allocation, ideally 5% to 10% of your portfolio, to avoid overexposure to its volatility.

- Monitor dividend sustainability by checking ULTY’s payout ratio and earnings reports, as return of capital signals trouble.

- A dividend reinvestment plan (DRIP) can compound growth by automatically reinvesting weekly payouts, but only if you’re comfortable with NAV erosion risks.

- Stay informed about market conditions, like tech sector trends or Federal Reserve rate decisions, which could sway ULTY’s volatile holdings.

- Regularly review analyst ratings—currently a “Hold” due to its price nearing the upper trading range ($6.12–$6.25 recently).

- Diversify with less risky income ETFs like SCHD to balance ULTY’s wild swings.

Approach with Eyes Wide Open

ULTY’s sky-high yield is a thrill ride for income seekers, but it’s not for everyone. Its fundamentals appeal to risk-tolerant investors betting on tech’s volatility, yet NAV erosion and capped gains demand vigilance.

Treat ULTY as a spicy side dish, not the main course. Allocate modestly, reinvest strategically, and keep a close eye on its orbit. For now, it’s a bold bet, but only for those ready to navigate its potential and stomach the turbulence.

The post $ULTY is Crushing It – Here’s Why I Can’t Stop Buying More appeared first on 24/7 Wall St..