Uber and DoorDash are pressing Republican lawmakers to get President Trump’s ‘no tax on tips’ to apply to their drivers

Drivers are most frequently classified as independent contractors and receive a 1099, which means they wouldn’t be eligible for that tax break under the proposed bill.

While Republicans are writing legislation to make good on President Trump’s promise to end taxes on tips, Uber and DoorDash are asking lawmakers to keep their drivers in mind.

The people who hope you don’t puke in the back of their car at 3am (or bring you that $24 burrito when it’s drizzling) are most frequently classified as independent contractors and receive a 1099, which means they wouldn’t be eligible for that tax break under the proposed bill, unlike the many casino and restaurant employees who get W-2s:

- A report from Gridwise said food delivery drivers make 53.4% of their earnings from tips, while ride-hailing drivers get ~10% of their income from gratuities.

- Restaurant workers collect 23% of their income from tips, according to data from Square, while casino dealers take home ~60% of their pay from tips, according to Payscale.

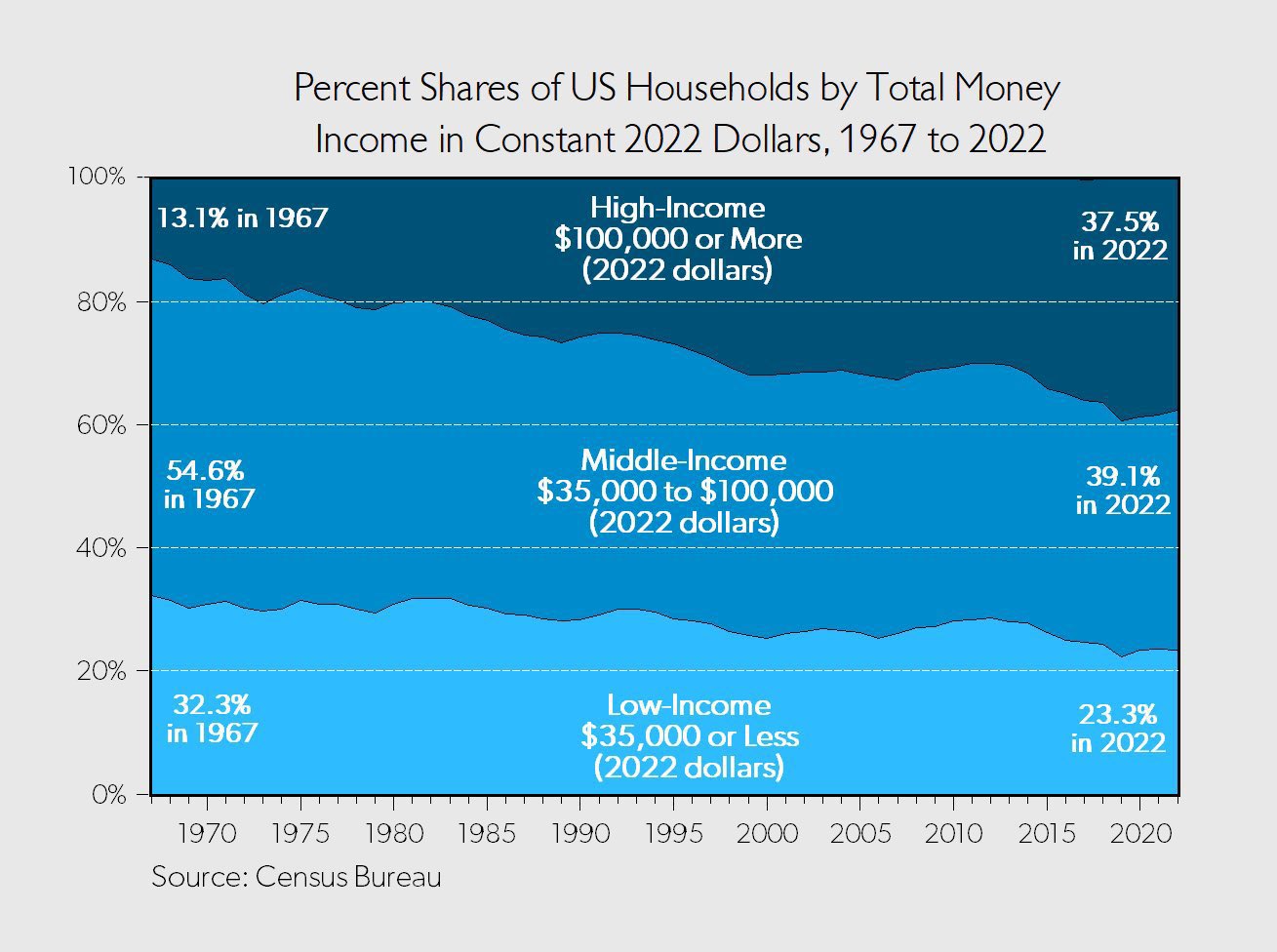

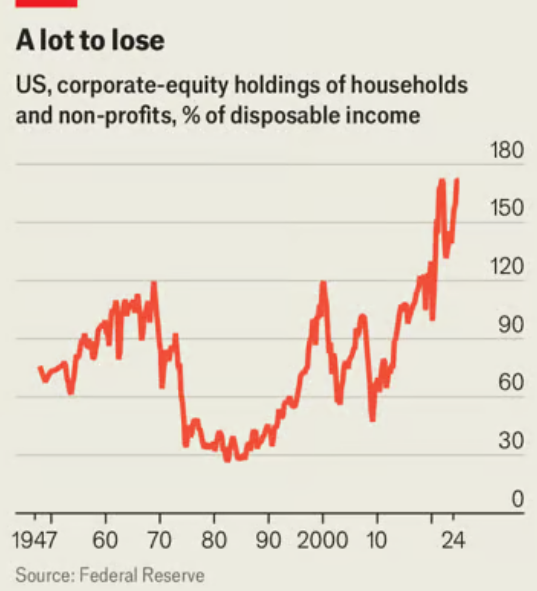

Critics have pointed out that low-income workers who don’t receive tips are missing out on needed help, although Trump has made other promises, including no tax on overtime, that are “in play” for this tax bill, per the WSJ.

To make up for the lost tax revenue, Axios reports the Trump administration is considering raising the tax rates on the biggest earners in the US from 37% to pre-2018 levels of 39.6% while lowering the threshold from the current benchmarks of $609,351 for an individual and $731,201 for a couple.—DL

This report was written by Dave Lozo and was originally published by Morning Brew.

This story was originally featured on Fortune.com