Trump’s decision on whether to bomb Iran could have knock-on effects for his fight against the Fed

if Trump decides to bomb Iran and the conflict produces a prolonged disruption to the supply of oil, that might strengthen the dollar while damaging the global economy.

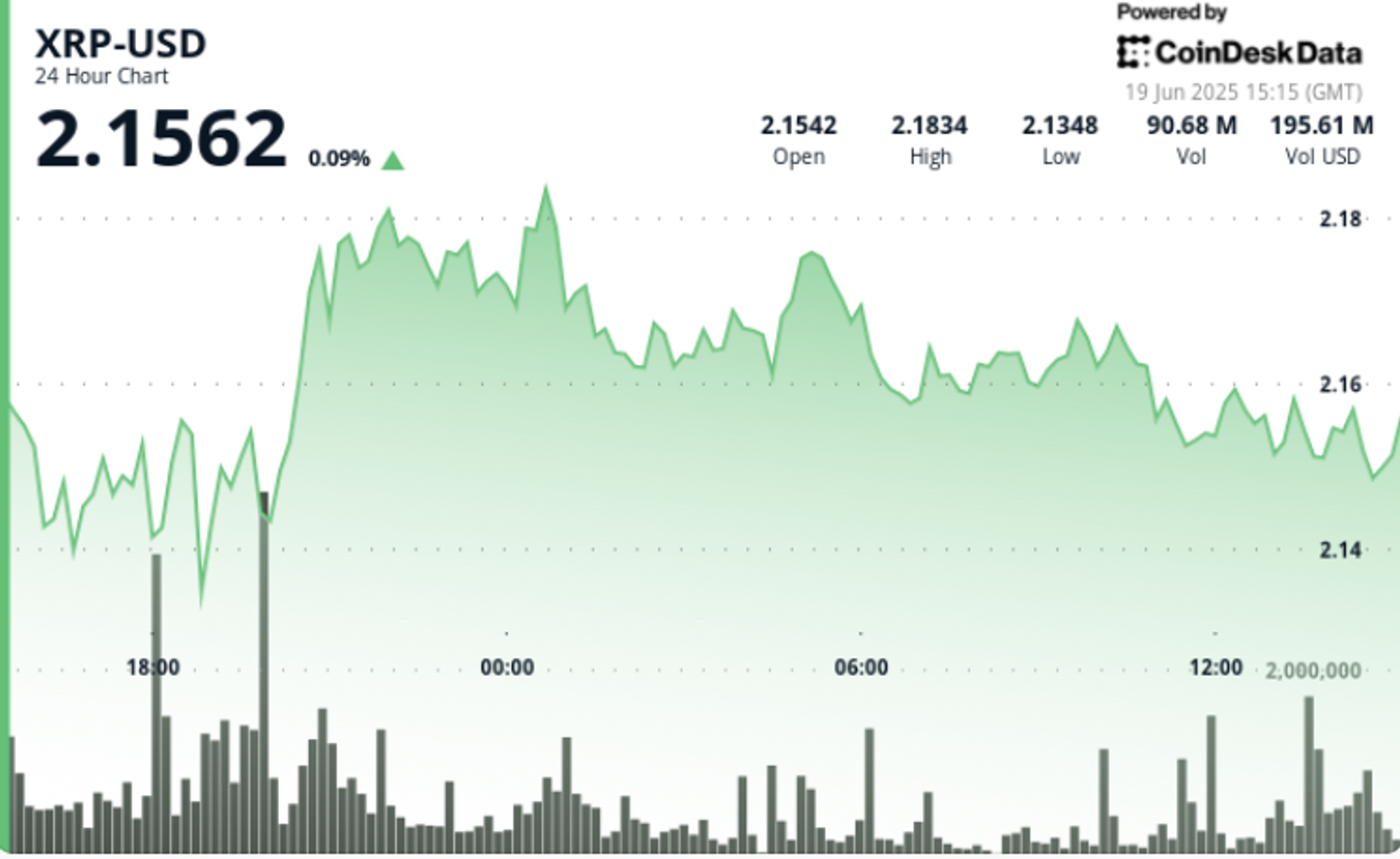

- With the Fed’s interest rate decision out of the way and a national holiday for the U.S. stock markets, investors are turning their attention to whether President Trump will bomb Iran. Stocks were largely down in Asia and Europe this morning, following a decline in the S&P 500 yesterday.

The human cost of global conflict is unbearable for the victims, of course, and it comes with an economic cost too, which analysts are trying to estimate right now.

President Trump has reportedly approved a plan to bomb Iran but not yet given the green light for action. The main issue for investors is what the Iran conflict might do to the price of oil and how that will affect the strength of the dollar. That, in turn, will likely influence the U.S. Federal Reserve’s future decisions on whether or not to cut interest rates.

Trump, of course, wants Fed Chair Jerome Powell to lower interest rates. He insulted Powell early this morning on Truth Social to underline that point: “Too Late—Powell is the WORST. A real dummy, who’s costing America $Billions!”

One possible outcome is that if Trump decides to bomb Iran and the conflict produces a prolonged disruption to the supply of oil, that might strengthen the dollar while damaging the global economy. (Oil markets are settled in dollars, and rising oil prices would thus trigger greater demand for U.S. currency.) Those two factors—economic weakness but dollar strength—could push the Fed to make the interest rate cuts that Trump wants.

Convera’s Antonio Ruggiero sent a note to clients on the dollar issue this morning: “Rising geopolitical tensions in the Middle East this week lent support to the greenback, with the DXY briefly pushing above 98.800 on Tuesday before paring gains. Behind the façade of safe-haven appeal lies the true driver of the dollar’s rebound: rising oil prices, now hovering near a five-month high. Since most global oil trades are settled in U.S. dollars, surging crude demand tends to drive additional demand for USD. This rebound in sentiment is also reflected in the options market, where—for the first time since April—traders have backed off from bearish dollar positions. Escalating tensions could amplify this further.”

At JPMorgan, Joseph Lupton and Bruce Kasman published a note that argued: “The rise in risk premia associated with the Mideast war, if sustained, is already sufficient to fully offset the cushion provided by the oil supply increase [from Saudi Arabia]. This leaves a net drag on global GDP growth of 0.6% this year. Concentrated in the second half, this drag should lower 2H25 global GDP growth by more than 1% at an annualized pace,” they said.

“A full curtailment of Iranian oil exports (1.8mbd) would, according to our model, lift oil prices to near $100/bbl and, if sustained, reduce global GDP by a full %-point (or, more likely, 2%-point annualized in 2H25), threatening a global recession,” they said.

The Fed, as always, is waiting for more data and less uncertainty.

The uncertainty of war won’t help, according to Daiwa Capital Markets: “The Trump administration has yet to take a definitive stance on intervention in the Iran-Israel conflict–with the plotted course either facilitating a return to calm or potentially triggering a broader conflict that could disrupt energy markets. Thus, uncertainty remains high and officials have demonstrated that they are willing to wait for additional clarity,” Lawrence Werther and Brendan Stuart told their clients in a note seen by Fortune.

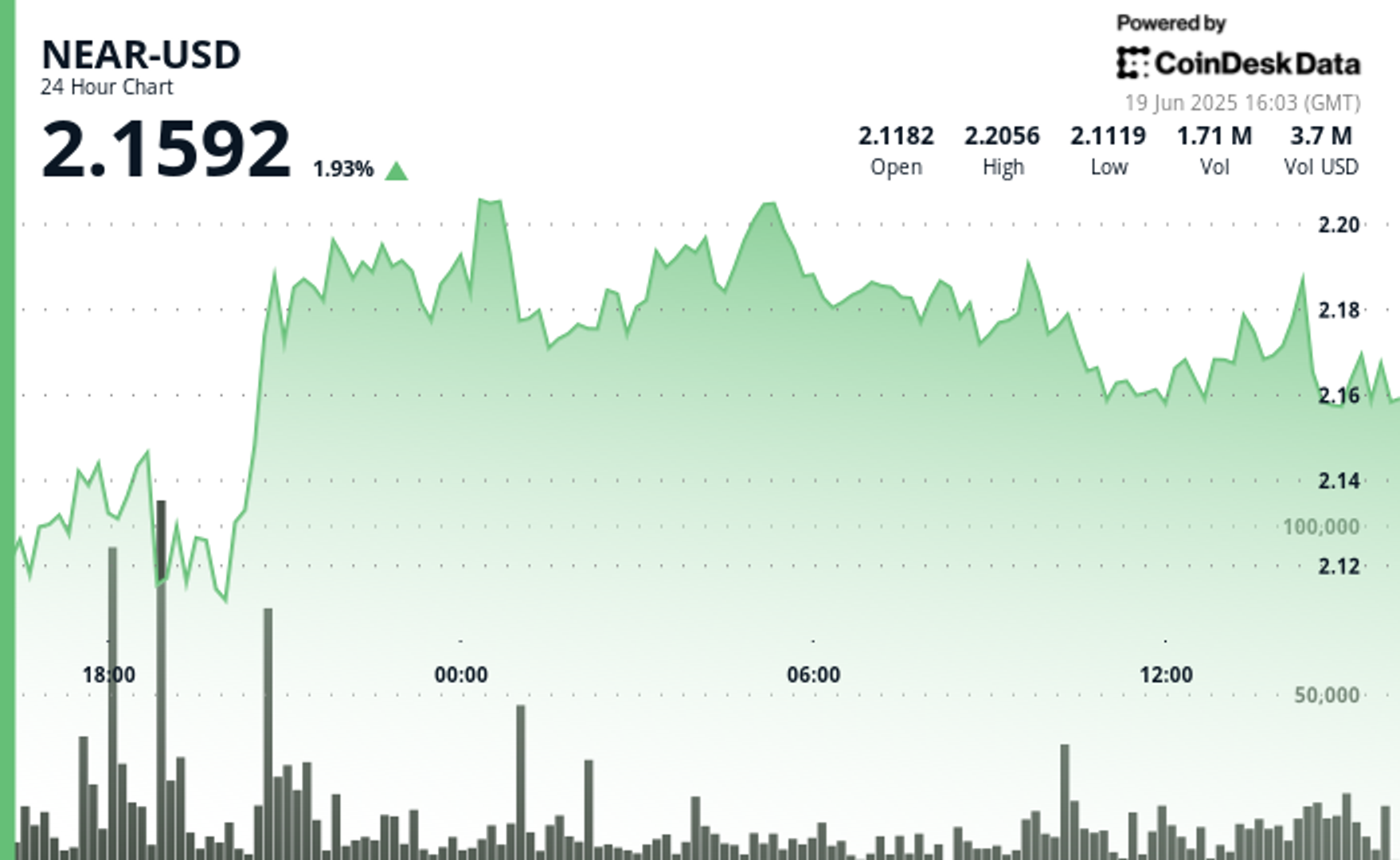

Here’s a snapshot of the action across global markets this morning:

- South Korea’s Kospi was up 0.19%.

- India’s Nifty 50 was flat.

- The S&P 500 closed flat yesterday. The market is closed for the Juneteenth holiday today.

- The U.K.’s FTSE 100 slipped 0.3% in early trading.

- China’s SSE Composite was down 0.82%.

- Japan’s Nikkei 225 was down 1%.

- Hong Kong’s Hang Seng was down 2%.

This story was originally featured on Fortune.com