Trump-affiliated crypto mining venture mulls IPO — Report

American Bitcoin Corp., a Trump family-backed crypto mining operation, has plans to raise additional capital, including through an initial public offering (IPO), according to an April 1 report by Bloomberg. On March 31, Hut 8 — a publicly traded Bitcoin (BTC) miner — acquired a majority stake in American Bitcoin (formerly American Data Centers), whose founders include Donald Trump Jr. and Eric Trump. After the deal announcement, Hut 8 transferred its Bitcoin mining equipment into the newly created entity, which is not yet publicly traded. While American Bitcoin will focus on crypto mining, Hut 8 plans to target data center infrastructure for use cases such as high-performance computing. The deal “evolves Hut 8 toward more predictable, financeable, lower-cost-of-capital segments,” Asher Genoot, CEO of Hut 8, said in a statement.“So you can see this in the long term as two sister publicly traded companies,” Genoot told Bloomberg. “One that is energy, infrastructure data centers and the other one that’s Bitcoin, AISCs and reserves and together they form a vertically integrated company that has some of the best economics out there.” According to Bloomberg, American Bitcoin is working with Bitmain, a Chinese Bitcoin mining hardware supplier. Bitmain has faced scrutiny after the US blacklisting of its artificial intelligence affiliate Sopghgo, Bloomberg reported. Bitcoin mining revenues per quarter. Source: Coin MetricsRelated: Analysts eye Bitcoin miners’ AI, chip sales ahead of Q4 earningsPivoting to new business linesBitcoin miners are increasingly pivoting toward alternative business lines, such as servicing artificial intelligence models, after the Bitcoin network’s April 2024 “halving” cut into mining revenues.Halvings occur every four years and cut in half the number of BTC mined per block.Miners are “diversifying into AI data-center hosting as a way to expand revenue and repurpose existing infrastructure for high-performance computing,” Coin Metrics said in a March report.Declining cryptocurrency prices have put even more pressure on Bitcoin miners in 2025, according to a report by JPMorgan.Magazine: Elon Musk’s plan to run government on blockchain faces uphill battle

American Bitcoin Corp., a Trump family-backed crypto mining operation, has plans to raise additional capital, including through an initial public offering (IPO), according to an April 1 report by Bloomberg.

On March 31, Hut 8 — a publicly traded Bitcoin (BTC) miner — acquired a majority stake in American Bitcoin (formerly American Data Centers), whose founders include Donald Trump Jr. and Eric Trump.

After the deal announcement, Hut 8 transferred its Bitcoin mining equipment into the newly created entity, which is not yet publicly traded.

While American Bitcoin will focus on crypto mining, Hut 8 plans to target data center infrastructure for use cases such as high-performance computing. The deal “evolves Hut 8 toward more predictable, financeable, lower-cost-of-capital segments,” Asher Genoot, CEO of Hut 8, said in a statement.

“So you can see this in the long term as two sister publicly traded companies,” Genoot told Bloomberg. “One that is energy, infrastructure data centers and the other one that’s Bitcoin, AISCs and reserves and together they form a vertically integrated company that has some of the best economics out there.”

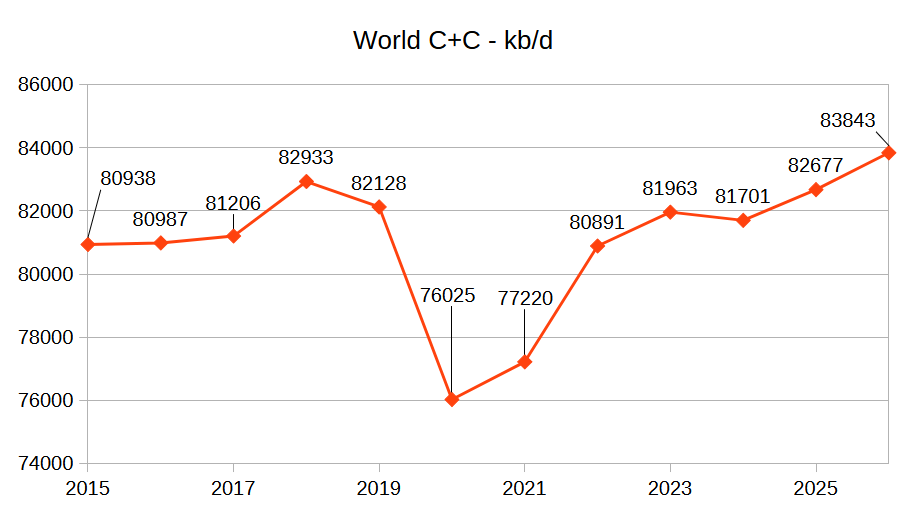

According to Bloomberg, American Bitcoin is working with Bitmain, a Chinese Bitcoin mining hardware supplier. Bitmain has faced scrutiny after the US blacklisting of its artificial intelligence affiliate Sopghgo, Bloomberg reported. Bitcoin mining revenues per quarter. Source: Coin Metrics

Related: Analysts eye Bitcoin miners’ AI, chip sales ahead of Q4 earnings

Pivoting to new business lines

Bitcoin miners are increasingly pivoting toward alternative business lines, such as servicing artificial intelligence models, after the Bitcoin network’s April 2024 “halving” cut into mining revenues.

Halvings occur every four years and cut in half the number of BTC mined per block.

Miners are “diversifying into AI data-center hosting as a way to expand revenue and repurpose existing infrastructure for high-performance computing,” Coin Metrics said in a March report.

Declining cryptocurrency prices have put even more pressure on Bitcoin miners in 2025, according to a report by JPMorgan.

Magazine: Elon Musk’s plan to run government on blockchain faces uphill battle