Top analyst overhauls Apple stock price target amid key iPhone challenge

Apple's new iPhone 16 hasn't yet sparked a surge in customer upgrades.

Apple shares edged lower in early Wednesday trading, extending the stock's steady 2025 decline, after a top Wall Street analyst overhauled his price target on the tech giant amid a crucial delay in its AI strategy.

Apple (AAPL) shares have slumped more than 15% from their record peak in mid-December, shedding nearly $600 billion in value along the way, as investors worry over the slower-than-expected demand for its new iPhone 16 and mixed reception for its new Apple Intelligence AI rollout.

iPhone sales, as well, have been slowing over the past year, with December-quarter revenues from the flagship smartphone slipped 0.8% to $69.14 billion, while finance chief Kevan Parekh cautioned that current-quarter revenue would likely rise in the low- to mid-single-digits percent compared to last year.

Further concerns were stoked last week, as well, when Bloomberg News reported that Apple will delay updates to its Siri digital assistant, a key component of the interface between customers and hardware, well into the future.

The delays were also tied to reports that Apple CEO Tim Cook could be looking to make changes in the leadership of Apple's AI division, which is central to the group's growth story over the coming years.

Morgan Stanley analyst Erik Woodring sees the Siri delay, as well as the prospect of U.S. tariffs on Asia-made goods, as adding to Apple's recent challenges, and lowered his stock price target by $23, taking it to $252 per share, in a note published Wednesday.

Siri delay will tame iPhone upgrades

"The postponement of an advanced Siri integrated into Apple Intelligence is likely to temper (next twelve month) iPhone upgrade rates vs. our prior expectations," Woodring and his team wrote.

"[Around] 50% of iPhone owners that didn’t upgrade to an iPhone 16 acknowledged that the delayed Apple Intelligence rollout had an impact on their decision not to upgrade," Woodring noted.

The bank trimmed iPhone shipment forecast to around 230 million units for this year, a tally that would be largely flat to 2024 levels, and sees a 6% increase to 243 million units for 2026.

Related: Top analyst weighs in on Apple's massive U.S. spending surprise

That likely means a lower overall revenue tally of around $436 million, the bank said, with fiscal year 2026 earnings in the region of $8 per share.

"We are [also] incorporating $2 billion of higher product input costs in 2025 to account for China tariffs," Woodring said, noting that some of that total will be mitigated by the company itself.

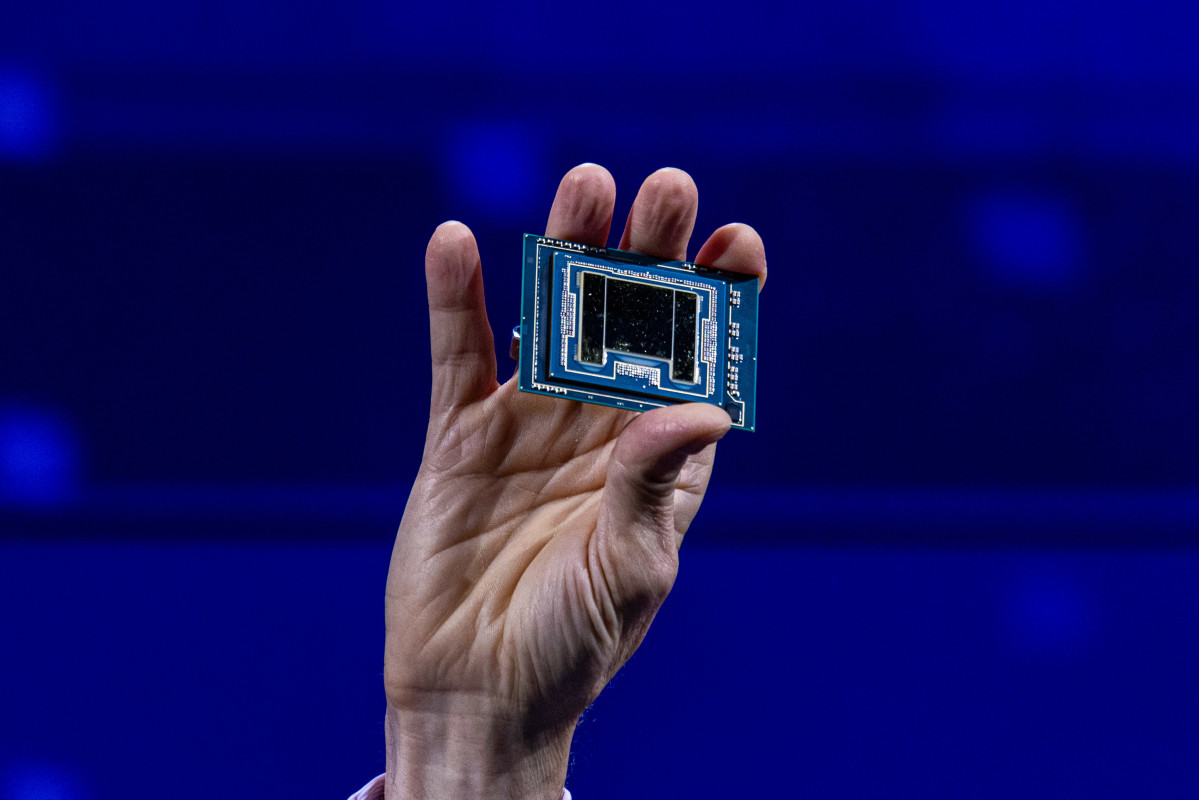

A component of that mitigation was revealed last month, when Apple said it would pair with its key supplier to build an AI-focused data center in Texas as part of a broader plan to spend more than $500 billion in the U.S. over the next four years.

Apple U.S. spending push

Taiwan-based Hon Hai Precision, which is commonly known as Foxconn and is Apple's main iPhone assembler, will help construct the 250,000-square-foot data center, slated for the Houston area, that will house servers that support Apple Intelligence. It's expected to be completed by 2026.

The broader $500 billion spending plan includes, however, purchases from Apple suppliers, media production for its Apple TV+ division and other infrastructure tied to its Apple Intelligence rollout.

More AI Stocks:

- Nvidia-backed startup could be hottest tech IPO of the year

- Apple blames name-calling glitch on its new AI feature

- Several AI leaders are considering a deal that could save Intel

Apple did not break down the amount of new spending included in its $500 billion plan, which works out to around a third of its annual revenue when spread over the four-year period.

Apple shares were marked 0.1% lower in premarket trading to indicate an opening bell price of $220.14 each, a move that would extend the stock's year-to-date decline to around 9.5%.

Related: Veteran fund manager unveils eye-popping S&P 500 forecast