Tony Robbins says IRAs and 401(k)s will only take you so far in retirement

Funding IRAs and 401(k)s for retirement is essential, but Robbins' has urgent advice about another decision.

Will you inherit money? Some pundits say inheriting money is the only way to build wealth these days. Of course, inheriting money would be nice, but there may be other situations where you could come into an unexpected bit of money such as a work-related bonus or maybe the sale of a car.

In his book, Money: Master the Game, author Tony Robbins asks a hypothetical question: What would you do with an unexpected $10,000 bonus or a $100,000 inheritance? Would you put it in your IRA? Go to Vegas and put it all on red? Buy some stock in Magnificant Seven companies?

Don’t miss the move: SIGN UP for TheStreet’s FREE Daily newsletter

"Would you put it all in one place or spread it around?" he asks. "The answer to that last question is the key to your financial future," Robbins writes.

Related: Tony Robbins' blunt advice about IRAs and other surprising retirement decisions

Asset allocation is the most important investment decision anyone will make in his or her lifetime, Robbins asserts. You've ideally already made the decision to automate your saving and investing by making regular contributions to your IRAs and 401(k). That decision "gets you in the game," says Robbins. Now you have to stay in the game for the long haul.

"You can lose it all if you aren't careful about where you put your money," he says. "Asset allocation is how you stay wealthy. Shutterstock

Tony Robbins explains asset allocation

Asset allocation doesn't just mean diversification. Robbins explains asset allocation like this: "It means dividing up your money among different classes, or types, of investments — such as stocks, bonds, commodities, or real estate — and in specific proportions that you decide in advance, according to your goals or needs, risk tolerance and stage of life."

More Tony Robbins:

- Tony Robbins warns Americans on Social Security mistake to avoid

- Philanthropist warns U.S. workers on retirement, Social Security

- Tony Robbins has blunt words on Social Security and retirement

Whether you have $1,000 or $1 million to invest, the principles are the same, adds Robbins. "Asset allocation is [also] the one key still that can set you apart from 99% of all investors," Robbins writes, "And guess what? It won't cost you a dime."

Related: Tony Robbins has blunt words on a major Social Security fear

At its most fundamental, asset allocation means not putting all your eggs in one basket. It means, Robbins says bluntly, "diversify or die."

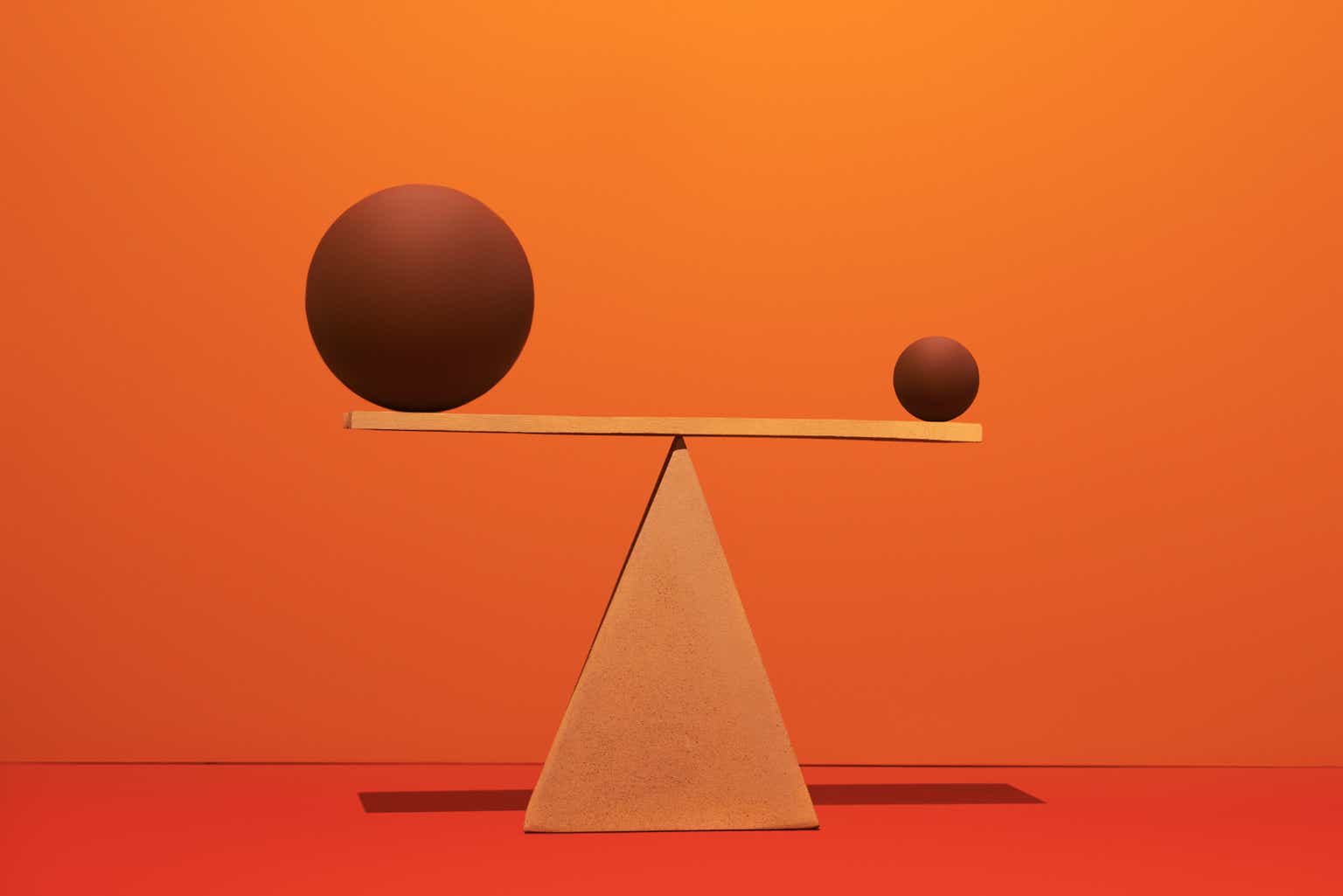

Asset allocation divided between two asset baskets

Each basket of money should have different levels of risk and reward. One is very safe and money will grow slowly there. The other basket of money can grow faster, but that makes it more risky.

The security/peace of mind asset basket

The money you allocate into this basket is money that is cash or cash equivalents. Robbins calls it the slow but steady contender in the race to wealth. This basket could contain a combination of, yes, cash, but also money-market funds, bonds, CDs, your home, your pension (if you're lucky enough to have one), annuities, life insurance, and "structured notes," which are similar to CDs. Some types of structured notes are set up in such a way that the principal is protected so you'll never lose your original investment. This is the type of structured note you want in your security basket.

The risk/growth asset basket

"This is where everybody wants to be because it's sexy, exciting," says Robbins. You can get a higher return, but you could also lose everything you've saved and invested. "What ever you put [here] you have to be prepared to lose a portion or even all of it if you don't have protective measures in place."

Markets have up times and down times, reminds Robbins.

That said, there are seven assets that could go into this basket: equities, high-yield bonds, real estate (not your home), commodities, currencies, collectibles and structured notes. The structured notes that go into the growth basket may not have the same protections as the ones in the security basket so you'll want to mak sure you know the difference.

Robbins says there is no magic way to divide your two baskets of investment. Some people will put 30% in the security/peace of mind basket and 70% in the risk/growth basket. Others will do 60/40 or 50/50. "What matters is what will meet both your financial and emotional needs.

Related: Veteran fund manager unveils eye-popping S&P 500 forecast