Through All of the Tariff Drama, Wall Street's Most Bullish Strategist Hasn't Flinched. He Still Thinks the S&P 500 Index Can Hit 7,000 This Year.

After the tariff drama began to unfold in late March and early April, most Wall Street strategists did not hesitate to lower their price targets for the benchmark S&P 500 (SNPINDEX: ^GSPC). After all, elevated tariff rates could increase inflation and slow the economy, potentially leading to a recession or some kind of stagflation scenario that would make the monetary tools at the Federal Reserve's disposal less effective.But through the last month and a half, one of Wall Street's most bullish strategists coming into the year, Wells Fargo's Christopher Harvey, hasn't flinched. He hasn't once changed his roughly 7,000 price target for the S&P 500, which is now the highest among his peers. And he still thinks that price target is achievable this year. Here's why.Continue reading

After the tariff drama began to unfold in late March and early April, most Wall Street strategists did not hesitate to lower their price targets for the benchmark S&P 500 (SNPINDEX: ^GSPC). After all, elevated tariff rates could increase inflation and slow the economy, potentially leading to a recession or some kind of stagflation scenario that would make the monetary tools at the Federal Reserve's disposal less effective.

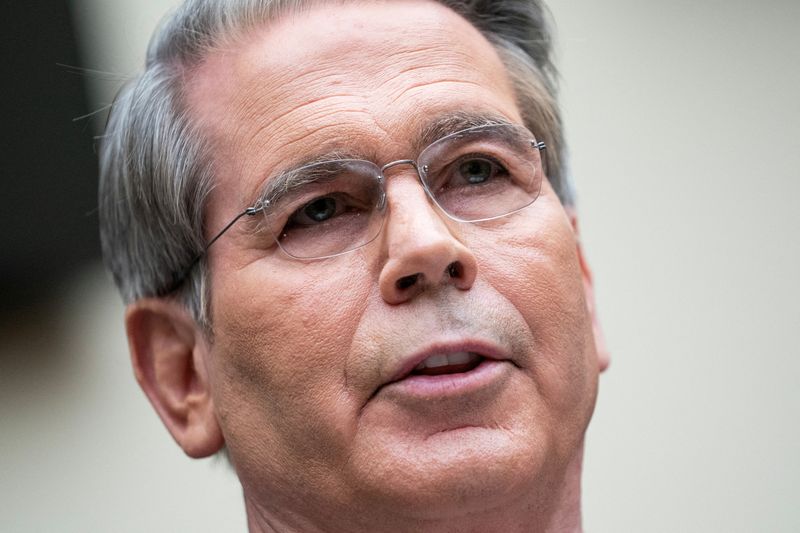

But through the last month and a half, one of Wall Street's most bullish strategists coming into the year, Wells Fargo's Christopher Harvey, hasn't flinched. He hasn't once changed his roughly 7,000 price target for the S&P 500, which is now the highest among his peers. And he still thinks that price target is achievable this year. Here's why.