Think Delta Air Lines Is Expensive? This Chart Might Change Your Mind.

Investors might not consider Delta Air Lines (NYSE: DAL) stock expensive due to its low price-to-earnings ratio of just over 8 times earnings. Still, some of them do stress over Delta's adjusted net debt of $16.9 billion and the traditional cyclicality of its revenue and earnings. That said, I think the risk is a lot less than in previous years. Here's why.One of the longstanding, and justified, criticisms of the airline industry is that it hasn't generated a return on invested capital (ROIC) sufficient to cover its weighted average cost of capital (WACC). While airlines will all have different WACCs, a rough estimate interpolated from International Air Transport Association (IATA) figures suggests it averages around 8% or 9%.Image source: Getty Images.Continue reading

Investors might not consider Delta Air Lines (NYSE: DAL) stock expensive due to its low price-to-earnings ratio of just over 8 times earnings. Still, some of them do stress over Delta's adjusted net debt of $16.9 billion and the traditional cyclicality of its revenue and earnings. That said, I think the risk is a lot less than in previous years. Here's why.

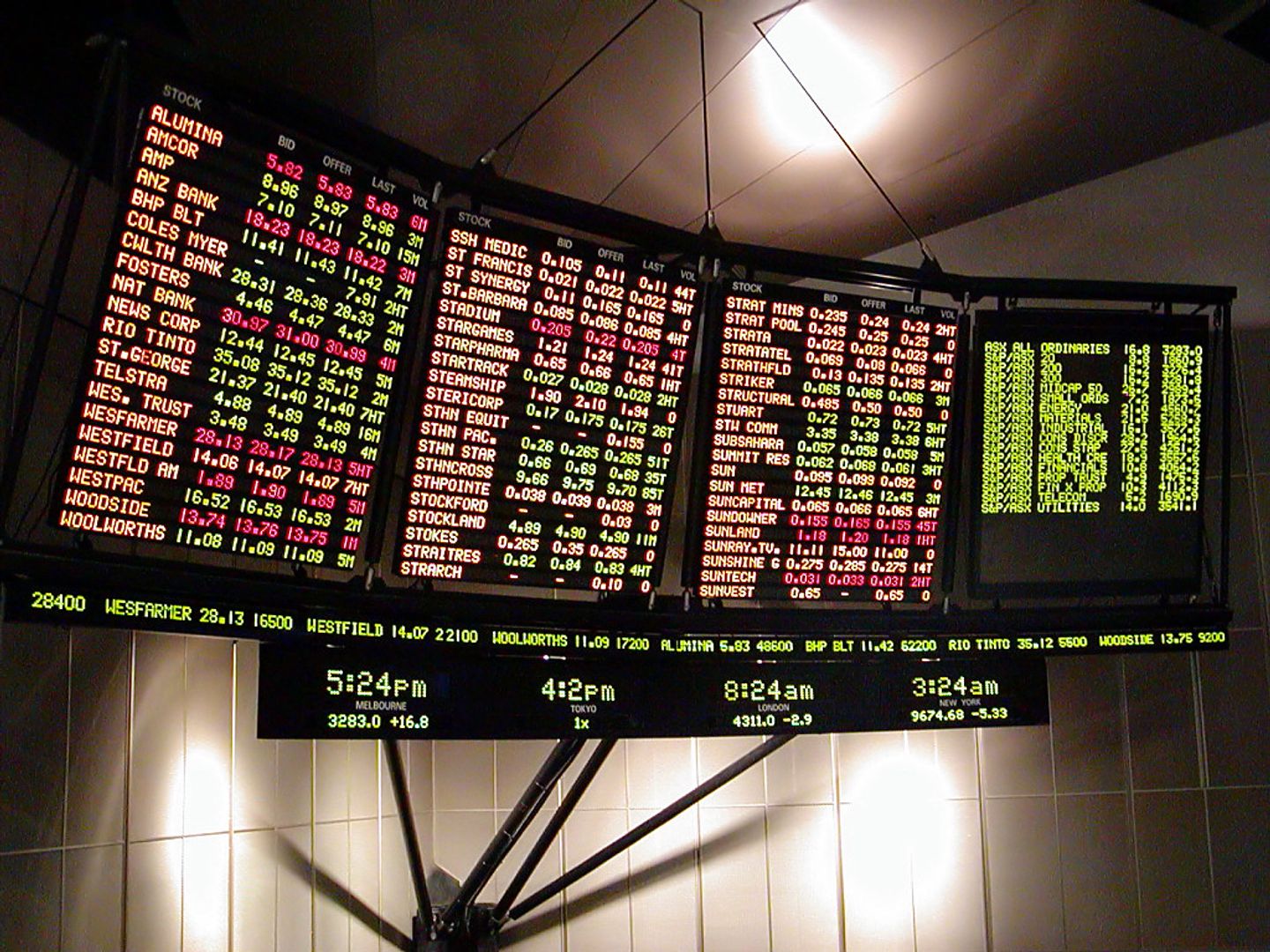

One of the longstanding, and justified, criticisms of the airline industry is that it hasn't generated a return on invested capital (ROIC) sufficient to cover its weighted average cost of capital (WACC). While airlines will all have different WACCs, a rough estimate interpolated from International Air Transport Association (IATA) figures suggests it averages around 8% or 9%.

Image source: Getty Images.