These Two ETFs Track What Members of Congress Are Actively Trading

This post may contain links from our sponsors and affiliates, and Flywheel Publishing may receive compensation for actions taken through them. If you want exposure to what elected officials are trading, there are two ways to do that. For one, you could always track down what each member of Congress is buying and selling and […] The post These Two ETFs Track What Members of Congress Are Actively Trading appeared first on 24/7 Wall St..

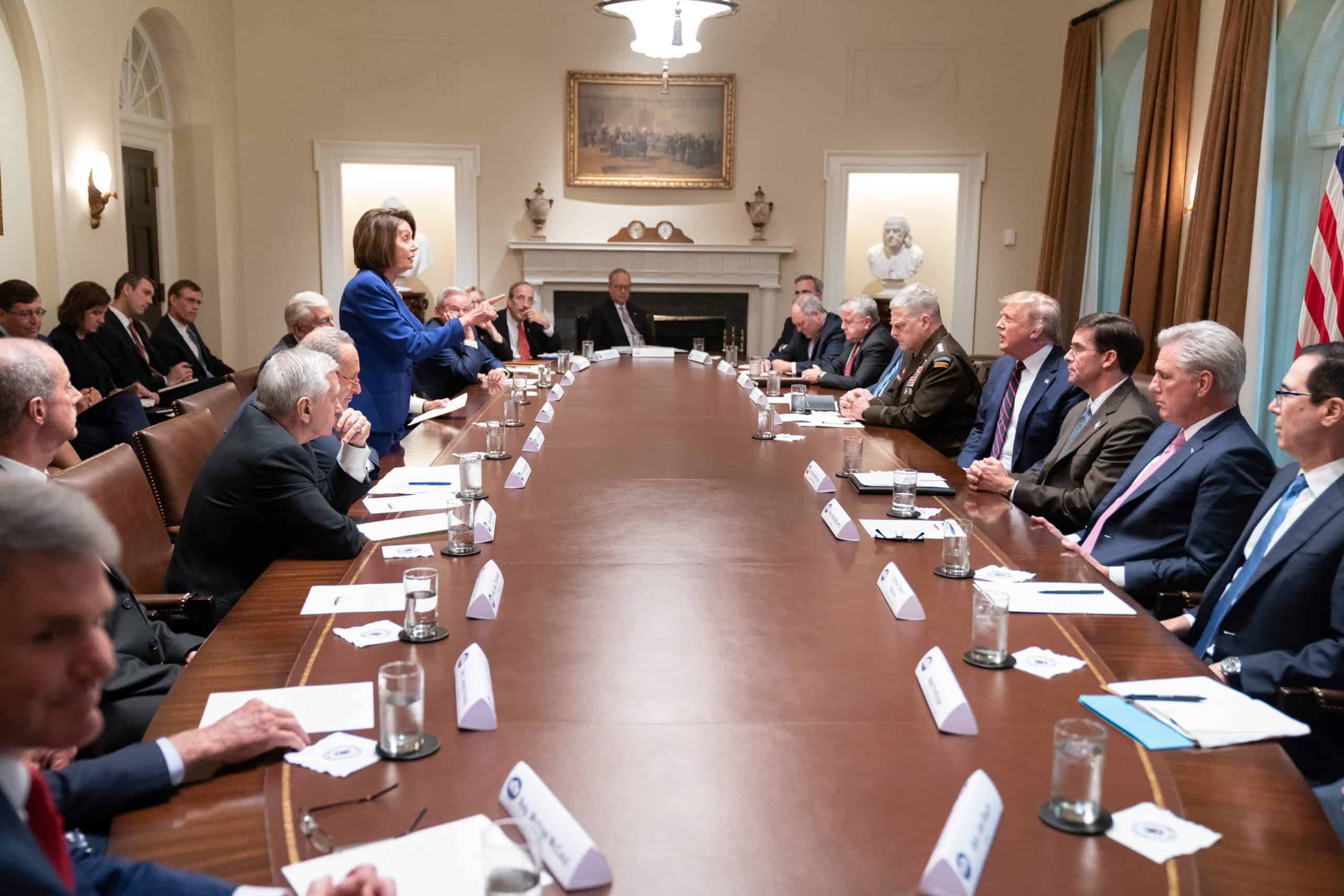

If you want exposure to what elected officials are trading, there are two ways to do that. For one, you could always track down what each member of Congress is buying and selling and tag along, such as Nancy Pelosi.

Key Points About This Article

- Congress has made millions of dollars over the years trading stocks. You can gain exposure by investing in these exchange-traded funds.

- The Unusual Whales Subversive Democratic ETF (NANC) invests in equity securities purchased or sold by Democratic members of Congress and their spouses.

- The Unusual Whales Subversive Republican ETF (GOP) invests in equity securities purchased or sold by Republican members of Congress and their spouses.

- Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here here.(Sponsor)

Or, you can make life a bit easier and invest in ETFs that track the stocks Democrats and Republicans buy.

Most recently, Nancy Pelosi took a stake in the Tempus AI stock by buying 50 of the TEM January 2026 $20 call options in mid-January. We can see that Pelosi’s spouse bought between $250,000 and $500,000 worth of Amazon in January. And we can see that New Jersey’s Josh Gottheimer bought between $500,000 and $1 million worth of Microsoft stock.

Granted, your elected officials don’t have to disclose what they bought for about 30 to 45 days after the transaction, per the STOCK Act. Oftentimes, they disclose sooner than that.

Part of the STOCK Act “Amends the Ethics in Government Act of 1978 (EGA) to require specified individuals to file reports within 30 to 45 days after receiving notice of a purchase, sale, or exchange which exceeds $1,000 in stocks, bonds, commodities futures, and other forms of securities and subject to any waivers and exclusions.”

With that, members of Congress have stood to make millions of dollars trading stocks.

And while you can always hunt down what they’re trading, you can gain big exposure to those trades with the two exchange-traded funds listed below.

Unusual Whales Subversive Democratic ETF

With an expense ratio of 0.74%, the Unusual Whales Subversive Democratic ETF (BATS:NANC) invests in equity securities purchased or sold by Democratic members of Congress and their spouses.

According to the NANC ETF Fact Sheet, “We have partnered with Unusual Whales to develop an ETF that will allow investors access to the near- real-time trading disclosures of members of Congress in both parties. NANC focuses on the Democratic Party. “

Since it began trading in early 2023, the ETF ran from a low of about $23 to a recent high of $41.08. Now back to $35.85 thanks to the market pullback, it’s a bargain. Better, some of its top holdings include Nvidia, Microsoft, Amazon, Salesforce, Apple, Alphabet, American Express and Netflix to name a few of the top ones.

Unusual Whales Subversive Republican ETF

With an expense ratio of 0.74%, the Unusual Whales Subversive Republican ETF (BATS:GOP) invests in equity securities purchased or sold by Republican members of Congress and their spouses.

Much like NANC, the GOP ETF has been in a significant uptrend. In fact, since it began trading in early 2023 at about $25, it ran to a recent high of $34. Now back to $30.55, it’s also a bargain. Better, some of its top stock holdings include JPMorgan, iShares Bitcoin Trust ETF, AT&T, Chevron, Nvidia, Intel, and Tyson Foods to name a few.

There’s also the Point Bridge GOP Stock Tracker ETF

With an expense ratio of 0.72%, the Point Bridge GOP Stock Tracker ETF (BATS:MAGA) is made up of stocks within the Solactive U.S. 500 Index that are highly supportive of Republican candidates for federal office, including President, Vice President, Congress, and other Republican Party-affiliated groups, as noted by Point Bridge Capital.

At the moment, some of the top holdings of the GOP ETF include Dollar General, Monster Beverage, Yum! Brands, American Water Works, Hess Corp., Berkshire Hathaway, Exelon Corp., AutoZone and HEICO to name just a few.

Since the ETF started to trade on September 8, 2017, it ran from about $22.39 to a recent high of $51.48. Now back to $47.94, it’s looking like a bargain too.

No matter which party you’re a part of, these are just a few of the top ways the average investor can trade what members of Congress are trading.

Granted, your elected officials don’t have to disclose what they bought for about 30 to 45 days after the transaction, per the STOCK Act, as we mentioned earlier. But you still have the opportunity to profit along with them with these ETFs.

The post These Two ETFs Track What Members of Congress Are Actively Trading appeared first on 24/7 Wall St..