These Insiders Are Scooping Up Shares Now

Though insider buying has slowed during the first-quarter earnings reporting season, some beneficial owners still made huge purchases. The post These Insiders Are Scooping Up Shares Now appeared first on 24/7 Wall St..

Insider buying has been fairly slow since the beginning of the month, due largely to the current first-quarter earnings reporting season. Yet, a couple of beneficial owners still made some huge purchases, in a spinoff of an industrial giant and in a gold miner. A restaurant operator and a trucking company also saw notable insider transactions.

24/7 Wall St. Key Points:

-

Insider buying has slowed considerably during the current first-quarter earnings reporting season.

-

Yet, a couple of beneficial owners still made huge purchases.

-

Take this quiz to see if you’re on track to retire. (sponsored)

Let’s take a quick look at these notable transactions of the past week or so.

Is Insider Buying Important?

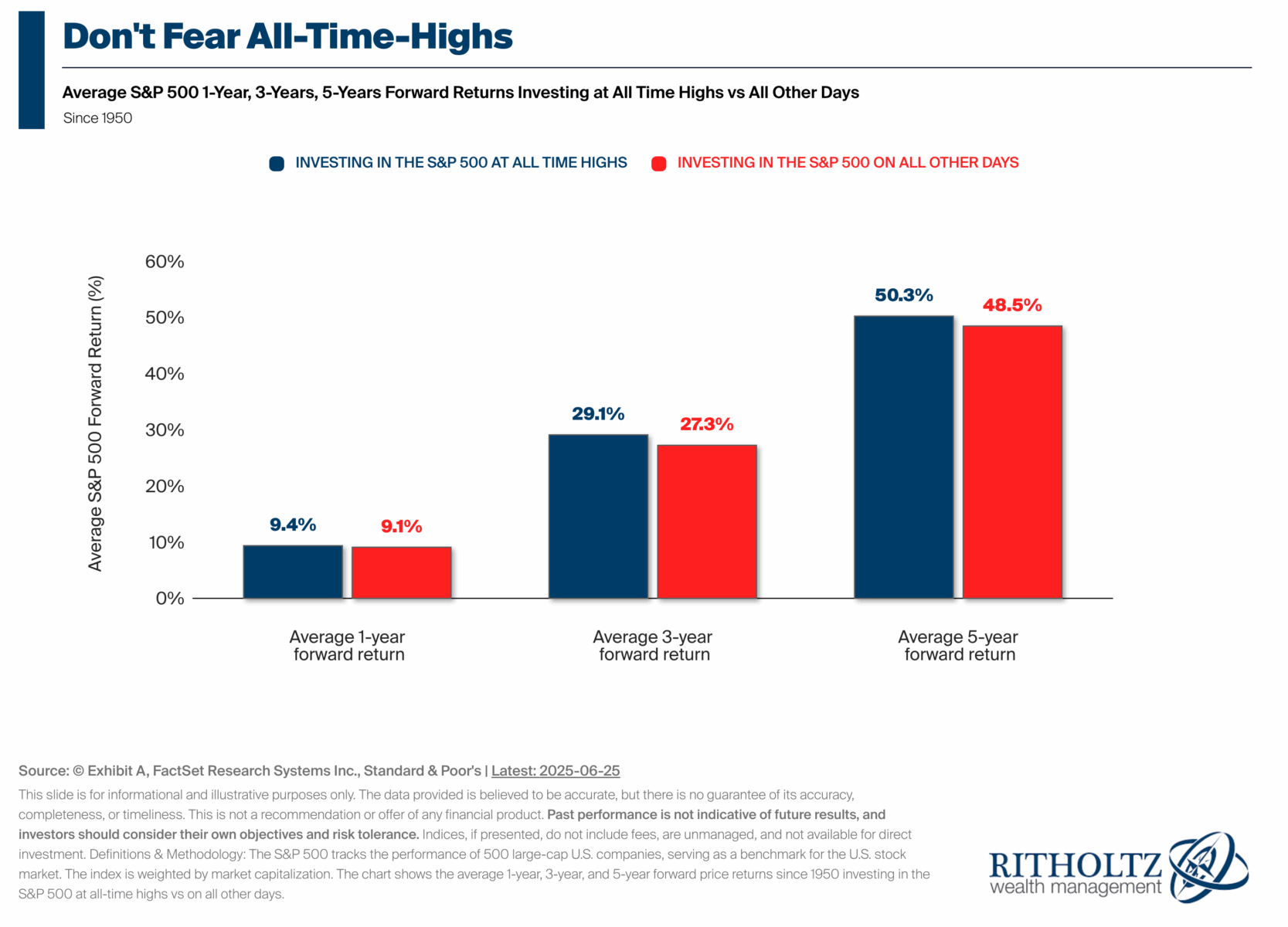

A well-known adage reminds us that corporate insiders and 10% owners really only buy shares of a company because they believe the stock price will rise and they want to profit from it. Thus, insider buying can be an encouraging signal for potential investors. This is all the more so during times of uncertainty in the markets, and even when markets are near all-time highs.

As indicated, the first-quarter earnings-reporting season is underway, and many insiders are prohibited from buying or selling shares. Below are some of the most notable insider purchases that were reported recently, starting with the largest and most prominent.

Resideo Technologies

- Buyer(s): 10% owner CD&R Channel Holdings II

- Total shares: more than 5.7 million

- Price per share: $17.38

- Total cost: around $1.0 billion

This private equity firm took a huge stake in Resideo Technologies Inc. (NYSE: REZI), an environment, energy, and security solutions provider that was spun out of Honeywell in 2018.

This Arizona-based company just posted better-than-expected first-quarter results. The stock was last seen trading about 14% more than the purchase price above, and 22.2% higher than a month ago. The consensus target price is $23.00, but just one of the four analysts who cover the stock recommends buying shares.

Note that a director bought some shares in late February as well.

NovaGold Resources

- Buyer(s): 10% Electrum Strategic Resources

- Total shares: more than 13.3 million

- Price per share: $3.75

- Total cost: about $50.0 million

This private equity firm took advantage of a common offering of NovaGold Resources Inc. (NYSE: NG) shares to boost its stake to around 92.9 million shares. The offering aimed to fund the purchase price for the Salt Lake City-based mineral exploration company’s previously announced acquisition of an additional 10% ownership interest in Donlin Gold.

Despite retreating from a 52-week high in recent days, NovaGold shares are still 19.24% higher than 90 days ago and a bit higher than the offering price. The $4.95 consensus price target signals upside potential of 30.9%. One of the two analysts who cover the stock recommends buying shares.

Note that 26.5% of NovaGold shares are held by insiders.

Cracker Barrel Old Country Store

- Buyer(s): 10% owner GMT Capital

- Total shares: 211,900

- Price per share: $41.84 to $44.60

- Total cost: almost $9.1 million

This buyer has spent about $19.9 million on Cracker Barrel Old Country Store Inc. (NASDAQ: CBRL) since it began acquiring shares in the beginning of April. Its stake is up to over 2.8 million shares. There are 22.2 million or so shares outstanding.

The stock is up 16.3% since the Tennessee-based operator of restaurant and retail outlets posted better-than-expected quarterly results in early March, but still down 12.2% year to date. Shares were last seen changing hands for more than the buyer’s purchase price range.

Analysts have a consensus price target of $46.00, which indicates that overall they see no upside in the next 12 months. The high price target is up at $55.00. However, only two of the 10 analysts who cover the stock recommend buying shares.

Heartland Express

- Buyer(s): CEO Michael Gerdin and other insiders

- Total shares: more than 544,900

- Price per share: $7.51 to $8.35

- Total cost: almost $4.3 million

Heartland Express Inc. (NASDAQ: HTLD) recently posted a first-quarter loss with revenue that was less than Wall Street expected. The Iowa-based carrier blamed adverse weather and tariff uncertainty.

Still, the stock popped 9.6% in the past week to more than the top of the purchase price range above. The share price is 24.6% lower than at the beginning of the year. Analysts on average see 13.7% upside in the next 52 weeks to their consensus price target of $9.62. However, none of the analysts who cover the stock recommend buying shares. J.P. Morgan reiterated its Underweight rating after the quarterly report.

Note that Gerdin’s stake is up to less than 1.5 million shares.

And Other Insider Buying

Since the beginning of the month, some insider buying was reported at American Homes 4 Rent, Apple Hospitality REIT, Biogen, Blackstone, Caterpillar, Clorox, Hecla Mining, Huntsman, International Flavors & Fragrances, KKR, LyondellBasell Industries, Magnolia Oil & Gas, Matador Resources, Southwest Airlines, Smurfit Westrock, and Transocean as well.

Three Dividend Aristocrats Billionaires Continue to Buy in Bulk

The post These Insiders Are Scooping Up Shares Now appeared first on 24/7 Wall St..