These Are the 2 Best ETFs to Buy for April

Spring is in the air and April is the perfect time to spruce up your portfolio. Exchange-traded funds (ETFs) are the perfect addition because they add instant diversity to your stock holdings by spanning industries and geographies at low cost. Two ETFs that look like solid buys for next month are the Vanguard Growth ETF […] The post These Are the 2 Best ETFs to Buy for April appeared first on 24/7 Wall St..

Spring is in the air and April is the perfect time to spruce up your portfolio. Exchange-traded funds (ETFs) are the perfect addition because they add instant diversity to your stock holdings by spanning industries and geographies at low cost.

Two ETFs that look like solid buys for next month are the Vanguard Growth ETF (NYSEARCA:VUG) and the Vanguard Russell 2000 ETF (NASDAQ:VTWO). Here is why these two are poised to bloom as interest rate cuts loom and other tailwinds kick in.

24/7 Wall St. Insights:

-

ETFs are the perfect vehicle to instantly diversify your portfolio across market caps, industries, and geographies, protecting your downside from voltility.

-

The Vanguard Growth ETF (VUG) gives you access to the biggest, tech-oriented growth stocks while the Vanguard Russell 2000 ETF (VTWO) lets you cash in on small-cap stocks that are wound like a coiled spring, ready to shoot higher.

-

If you’re looking for some stocks with huge potential, make sure to grab a free copy of our brand-new “The Next NVIDIA” report. It features a software stock we’re confident has 10X potential.

Interest rate growth boost

Let’s start with the big one: interest rate cuts. The Federal Reserve’s benchmark rate is at 4.33% now, but there are whispers of a quarter-point trim by June — maybe April if inflation holds at 2.8% — are getting louder.

Lower rates are rocket fuel for growth stocks like the Vanguard Growth ETF. Its 250 holdings lean heavily on tech titans (55% of the pie) like Apple (NASDAQ:AAPL) and Nvidia (NASDAQ:NVDA), which thrive when borrowing is cheap. Cheaper debt means more cash for R&D and buybacks.

Vanguard Growth’s 22% return in 2024 could stretch to 25% if rates dip, while the Vanguard Russell 2000 ETF, which tracks 1,970 small-cap Russell 2000 stocks, gets a similar lift. Small-cap stocks, particularly industrials and financials, which represent a combined 40% of the ETF’s total, rely on loans to grow. A 1% rate drop could slash borrowing costs 20%, which could juice earnings.

VTWO gained 16% in 2024 and could hit 18% to 20% gains with that tailwind.

Vanguard Growth’s tech edge

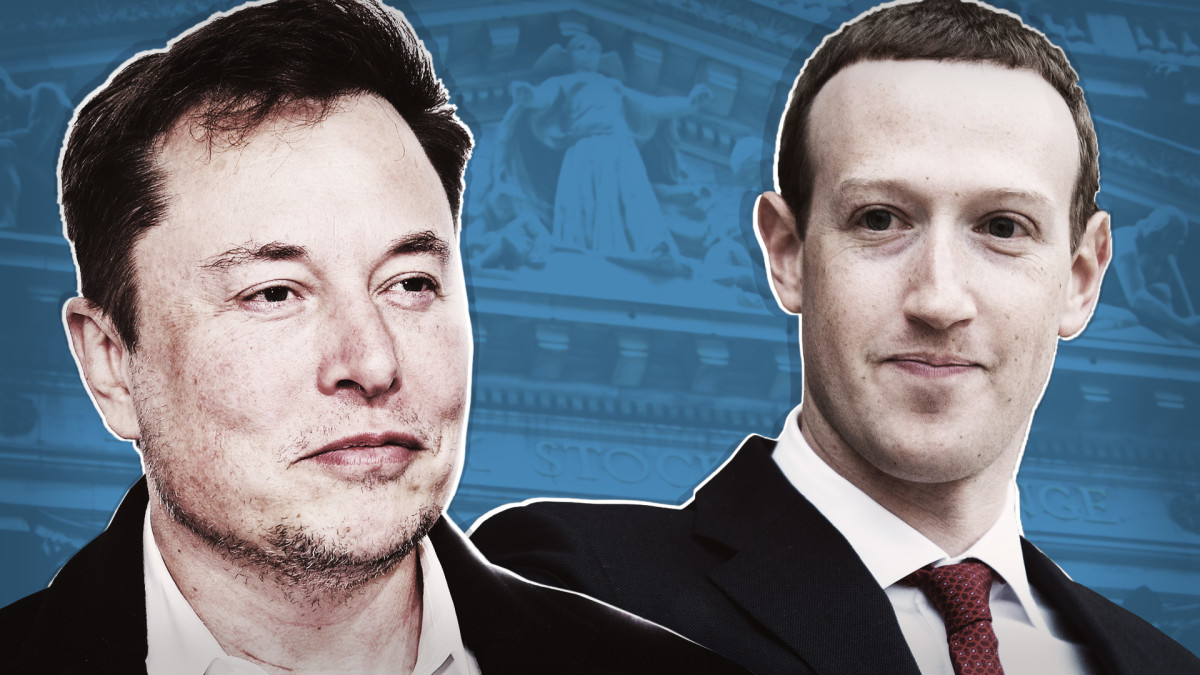

The bull case for VUG is not just about interest rates, it is riding the AI wave, too. Apple accounts for 11% of the ETF, Microsoft is 10%, and Nvidia, 9%, and all are pouring billions into AI, from Apple Intelligence to Nvidia’s chips. It is poised for a multi-year boom.

The ETF has a super-low expense ratio of 0.04% fee and a renewed, pro-business vibe in Washington, including tax cuts, could juice tech profits further. Sure, tariffs, especially on China, could disrupt supply chains, but VUG’s 15x forward P/E highlights its value orientation, especially when stacked up against the Invesco QQQ Trust Series 1‘s (NASDAQ:QQQ) 20x.

It makes VUG a buy in April. It is strung taut like a bow from the potential for rate cuts plus AI hype that could push its returns past last year’s gains.

Vanguard Russell 2000 small-cap snapback

The Vanguard Russell 2000 ETF has its own thing going on. Small-caps lagged in 2024, with the Russell 2000 returning 15% compared to the S&P 500’s 23%, but that is flipping. There is a “value rotation” underway in the market as investors ditch overbought tech for bargains.

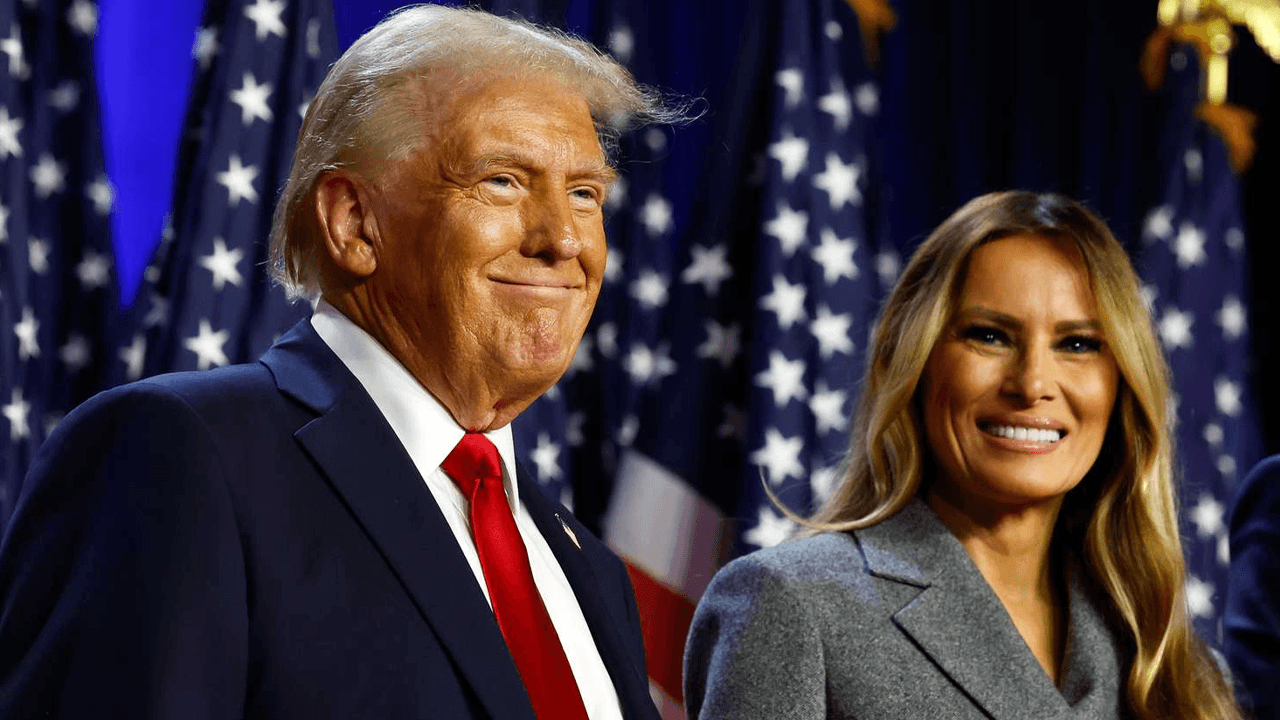

VTWO’s 12x forward P/E versus VUG’s 15x is dirt-cheap, and its 1.5% yield beats VUG’s 0.4%. President Trump’s tariffs could benefit small-cap stocks since their businesses are less trade sensitive, with Edward Jones saying they derive less than 30% of their revenue overseas. Tax cuts, on the other hand, could also lift their bottom lines, while rate cuts are icing on the cake. A 20% post-Fed pivot like the one that occurred in 2022 isn’t wild to bet on.

Here’s what could trip them up

Let’s take off the rose-colored glasses. There are risks. VUG is a tech-heavy ETF with 70% of the stocks in top sectors, meaning an AI bust or tariff hit could stall gains. VTWO’s small-caps are volatile with 18% annualized swings, according to Vanguard. And a recession could gut earnings for both. If inflation spikes past 3%, the Fed would likely delay any rate cuts, too, but April’s timing, which anticipates pre-summer Fed moves, suggests favorable timing.

How they fit together

Why buy both of these ETFs? Vanguard Groth is, well, your growth engine. It holds big names, meaning potentially big gains. Vanguard Russell 2000 is the scrappy underdog: its holdings are cheap and ready to pop.

VUG has a 10-year annualized 15.2%return pairs well with VTWO’s 8.8% returns, balancing both risk and reward. Their miniscule expense ratios keep costs low and beats most funds while allowing for diversification across market caps.

April makes an excellent time to grab VUG and VTWO: rate cuts are coming, tech is humming, and small-caps are like a thoroughbred spoiling for a race. These two aren’t perfect, but they’re cheap, timely, and primed to run. And spring is your season to jump in.

The post These Are the 2 Best ETFs to Buy for April appeared first on 24/7 Wall St..