The Fed’s Decision Is In. Here’s What what Social Security Cost of Living Adjustment (COLA) Looks Like

All eyes were on the Federal Reserve this week, as America’s Central Bank met to determine whether to lower interest rates. Rates have been elevated in the post-pandemic era as the Fed aimed to curb the rampant inflation that occurred in part due to supply chain disruptions and COVID-related stimulus spending– and many consumers are […] The post The Fed’s Decision Is In. Here’s What what Social Security Cost of Living Adjustment (COLA) Looks Like appeared first on 24/7 Wall St..

Key Points

-

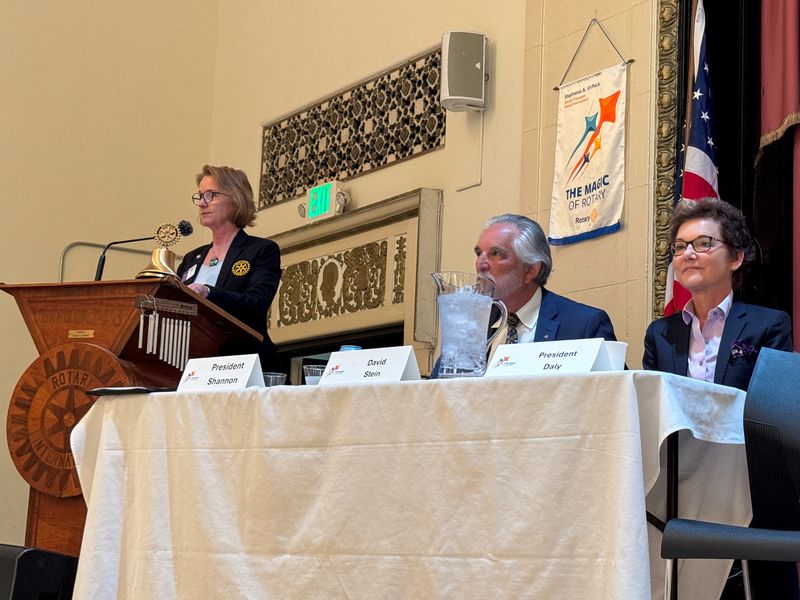

The Federal Reserve met in mid-June to determine whether to cut interest rates.

-

Fed officials held rates steady and expressed concerns that tariffs would lead to more inflation.

-

Retirees could see their Social Security COLA adjustment increase due to rising inflation.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

All eyes were on the Federal Reserve this week, as America’s Central Bank met to determine whether to lower interest rates. Rates have been elevated in the post-pandemic era as the Fed aimed to curb the rampant inflation that occurred in part due to supply chain disruptions and COVID-related stimulus spending– and many consumers are eagerly awaiting rate cuts.

For retirees on Social Security, though, one big focus of the Fed meeting was how it might impact Cost of Living Adjustments (COLAs). COLAs are better known as Social Security raises, and they are benefit bumps that happen most years. Seniors count on these raises to help them make ends meet, and speculation is often rampant regarding how large each year’s benefit increase will be.

So, with the Fed meeting over, what does the Central Bank’s decision mean for the 2026 COLA? Here’s what retirees need to know.

Concern about inflation could mean a larger COLA in 2026

The Federal Reserve held interest rates steady in June, much to the dismay of those hoping for a rate cut. The Fed doesn’t directly control how much consumers pay to borrow, but it controls the overnight rate at which banks can borrow money from each other. This indirectly affects how much consumers pay for credit.

The fact that the Fed didn’t change interest rates has no direct impact on the 2026 COLA, as interest rate data is not what determines the Cost of Living Adjustment. However, the decision that was made and statements by Fed officials are still very important to seniors because of what they say about how inflation will trend.

If the Fed thought inflation was cooling, this would have likely resulted in rates being lowered — and that would suggest a smaller COLA was likely. They didn’t do that, though, and, in fact, Fed Chair Jerome Powell was also quoted by CNBC as saying, “Everyone that I know is forecasting a meaningful increase in inflation in coming months from tariffs because someone has to pay for the tariffs.”

If that is indeed the case and the price of goods and services goes up substantially due to tariffs, retirees will be on track for a bigger raise next year.

How much will the 2026 COLA be?

In 2025, retirees received a 2.5% Social Security benefits increase, which was the smallest in years. That happened because the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) showed the cost of a basket of goods and services was only up around 2.5% year-over-year, and CPI-W data is used to calculate the Social Security raise.

If tariffs cause the cost of that same basket of goods and services to go up more than 2.5% during the months when the COLA is calculated — which Powell’s statement suggests may very well be the case — retirees could find themselves with a much bigger benefit bump in 2026.

With the pause on many of the President’s proposed tariffs slated to end in July, there is a very real possibility that this will happen. That’s because the COLA formula takes into account CPI-W data for the third quarter of the year, or the months of July, August, and September, to determine how much extra money seniors will get. The tariff pause could run out and result in a price increase happening right when seniors need it to.

Retirees will want to watch for that CPI number when it is released to get more insight into what their COLA will look like. The next Fed meeting is also scheduled for the end of July, on the 28th and 29th. If officials continue to express concerns about inflation and keep rates steady or even raise rates, then this would be another clear indicator that inflation isn’t going to cool during the crucial third quarter. While that may be bad news for the economy as a whole, it could be a welcome relief to retirees hoping for bigger checks.

The post The Fed’s Decision Is In. Here’s What what Social Security Cost of Living Adjustment (COLA) Looks Like appeared first on 24/7 Wall St..