Stock Market Today: Stocks soar as the U.S. and China agree tariff pause

A cooling of trade tensions between the world's two biggest economies has U.S. stocks set to soar in early Monday trading.

U.S. stock futures soared in early trading, while the dollar rallied and Treasury bond yields spiked, after Washington and Beijing agreed to a 90-day tariff truce that will re-open billions in trade between the world's two biggest economies.

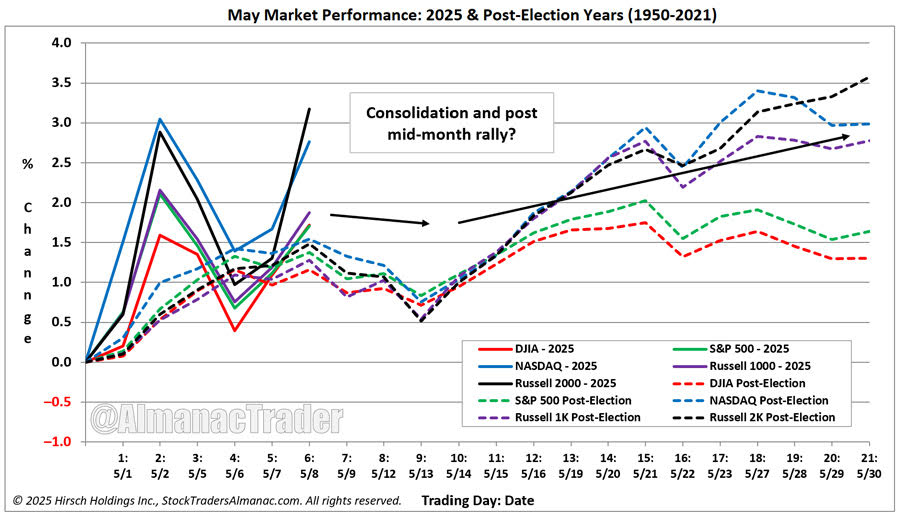

Stocks ended modestly lower on Friday, with the S&P 500 slipping by around 4 points into the close of trading to take its weekly decline to around 0.47%, leaving the benchmark just a few points shy of its April 2 'Liberation Day' levels.

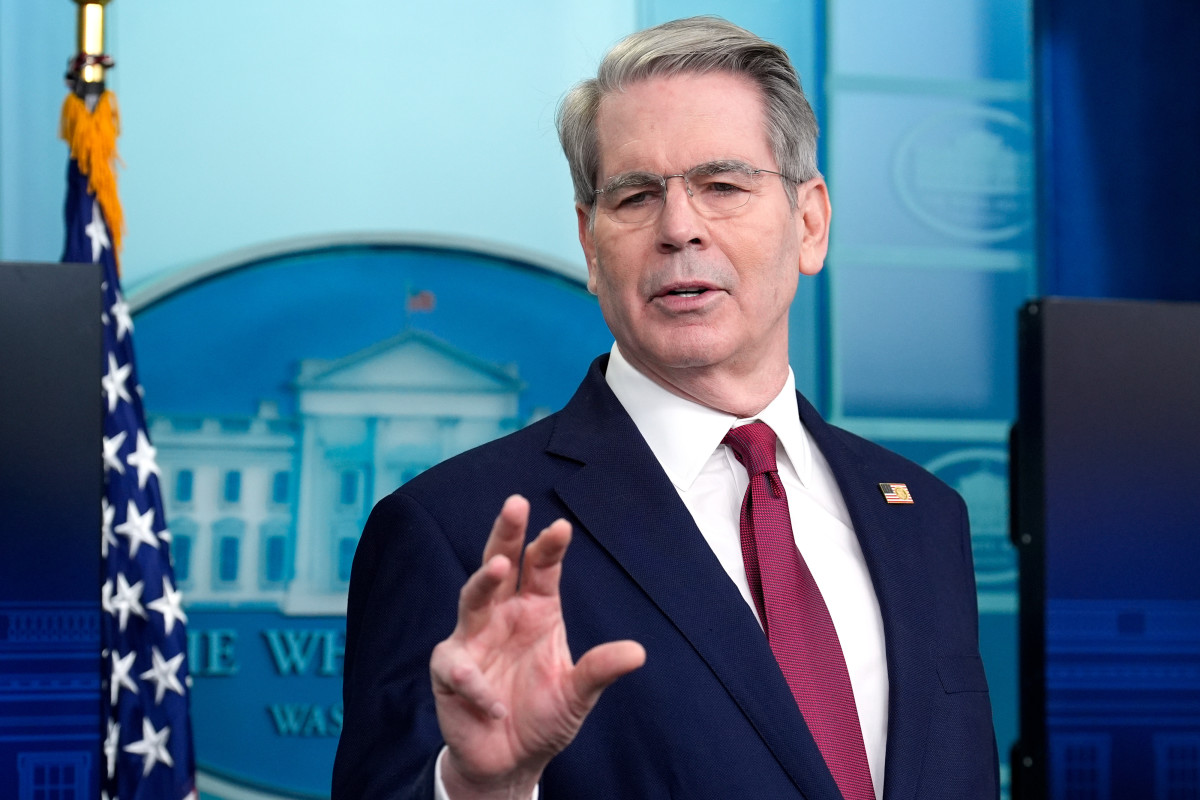

The weekend deal to reduce so-called 'reciprocal' tariffs between the U.S. and China, reached after a weekend of talks in Switzerland spearheaded by Treasury Secretary Scott Bessent, however, will push stocks firmly north of those levels as the start of trading.

Bessent called the existing tariffs, which included a 145% levy on China-made goods entering the United States, "the equivalent of an embargo, and neither side wants that. We do want trade."

The two nations agreed to reduce their tariff barriers to a baseline of 10%, the same level put in place last month after President Donald Trump paused his reciprocal levies, for at least 90 days, with the U.S. readout of the agreement declaring the two sides will "establish a mechanism to continue discussions about economic and trade relations.”

“This news is undoubtedly better than investors had hoped; in the run up to these talks President Trump signaled that a tariff rate of 80% “feels about right” whilst there had been other reports that 60% might be the more likely floor," said Lindsay James, investment strategist at London-based Quilter.

Related: Global investors wary of U.S. stocks as trade war concerns grip sentiment

Stocks are set to soar at the start of trading on the back of the agreement, which immediately opens up $600 billion in two-way trade and could serve as a template for future talks, particularly with the European Union.

Futures tied to the S&P 500 suggest an opening bell gain of around 161 points, with the Dow Jones Industrial Average priced for a surge of around 900 points.

The tech-focused Nasdaq, meanwhile, is set for a gain of around 765 points, with index heavyweights Nvidia (NVDA) , Tesla (TSLA) , Apple (AAPL) and Amazon (AMZN) all trading between 5% and 8% higher in premarket trading.

Pharmaceutical stocks, however, were moving sharply lower after President Trump said last night that he would sign an executive order to lower prescription drug prices.

Eli Lilly (LLY) shares were marked 2.66% lower in premarket trading, with Pfizer (PFE) down 3.01% and Bristol Myers (BMY) down 3.16%.

In the bond market, news of the deal clipped safe-haven assets such as U.S. Treasuries, sending yields sharply higher, with benchmark 10-year notes rising 7 basis points to 4.431% and 2-year notes leaping 10 basis points to 3.983%.

The U.S. dollar index, which tracks the greenback against a basket of six global currencies, was marked 1.14% higher at 101.491.

More Economic Analysis:

- Fed inflation gauge sets up stagflation risks as tariff policies bite

- U.S. recession risk leaps as GDP shrinks

- Like it or not, the bond market rules all

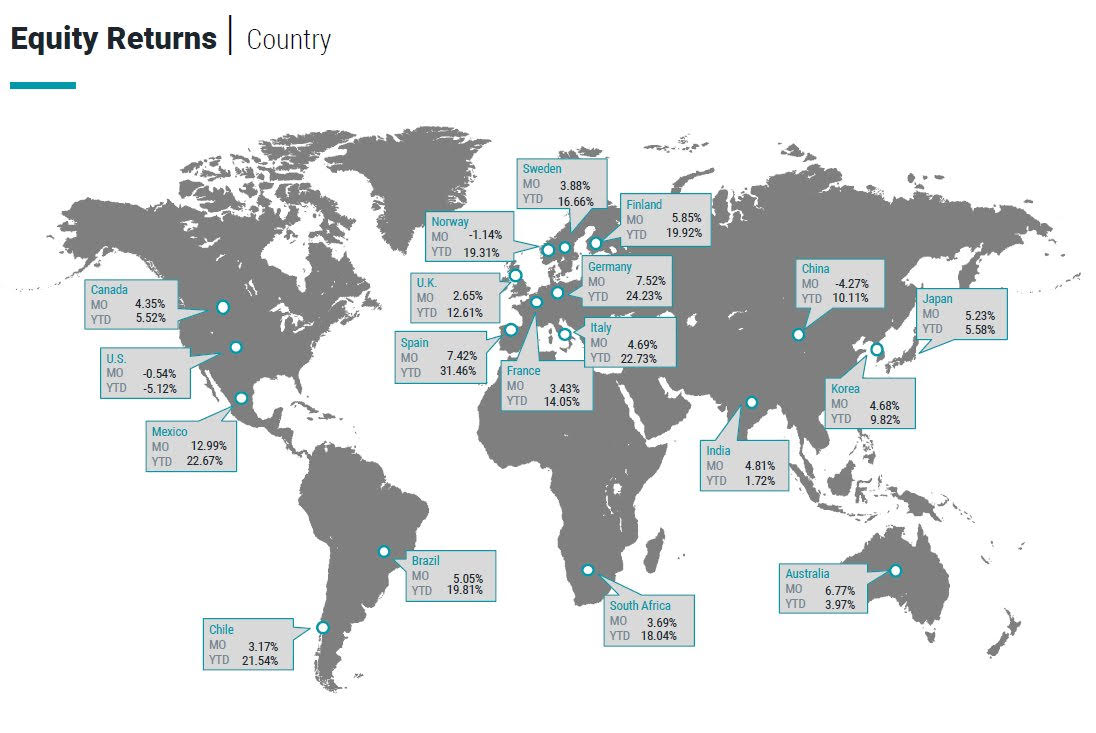

Global stocks were also on the move following news of the tariff truce, with Europe's Stoxx 600 rising 1.16% in Frankfurt and Britain's FTSE 100 up 1.16% in London.

In overseas markets, Japan's Nikkei 225 ended 0.38% higher in Tokyo prior to the U.S.-China tariff pause, while stocks in China rose by around 1.7%. The region-wide MSCI ex-Japan index, meanwhile, surged 1.86%.