Stock Market Today: Stocks Moving Back to Even as FOMC Meeting Kicks Off

Yesterday's optimism has given way to today's reality. Will the Fed choose to lower rates?

Update at 10:40 a.m. ET

FOMC Meeting Kicks Off Today

As TheStreet's Todd Campbell reports, the Federal Reserve's policy-making Federal Open Market Committee will announce its decision on interest rates tomorrow, June 18.

The Fed is in a bind. President Trump has been calling for rate cuts, but the economy doesn't necessarily need them. As Todd tells us, "the Fed's mission is to use the Fed Funds Rate to maintain low unemployment and inflation, two often competing goals."

This year, the job market has weakened, with nearly 700,000 workers laid off, while inflation has been sticky.

So, what's the Fed to do? Should it prioritize inflation or jobs? Both are problematic. And if tariffs are one of the reasons inflation is sticky and jobs are declining, then is it the Fed's job to take action? We'll find out tomorrow, although the odds that the Fed will act this month are low.

For now, stocks are off their worst levels of the day. The Dow Jones Industrial Average is nearly flat, while the S&P 500 is off just 0.21%.

Top-performing stocks include those in the energy sector as well as Oracle (ORCL) , AMD (AMD) and Micron (MU) among tech stocks.

Stock Market Today

So much to cover today!

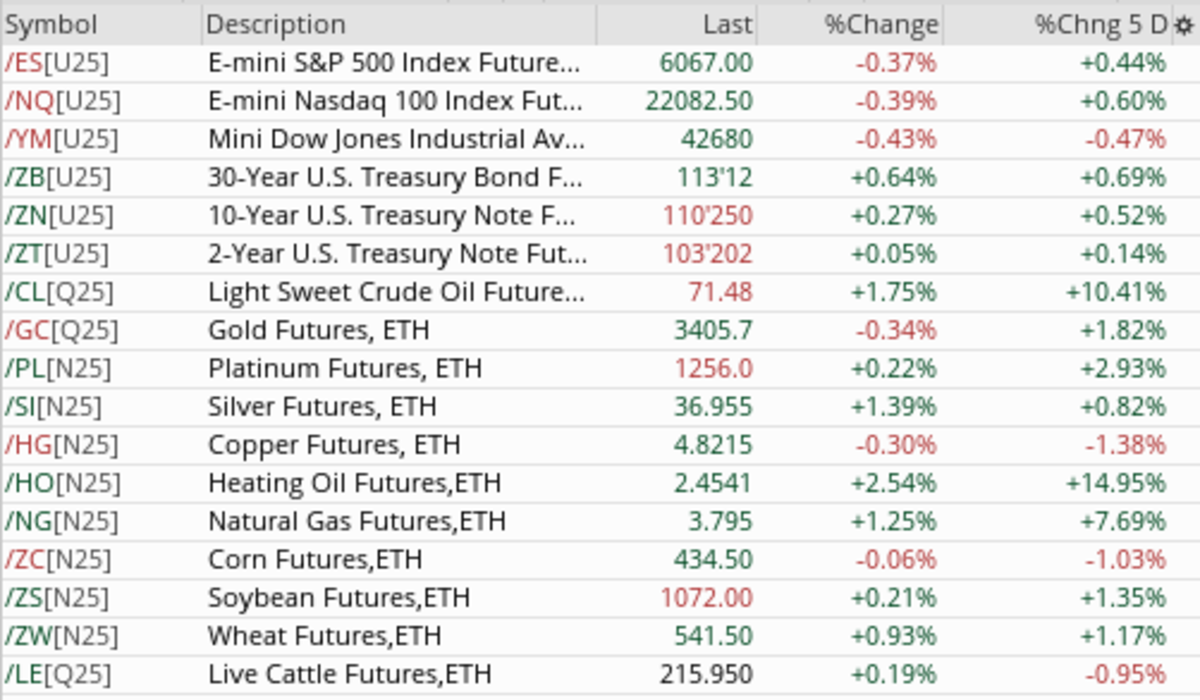

Let's begin with the futures.

Stocks are trading down by about 0.5%. As is gold.

What's rallying? Oil! "Black Gold" is up more than 1.5% on worries that a resolution in the Middle East might take longer than it seemed just yesterday.

Bonds are also up in a flight to quality, as well as fresh calls from President Trump for the Fed to lower interest rates.

Here's a table of the futures:

Overnight, it's been a rocky road. Since yesterday's close, the S&P 500 futures have mostly trended lower.

What's happening?

Well, the big news, as mentioned above, is the war in the Middle East. Any hopes for a quick resolution are currently dashed. Although Iran has suggested that it is open to a diplomatic end, Israel has continued to attack, likely to cripple Iran's ability to launch further attacks.

Over on TheStreet Pro, Stephen Guilfoyle reports that Israel has already destroyed more than one-third of Iran's ballistic missile capabilities. He also said, "Saudi Arabia had supposedly lobbied the U.S. president as well, to pressure Israel to slow down their campaign. Israeli officials claimed that President Trump had not told them to stop.

"In addition, senior Iranian officials have expressed a mistrust of the U.S. president and rejected U.S. claims that there was no involvement in the attack on their nation."

There's more big news! As we discussed yesterday, world leaders are meeting in Canada. However, Trump departed the meeting early in order to deal with the Middle East. And that makes sense.

But in the day he spent with other leaders, Trump was able to sign a previously negotiated trade deal with the UK.

Yesterday, we also discussed the tax bill that's making its way through the Senate. Senate Republicans are divided on several issues, notably the state-and-local-tax, or SALT, deduction, which is currently capped at $10,000. Legislators from high-tax states like New York would like to raise that cap to $40,000.

Other tax issues are being debated, too, like a longer phase-out period for clean energy tax credits and deeper cuts to medicaid. There was general agreement among majority Republicans that the 2017 tax cuts should be extended and not left to expire this year.

Economics

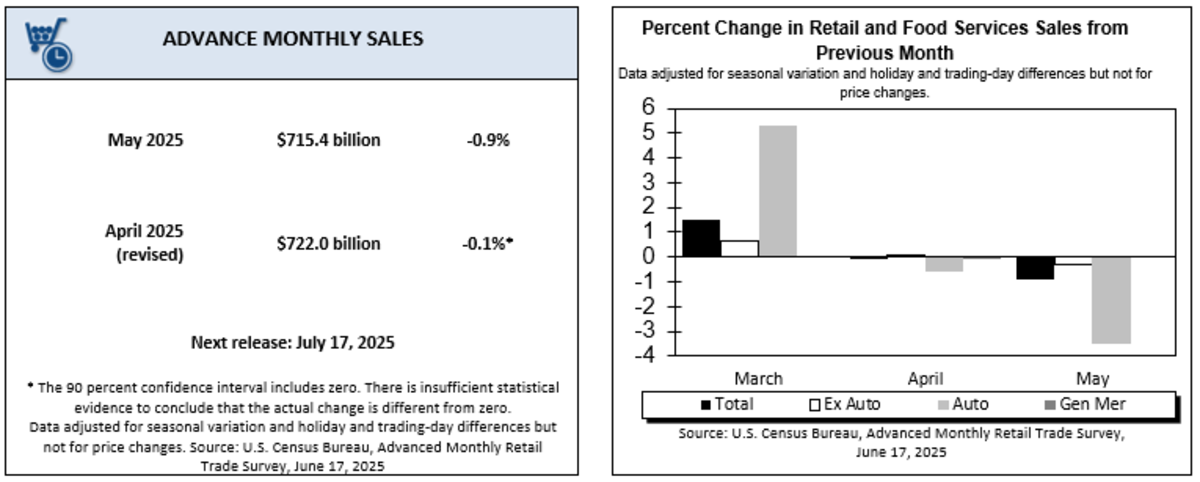

Last up, there are several economic reports to watch today. The big one being retail sales. According the the U.S. Census Bureau, retail sales fell for the second month in a row. For May, sales were down by 0.9%, which was weaker than expected.

Here's a nice take on the report:

Interesting breakdown on retail sales. Autos down after pre-tariff bump. Notable drop in building materials, restaurants and bars. Looks like consumers pulling back on discretionary spending, but still shopping online. pic.twitter.com/d6prJKzWwH— Kathy Jones (@KathyJones) June 17, 2025

We'll be back later with more.