Stock Market Today: Stocks end lower, Nvidia beats Wall Street forecasts

Stocks end lower as the AI chipmaker beat analysts' first-quarter earnings and revenue forecasts after the bell.

Updated 4:40 p.m. ET

Stocks finished lower Wednesday while AI chipmaking heavyweight Nvidia (NVDA) beat Wall Street's quarterly earnings forecasts after the bell.

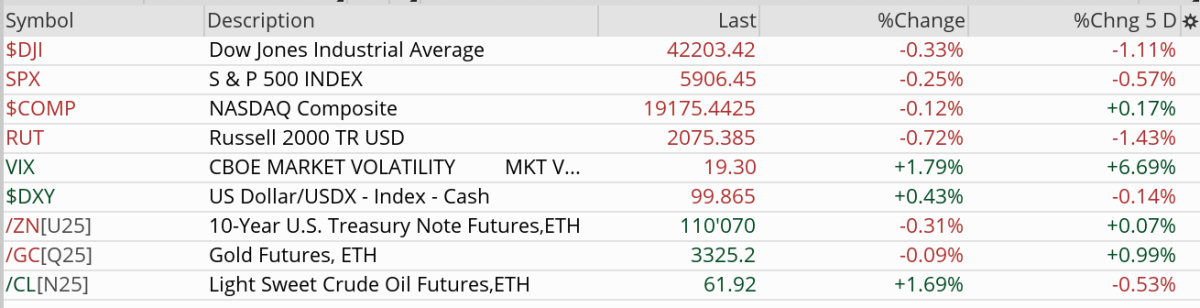

The Dow Jones Industrial Average lost 244.95 points, or 0.58%, to finish the session at 42,098.70, while the S&P 500 slipped 0.56% to close at 5,888.55 and the tech-heavy Nasdaq dropped 0.51% to end the day at 19,100.94.

Nvidia reported adjusted earnings of 96 cents per share on $44.06 billion in revenue, beating estimates of 93 cent per share on $43.31 billion in sales. Data center revenue surged 73% from a year ago to $39.1 billion.

Shares of Nvidia were up 3.7% in after-hours trading.

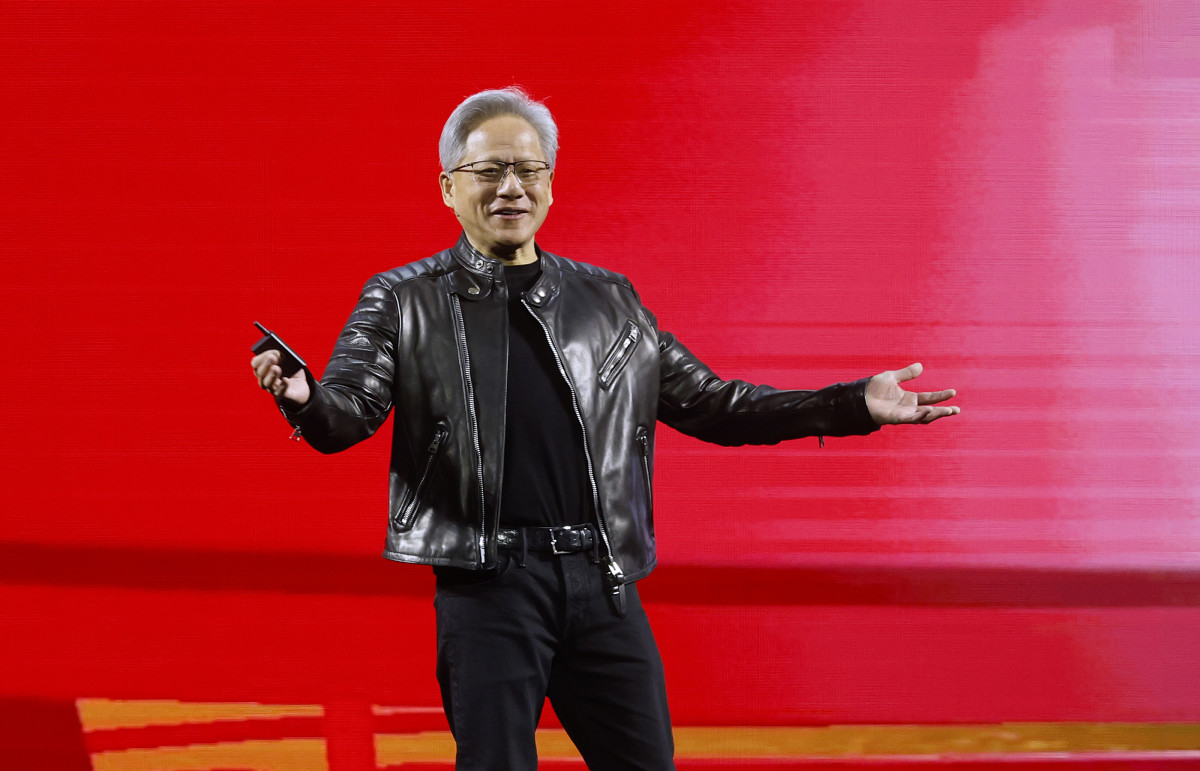

“Global demand for Nvidia’s AI infrastructure is incredibly strong. AI inference token generation has surged tenfold in just one year, and as AI agents become mainstream, the demand for AI computing will accelerate,” CEO and founder Jensen Huang said in a statement.

“Countries around the world are recognizing AI as essential infrastructure — just like electricity and the internet — and NVIDIA stands at the center of this profound transformation,” he added.

Nvidia incurred a $4.5 billion charge after the U.S. government said that a license would be required for exports of the company’s H20 products to China.

“Sales of H20 products were $4.6 billion for the first quarter of fiscal 2026 prior to the new export licensing requirements,” the company said “Nvidia was unable to ship an additional $2.5 billion of H20 revenue in the first quarter.”

Updated 3:52 p.m. ET

Stocks lost their mojo in late-afternoon trading on a news report that the Trump Administration may be suspending export licenses for software sold to Chinese customers used to design semiconductors.

The Financial Times newspaper reported the companies affected include Cadence Design Systems (CDNS) , Synopsys (SNPS) and Siemens EDA to stop supplying their technology to China.

The S&P 500 was off 0.4% t 5,898.30, the Nasdaq Composite Index was down 0.3% to 19,147. The Dow Jones Industrial Average was down 260 points to 42,080.

Updated 2:55 p.m. ET

Technology shares were enjoying a modest rally this afternoon as investor awaited earnings from AI giant Nvidia (NVDA) and Salesforce (CRM) , both due after today's close.

Nvidia shares were up 1% to $136.90 at 2:40 p.m. Nvidia's semiconductors and Graphic Processing Units dominate the market for chips used to power artificial intelligence applications.

Salesforce, a powerhouse in customer relations management, was off 0.8% at $275.01.

While techs were higher, the Standard & Poor's 500 Index and the Dow Jones Industrial were both modestly lower. Drifting is a good descriptor for the overall market.

The Federal Reserve, meanwhile, released the minutes of its May 6-7 meeting. The minutes suggest Fed officials believed market and trade volatility were enough to leave its key federal funds rate at 4.25% to 4.5%.

Nine of 11 S&P 500 sectors were lower. The leading sector was information technology led by Fair Isaac Corp. (FICO) , up 8.6%. It was followed by Broadcom (AVGO) and Super Micro Computer (SMCI) , up 1.6% and 1.32%, respectively.

Communications Services were the other winners led by Discovery Inc. (WBD) and News Corp. Class B (NWS) , up 4,3% and 1.3%, respectively. Facebook parent Meta Platforms (META) was up slightly after its annual meeting. The company is breaking its AI team into two pieces to better compete with OpenAI and Google-parent Alphabet (GOOGL) .

Utilities were still the weakest sector, off 1.6%, weighed down by higher interest rates. The 10-year yield was at 4.481%, up from 4.45% on Tuesday.

Updated 1:40 p.m. ET

Shares of Nvidia (NVDA) were edging higher this afternoon ahead of its fiscal-first-quarter earnings report, due after Wednesday's close.

The shares were up 0.5% to $136.14 at 1:20 p.m.

Stocks generally were lower with the Standard &Poor's 500 Index off just six points at 5,915. The Nasdaq Composite was off very slightly at 19,199. The Dow Jones industrials were off 102 points at 42,242.

Only two of 11 S&P 500 sectors were higher, however: Communications Services and Information Technology. The first includes Facebook parent Meta Platforms (META) , up 0.6% to $646.16 as the company holds its annual meeting

Techs were led by Fair Isaac (FICO) , the company that generates credit scores for consumers. The shares were up 8.6% to $1632.

The weakest sector was utilities, lower because bond yields had moved higher today. The 10-year Treasury yield was at 4.49%, up slightly from Monday. The yield had reached as much as 4.61% on May 21.

Crude oil was up $1.11 at $62.00.

The Federal Reserve was scheduled to release minutes of its May 6-7 meeting at 2 p.m. ET.

Midday Update: Drifting Lower

Midday Update: Drifting Lower

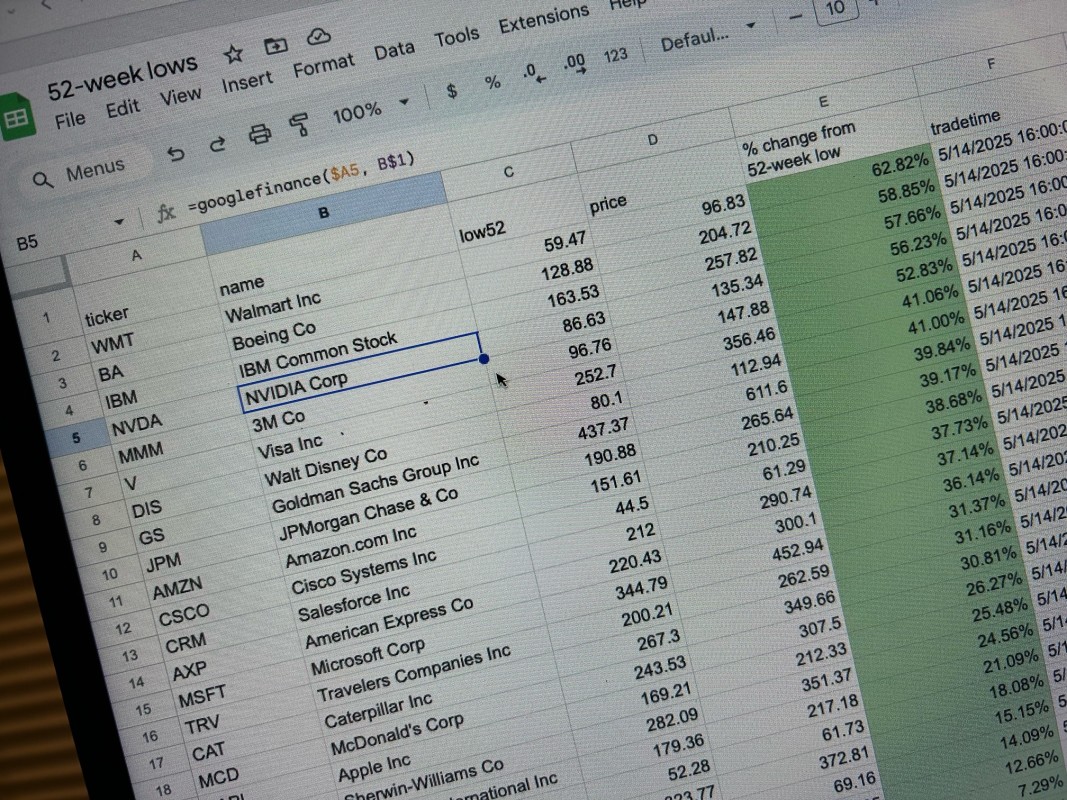

Stocks are drifting lower in midday trading. The S&P 500 Index is 30 points off the day's highs at 5906, down 0.25% on the day.

More stocks are down than up, too. Among S&P 500 constituents, for every stock that's higher today, around 5 are down.

You can see that clearly on this heat map, where the biggest ups include AutoZone (AZO) , Palantir (PLTR) , and the healthcare providers like UnitedHealth (UNH) , Elevance (ELV) and CVS (CVS) .

UNH has been beaten down, and while there's no big news to explain today's gain, the company has mentioned seeing cost benefits to using AI in the future and reports say that Congress members have bought stock.

Nvidia has drifted off the day's highs and is down slightly. But there are way more red boxes that green ones.

Yesterday, I mentioned the huge gain in the Conference Board's Consumer Sentiment for May.

David Rosenberg tweeted the following, which prompted some discussion in TheStreet Pro's Daily Diary about the value of this survey.

While everyone celebrates today’s ripping consumer confidence number for May, let’s put the 98 headline into perspective. It’s the same number that presaged the 1973, 1990, 2001, 2007, and 2020 recessions. Doh! Not to mention what it says about society that more than twice as…— David Rosenberg (@EconguyRosie) May 27, 2025

Our own Doug Kass at TheStreet Pro suggested that this number should be ignored. It's a lagging indicator that was influenced by the big jump in stock prices. Especially considering that people are more than twice as confident in the stock market as they are in their own jobs!

What else is happening?

While not directly related to Tesla (TSLA) , another SpaceX rocket launch failed yesterday. While launching rockets into space is incredibly hard and failure will be part of the road to success, this begs the question of whether Elon Musk has taken his eye off the ball with his foray into politics.

That's all for now!

Stock Market Today

Happy Wednesday!

After the close of trading today, all eyes will turn to Nvidia (NVDA) as investors await the company's Q1 earnings release. The Santa Clara, Calif., semiconductor maker is expected to report earnings of 93 cents a share on revenue of $43.2 billion, according to LSEG.

TheStreet Pro's Stephen "Sarge" Guilfoyle says in his Market Recon column today that investors should also be on the lookout for "the reality (or not) of the company's April projection of a $5.5 billion inventory-based charge after President Trump tightened export controls for high-technology-type products headed for mainland China that could be used for military purposes."

Nvidia shares are up in premarket trading.

What else is happening today? Salesforce (CRM) is also set to report after the close. Expectations are for quarterly earnings per share of $2.55 on revenue of $9.75 billion.

Yesterday was quite a day. Following Sunday's news that the Trump administration's aggressive tariffs on Europe would be delayed at least until July, stocks ripped more than 2% higher. All sectors were up, led by Consumer Discretionary, which gained nearly 3%. Breadth was strong, too.

As for today, expect the market to be less exuberant. S&P futures are up 0.11%, while the Dow is down slightly. European markets are lower.

Bond prices are slightly lower, sending yields up, while gold and crude oil are higher.