Stock Market Today: Stocks end lower as Wall Street comeback stalls

With the Fed decision behind it, markets are now likely to focus on the April 2 tariff deadline.

Updated at 4:27 PM EDT by Rob Lenihan

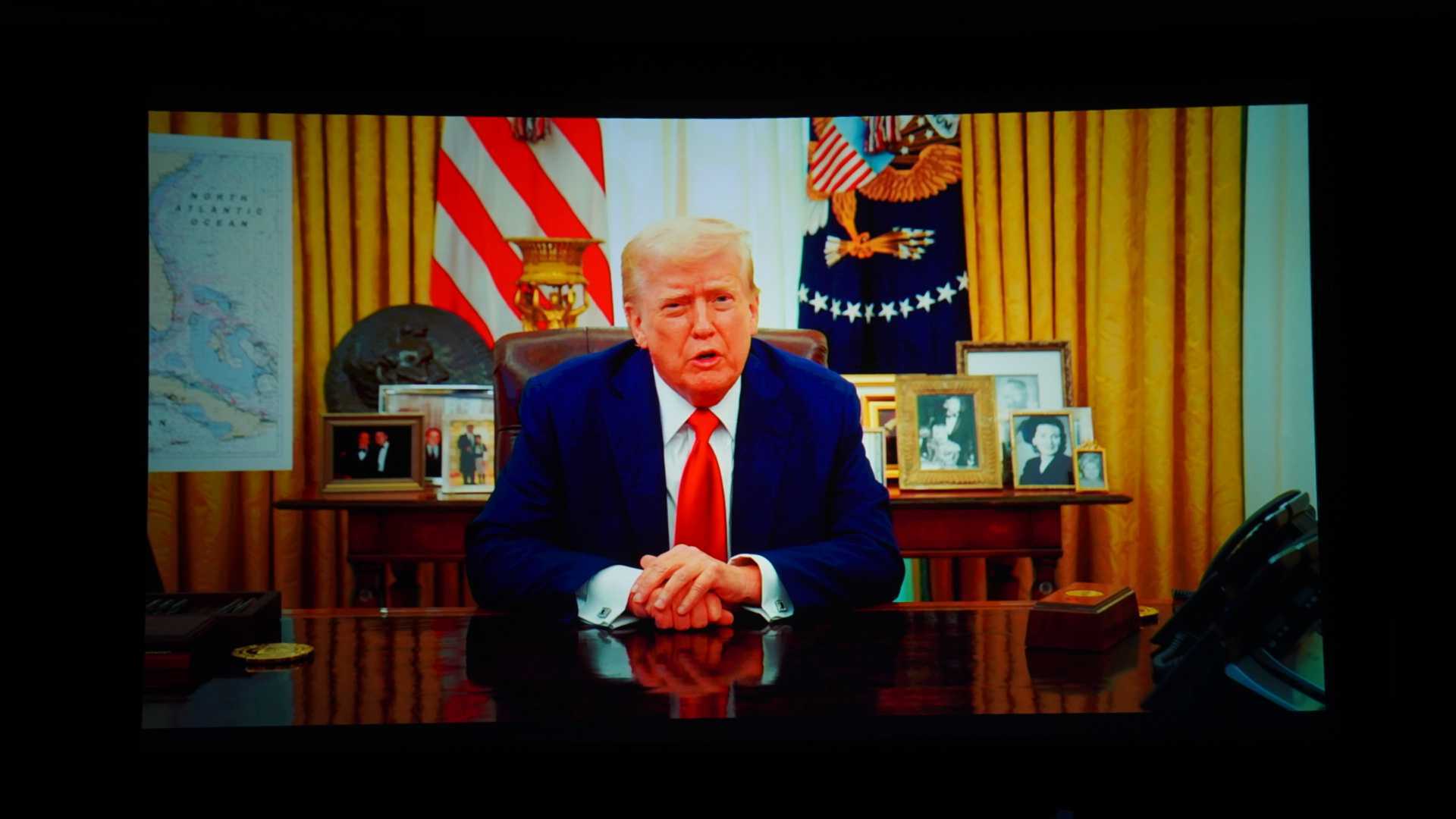

Stocks end lower Thursday, as investors parsed a surprisingly dovish Federal Reserve rate decision while cautiously eyeing changes to President Donald Trump's tariff plans over the coming weeks.

The Dow Jones Industrial Average was off 0.03%, or 11.31 points, to end the session at 41,953.02, while the S&P 500 at lost 0.22% to close at 5,662.89 and the tech-heavy Nasdaq slipped 0.33% to end the session at 17,691.63.

A report released by the Conference Board on Thursday showed its reading on leading U.S. economic indicators fell by slightly more than expected in the month of February.

The research organization said its leading economic index decreased by 0.3% in February after slipping by a revised 0.2% in January.

Economists had expected the leading economic index to dip by 0.2% compared to the 0.3% decline originally reported for the previous month.

“Without a doubt, the economy started showing signs of a slowdown a while ago and this metric is helpful in reminding investors of the fragility of business conditions,” said Jeffrey Roach, chief economist for LPL Financial.

Roach said that the two main risks globally are trade uncertainty and stagflation.

"These risks are not just in the U.S. but also in international economies, especially in the U.K. as highlighted in this morning’s press release from the Bank of England," he added. "Global investors should brace for heightened volatility as the global economy adjusts to the new regime."

Updated at 12:02 PM EDT

Back in black

Stocks are finding their footing heading into the afternoon session, with solid jobs data and a dovish Federal Reserve adding to this week's broader 'bargain hunting' tailwind in the wake of the S&P 500's fall into correction territory.

The benchmark was last seen 20 points, or 0.33% higher on the day, with the Dow rising 194 points and the Nasdaq up 70 points, or 0.4%.

"While the bottom of the recent correction is likely in, we probably haven’t seen the end of volatility. Policy uncertainty hasn’t disappeared, and the market remains sensitive to sentiment shifts," said Daniel Skelly, head of Morgan Stanley's wealth management market research & strategy team.

"With the S&P 500 still relatively close to correction territory, we do now see compelling opportunities in quality companies, especially for investors looking to average their way into positions," he added.

"Our preferred areas remain financials and industrials, which will likely benefit from deregulation and reshoring, respectively, later this year. Also, AI adopters look attractive, especially in sectors like healthcare and consumer internet, which are less exposed to tariff risk," Skelly said.

US stocks' best 2-day relative rally to ex-US in more than 4 months $VTI $VEU pic.twitter.com/hYZgfXak8Z— Mike Zaccardi, CFA, CMT