Stock Market Today: Stocks edge lower after $1.3 trillion selloff

The S&P 500 has lost more than $4 trillion in value since its mid-February peak.

U.S. stocks edged lower in early Tuesday trading, while the dollar extended declines against its global peers, as investors looked for a pause to yesterday's brutal selloff, which dragged the S&P 500 to its biggest decline of the year and closer to correction territory.

Updated at 9:39 AM EDT

More declines

The S&P 500 was marked 12 points lower, or 0.2%, in the opening minutes of trading, while the Nasdaq slipped 27 points, or 0.15%.

The Dow was marked 80 points lower and the mid-cap Russell 2000 index edged 4 points, or 0.12% higher.

The U.S. dollar index, meanwhile, was marked 0.5% lower against a basket of its global peers and trading at 103.406, the lowest since early November.

"US stocks are headed for their worst start to a presidential term since 2009, weighed down by recession fears and uncertainty around tariffs," said George Vessey, lead FX and macro strategist at Convera.

"The fundamentals of Trump’s plan for deregulation and tax cuts were expected to bolster a stronger dollar, but the implementation of his tariffs has dampened market sentiment, seemingly turning it dollar-negative," he added. "In the very short term, a consolidation phase or slight upward correction appears plausible for the dollar following last week’s turbulence; however, we believe we have already witnessed peak dollar strength for 2025."

Related: Another U.S. bank warns on stocks amid $4 trillion market rout

Updated at 9:04 AM EDT

Turning lower

Stock futures are turning lower heading into the start of trading, with futures contacts tied to the S&P 500 indicating a 5 point decline and those linked to the Nasdaq suggesting a modest 2 point pullback.

"The speed at which markets have declined over the past few days and weeks is a key sign that we are in a correction and not a bear market," said John Creekmur, chief investment officer, Creekmur Wealth Advisors.

"Corrections tend to be very short in duration and fast moving, while bear markets take longer to play out and their moves are not as noticeable over the very short term," he added. "The S&P 500 at current levels is an attractive opportunity for investors who missed out on the post-election gain, especially since the factors that fueled the post-election rally are still in play today, even though there is elevated uncertainty from tariffs."

Updated at 7:18 AM EDT

American outlook

American Airlines (AAL) shares moved lower in early trading after the carrier followed a larger rival, Delta Air Lines (DAL) , in forecasting a weaker-than-expected performance over the first quarter.

The carrier expects a loss of between 60 cents and 80 cents a share over the three months ending in March, compared with its prior forecast in late January of a loss of 20 cents to 40 cents a share.

"The revenue environment has been weaker than initially expected due to the impact of Flight 5342 and softness in the domestic leisure segment, primarily in March," American said in a Securities and Exchange Commission filing. "First quarter total revenue is now expected to be approximately flat versus the first quarter of 2024."

Late Monday, Delta said that last month it saw a "pretty significant shift in GDP sentiment and the output and the confidence signals that we monitor." The Atlanta carrier slashed its first-quarter profit forecast.

American shares were marked 3.44% lower in premarket trading to indicate an opening bell price of $12.04. Delta slumped 7.1% to $46.74.

Stock Market Today

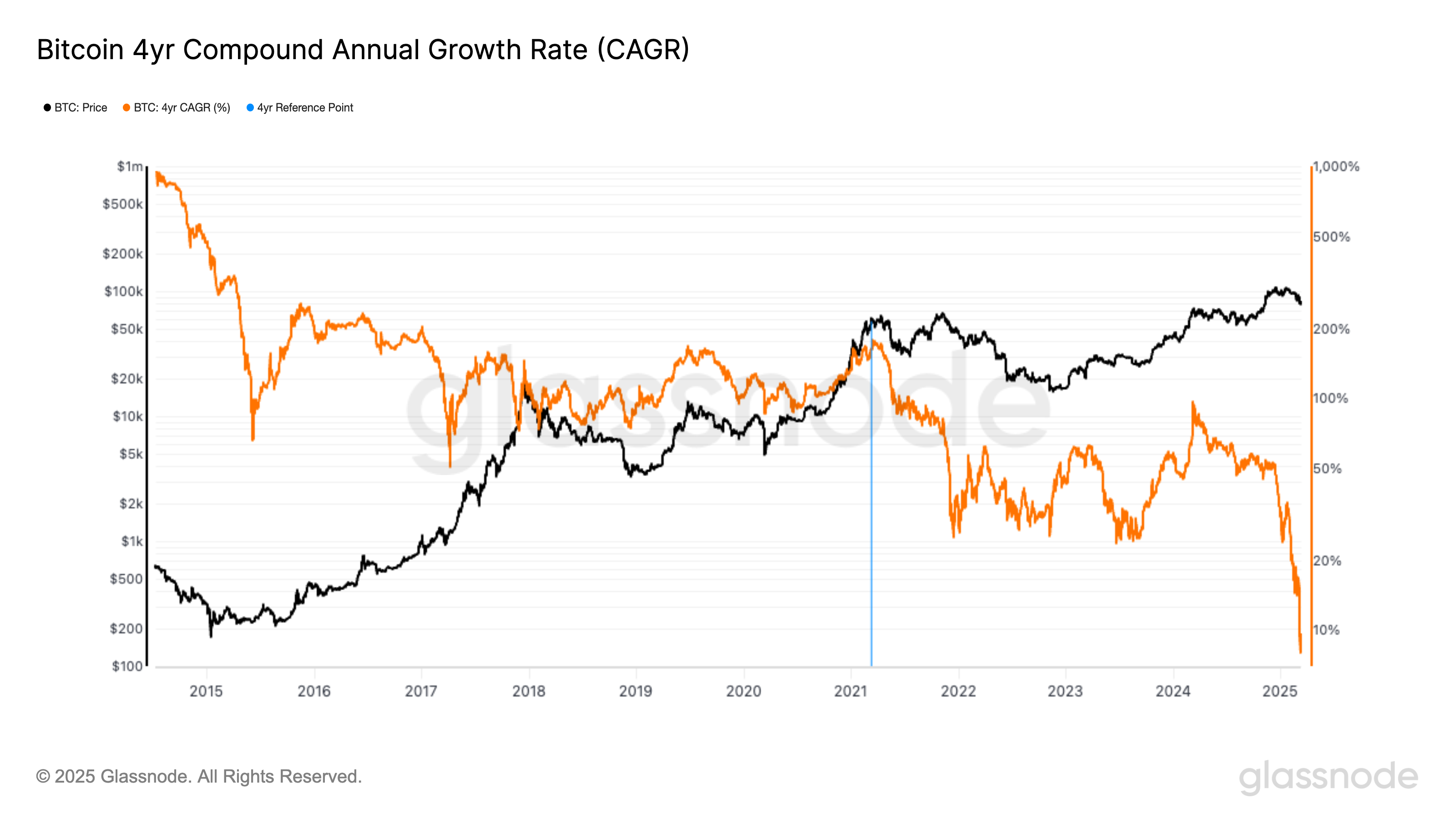

Stocks were pummeled across the board yesterday, with the tech-focused Nasdaq suffering its biggest decline since October 2022 and the S&P 500 down 2.7% on the session, and shedding $1.32 trillion in value, amid renewed recession fears tied to the tariff, spending and immigration policies of President Donald Trump.

The longer-run declines, which began last month as the President vacillated on imposing tariffs on America's key trading partners, have collectively wiped out more than $4 trillion in U.S. equity value as the S&P 500 has fallen 8.6% from its Feb. 19 peak.

The Nasdaq, meanwhile, is down more than 13.1% from its mid-December apex. It slumped more than 4% during yesterday's session amid a 15% plunge in Tesla (TSLA) and pullbacks for Magnificent 7 peers such as Nvidia (NVDA) and Apple (AAPL) .

"It had been widely expected that Donald Trump’s policies, whilst widely trailed in his election campaign, would in reality be watered down in order to maintain a business-friendly environment conducive to ongoing gains in the stock market," said Lindsay James, investment strategist at London-based Quilter Investors.

"However, the reality so far has been quite different, with on again/off again tariffs and no clear lines of negotiation, all perhaps designed to support his broader goal of seeing a manufacturing resurgence in the US," he added.

"With the promised tax breaks for firms that shift supply chains sitting in budget reconciliation, it is unclear whether firms will buy into his vision and go through the upheaval of moving to a higher cost jurisdiction to avoid what could ultimately be a one-term policy." Nasdaq

Analysts see the potential for more declines ahead as well, with Citigroup following rival HSBC in downgrading U.S. stocks to 'neutral' from 'overweight' in a note published late Monday, citing a "pause in U.S. exceptionalism."

That said, Wall Street is looking at a modest rebound heading into the Tuesday session, with futures contracts tied to the S&P 500 indicating an 18-point opening bell gain and those linked to the Dow Jones Industrial Average priced for a 115-point advance.

The Nasdaq, meanwhile, is called 85 points higher with premarket gains for Tesla, Nvidia and Palantir Technologies (PLTR) .

The market's key volatility gauge, however, remains firmly elevated and trading near the highest levels of the year, suggesting big moves are expected over the coming days.

CBOE Group's VIX index was last marked 16.1% higher in after-hours trading at $27.12, a level that suggests daily swings of around 1.7%, or 95 points, for the S&P 500.

More Wall Street Analysis:

- Analyst says AI stock picked by Cathie Wood will surge

- Analysts make surprise move on MongoDB stock price target

- Analysts reboot Rocket Lab's stock price target after earnings

In overseas markets, Europe's Stoxx 600, which has outperformed the S&P 500 by around 10% so far this year, edged 0.1% lower in midday trading in Frankfurt, while Britain's FTSE 100 slipped 0.13% lower in London.

Overnight in Asia, last night's selloff dragged Japan's Nikkei 225 0.64% lower by the close of trading, with the regional MSCI ex-Japan benchmark falling 0.48%.

Related: Veteran fund manager unveils eye-popping S&P 500 forecast