Stock Market Today: Stocks cautiously higher amid tariff uncertainty

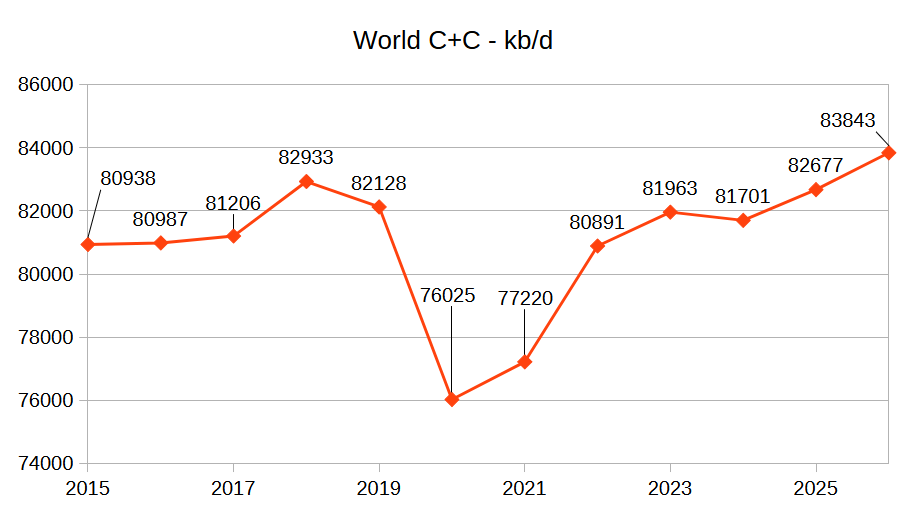

The S&P 500 is now up 4% from its March 13 low, but sits 6% south of its February 19 peak.

U.S. equity futures nudged higher in early Tuesday trading as investors hit pause on a solid three-day rally that lifted the S&P 500 firmly from its early March lows, even as they remain cautious about the impact of pending tariffs heading into next week's deadline.

Updated at 8:59 AM EDT

Tesla rally

Tesla shares are moving higher again Tuesday, following on from their strongest rally since November, as a top Wall Street analyst sees the potential for flat year-on-year delivery figures from the struggling EV maker next week.

"With 8 days of data remaining in the quarter, there's an outside chance Tesla could achieve flat y/y growth (or thereabouts) in 1Q25," said Piper Sandler analyst Alexander Potter. "That would be a solid result, in our view, given the disruptive impact of a factory shutdown earlier this quarter."

Tesla shares were marked 1.87% higher in premarket trading to indicate an opening bell price of $282.35 each.

Related: Tesla stock extends rally with Q1 delivery data on deck

Stock Market Today

The S&P 500 finished 1.8% higher last night, with tech stocks rising more than 2.2%, a rousing Monday rally tied to stronger-than-expected PMI activity data and comments from President Donald Trump that suggested, yet again, flexibility and negotiating room on tariffs ahead of their April 2 unveiling.

Megacap tech stocks were the standout performers on the session, with Nvidia (NVDA) rising 3.15% and Tesla (TSLA) having its best day since early November with an 11.9% rally.

S&P Global's Purchasing Managers Index reading showed a much-firmer-than-expected level of activity in the services sector this month, offsetting a likely tariff-related slump in manufacturing.

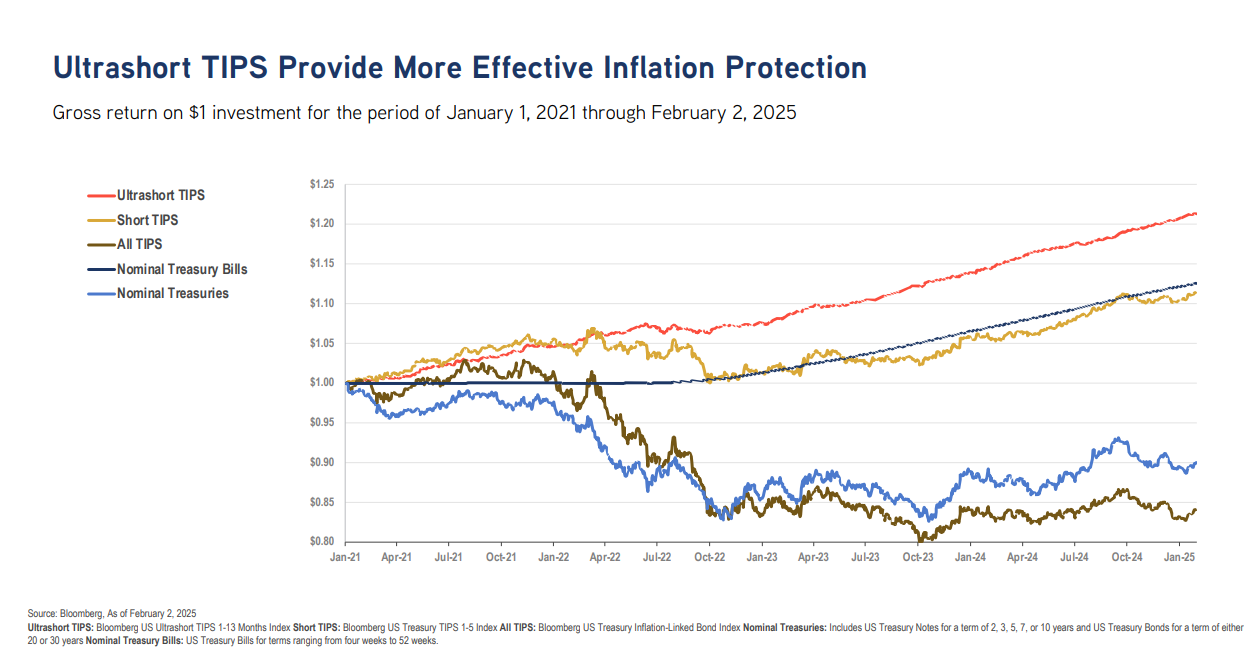

Comments from Atlanta Fed President Raphael Bostic, meanwhile, cast doubt on the market's betting for two more interest rate cuts between now and year-end.

"I moved to one mainly because I think we’re going to see inflation be very bumpy and not move dramatically and in a clear way to the 2% target,” Bostic, a non-voting member of the Fed's rate-setting board, told Bloomberg Television late Monday.

Treasury yields edged higher in the overnight session, with 2-year notes trading at 4.051% ahead of today's $69 billion auction and 10-year notes rising to 4.348% heading into the New York trading day.

The U.S. dollar index, which tracks the greenback against a basket of six global currencies, was marked 0.05% higher at $104.312.

Related: Crushing the dollar won't solve America's debt problem. It'll make it worse

On Wall Street, stocks are looking at a muted open. They could drift over the next two sessions amid a light calendar of economic and earnings releases and a subdued level for the VIX volatility index, which was pegged at a one-month low of $17.54 in after-hours trading.

Futures contracts tied to the S&P 500 suggest a modest 8 point opening bell decline for the benchmark, which is now up 4% from its March 13 low but down 6% from the all-time high it reached on Feb. 19.

The tech-focused Nasdaq is called 42 points lower while the Dow Jones Industrial Average is priced for a 57 point decline.

More Wall Street Analysis:

- Analysts revisit Apple stock price targets as Cook courts Beijing

- Analysts retool Southwest Air stock price targets on cost-cutting

- Analyst reboots Delta, American, Alaska Air price targets on uncertainty

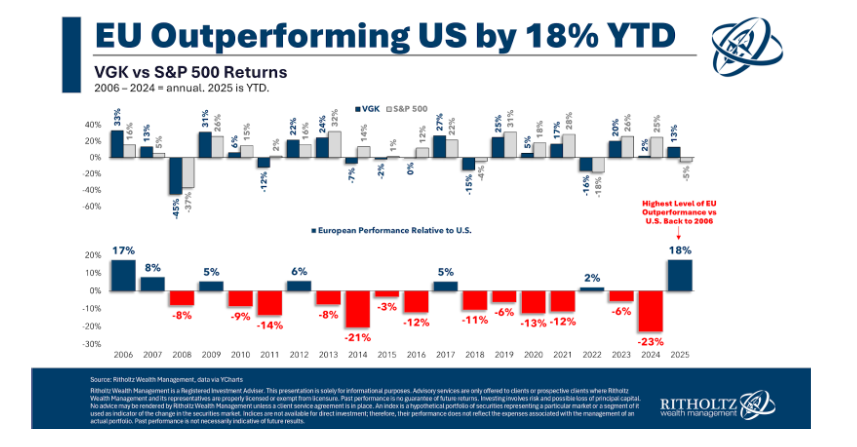

In overseas markets, Europe's Stoxx 600 was marked 0.45% higher following a firmer-than-expected reading of the Ifo Institute's business sentiment survey in Germany, while Britain's FTSE 100 rose 0.4% in London.

Overnight in Asia, tariff concerns and a firmer dollar dragged the regional MSCI ex-Japan index 0.59% lower into the close of trading. The Nikkei 225 ended 0.46% higher in Tokyo as the yen hit a three-week low against the greenback, supporting tech and export stocks.

Related: Veteran fund manager unveils eye-popping S&P 500 forecast