Stock Market Today: Shares turn lower after China news; CPI report in focus

The president says that a trade deal with China is 'done." Stand by.

Updated 3:10 pm EDT

Stocks were struggling in mid-afternoon trading as prices on a big tech and chip stocks were fading.

Meanwhile, the Standard & Poor's 500 Index was down 23 points to 6,015. The Nasdaq Composite down 116 points to 19,598 by 3:10 p.m. ET.

The Dow Jones Industrial Average has lost all of its gains and was down 31 points to 42,835.

Interest rates were lower with the 10-year Treasury yield down to 4.416% from Tuesday's 4.48%. Crude oil was up $3.08 a barrel to $68.06.

It's not clear exactly what's causing the pullback. One reason may well be that the "done deal" that President Trump touted this morning is little more than a headline.

For one thing, as Commerce Secretary Howard Lutnick conceded, the deal is a handshake and little more. The operative phrase they're using to describe the deal is "a framework" to continue talks.

Chris Versace of theStreet Pro noted: China agreed to issue export licenses for refined rare earths only for six months. Why do you care? These are metals used in magnets that are critical for electric vehicles and a host of other products.

Also, President Trump suggested that when a deal is done, imports from China will still face 55% tariff rates. That may limit what is brought into the U.S. Many U.S. customers of Chinese companies will almost balk at purchasing or be forced to raise prices more than any one expects now (at least in public).

Apple (AAPL) will probably continue to move production from China to India and maybe Vietnam.

The president wants all iPhones produced in the United States, which would require massive investments in plants, training and new supply chains.

Trump to Powell: Cut rates

TheStreet's Mary Helen Gillespie, who covers the Fed and related matters, noted today that "Trump took a break from touting the China development on his Truth Social platform to once again exhort the Fed to cut the Federal Funds rate in light of the May CPI rate:

"GREAT NUMBERS! FED SHOULD LOWER ONE FULL POINT...SO IMPORTANT!!!"

The Federal Reserve sets monetary policy to keep the nation's inflation and unemployment rates low at the same time.

This dual mandate is often at odds with itself. While rising interest rates should lower inflation, they can boost job losses. Lower interest rates can trim unemployment — but increase inflation.

Related: CPI inflation report resets interest rate cut bets

The Federal Reserve sets monetary policy to keep the nation's inflation and unemployment rates low at the same time. This dual mandate is often at odds because higher interest rates lower inflation but hike the loss of jobs, while lower interest rates decrease unemployment rates but increase inflation.

CME's closely watched FedWatch tool now projects chances of a rate cut in July at 16.5%, up from 14.4% on June 10.

Updated: 1:50 pm EDT

Tech stocks faltered, then recouped

Stocks generally moved higher in the morning, but struggles emerged in the early afternoon.

The problem: Some of the biggest technology stocks seemed to falter, even as many investors were cheering what was reported to be progress on tariff talks with China.

So, five of the seven Magnificent Seven were lower in the afternoon: Apple (AAPL) , Google-parent Alphabet (GOOGL) , Amazon.com (AMZN) , Facebook-parent Meta Platforms (META) and Nvidia (NVDA) .

The gainers were Microsoft (MSFT) , up 0.8% to $474.55, and Tesla (TSLA) , up 1.3% to $330.

Also higher: Broadcom (AVGO) , not technically a Mag 7stock, but it does have a bigger market cap than Tesla. It was up was 3.2% to $252.47.

The Nasdaq Composite briefly went negative but moved back up to a gain of 22 points to 19,742 by 1:30 p.m. ET.

Meanwhile, the Standard & Poor's 500 Index was up 0.2% to 6,052. The Dow Jones Industrial Average had added 0.6% to 43,106.

Interest rates were lower with the 10-year Treasury yield down to 4.42%. Crude oil was up nearly $2 a barrel to $66.79.

Updated 12:49 p.m. ET

A done deal or a deal in process to be done

The China news was that both the U.S. and China have agreed to talk again. President Trump said the agreement was a done deal. Whether it is done — as in there’s a document ready to be signed or really a hand-shake agreement that both sides agreed to something — was not clear. It’s probably the former. Most reports suggest there’s a lot more to be done.

But there were some positive developments from the deal/handshake: China will start shipping rare-earth metals, critical for magnets used in computers, motor vehicles and other products. The U.S. will let Chinese students study at U.S. universities.

Maybe Nvidia will be permitted to sell its H20 chipsets to Chinese AI companies. That’s not clear.

A Trump-Musk truce is worked out

Tesla was up 1.7% after CEO Elon Musk posted on X that he regretted some of his comments about the president after his messy departure from the White House. The shares have jumped 22% since their low on June 5.

The Wall Street Journal fleshed the point out, noting that Susie Wiles, Trump's chief of staff, and Vice President J.D. Vance on Friday called Musk to tell him to tone down the rhetoric.

Updated 11:20 a.m. ET today

Trump says China agrees to ship rare earths again

The morning's rally gained strength in the morning, thanks to gains in technology shares and President Trump's assertion that a China trade deal is done.

At 11:20 a.m. EDT the Standard & Poor's 500 Index was up 0.23% points to 6,052. The Nasdaq Composite was up 0.3% to 19,773, and the Dow Jones Industrial Average had added 0.38% to 43,031.

In a post, the president said China had agreed to supply rare earths and magnets to U.S. customers, and the U.S. would allow Chinese students into its colleges and universities.

He said the U.S. gets a total of 55% tariffs and China gets 10%. More details need to be worked out, however.

Eight of 11 S&P 500 sectors were higher, led by the Information Technology sector. Palantir (PLTR) and chipmakers Micron Technology (MU) and Broadcom (AVGO) were leading the sector, up 3.5%, 2.2% and 2.4%, respectively.

Meta Platforms (META) was flat after agreeing to take a 49% stake in artificial intelligence startup Scale AI for about $14.8 billion.

Updated 10:10 a.m.

Decent inflation report gives market a push

Stocks moved modestly higher at the open thanks to decent news on inflation and the added plus that the United States and China have agreed to keep talking.

At 10:07 a.m. ET, the Standard & Poor's 500 Index was up 6 points to 6,044. The Nasdaq Composite was up 20 points to 19,735, and the Dow Jones Industrial Average had added 55 points to 42,922.

The S&P 500's gain, if it holds would be its fourth straight. The index is getting closer to its 52-week high of 6,147.43, reached on Feb. 19.

Interest rates were slightly lower. The 10-year Treasury yield was down slightly to 4.455%.

Updated: 9:10 a.m. ET

Shares flip to higher after CPI report meets estimates

Stock futures abruptly turned higher after investors embraced the government's report on consumer price inflation.

At 9 a.m. futures trading in the Standard & Poor's 500 index had moved to a gain of 13 points. Nasdaq-100 futures were up 59 points, and futures on the Dow Jones Industrial Average had climbed 53 points.

Just before the Consume Price Index report came out, the futures market was modestly lower. The report will boost pressure on the Federal Reserve to cut interest rates at its June 17-18 meeting.

Futures trading has proved a fickle indicator for investors since the market bottomed in mid-April.

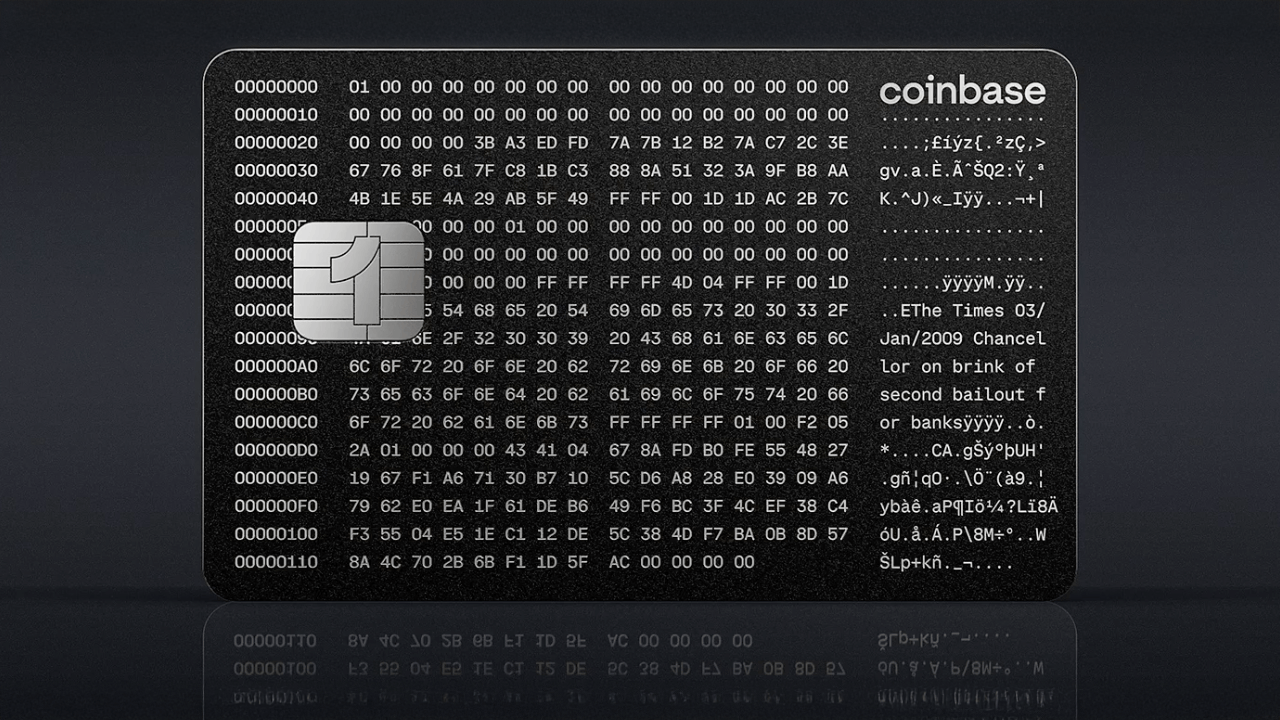

The CPI report suggested prices fell 0.1% in May but were up about 2.4%.

Oil prices were higher because the United States and China have agreed to continue their tariff negotiations.

Stock Market Today

Stocks are looking to open slightly lower on Wednesday as investors parse an inflation report that matched Wall Street expectations.

The Consumer Price Index report, released at 8:30 a.m. EDT, showed annual inflation at 2.4% in May, compared with 2.3% in April. The Wall Street Journal reported that the latest number matched estimates from economists.