General Motors makes $4 billion tariff move

Tariffs are forcing American car companies to make big decisions.

When President Donald Trump introduced his 25% auto tariffs earlier this year, he found an unlikely ally in the auto industry.

United Auto Workers President Shawn Fain, repesenting the largest auto worker union in the country, is a card-carrying liberal.

He campaigned for former U.S. Vice President Kamala Harris in her run against Trump and called Trump a scab, a derogatory term for a worker who crosses a picket line during a strike. He also warned that a Trump presidency would be bad for the country.

Related: Big 3 Auto CEO backs Trump tariffs despite huge costs

But since Trump has taken office, Fain's tune has changed.

It turns out that Trump's tariff policy is actually really good for the U.S. auto workers that Fain represents.

"We’re in a triage situation," Fain told ABC earlier this year. "Tariffs are an attempt to stop the bleeding from the hemorrhaging of jobs in America for the last 33 years."

The U.S. auto industry, including manufacturing and dealerships, employed over 2 million Americans last year. Over 1 million of those jobs were in vehicle and parts manufacturing.

The U.S. auto industry peaked in the 1970s, producing about 10 million vehicles annually.

Despite the population growing by more than 60% since then, car manufacturers produced just 10.6 million vehicles in the U.S. in 2023.

Tariffs incentivize companies to bring production home to avoid import taxes.

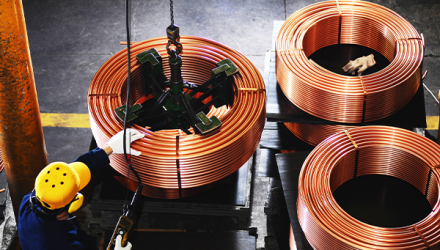

One of Detroit's Big 3 automakers just made a $4 billion commitment to do just that. Image source: Shutterstock

General Motors spends $4 billion to bring manufacturing to the U.S.

General Motors (GM) said earlier this year that auto tariffs will wipe out between $4 billion and $5 billion in EBITDA this year.

But GM CEO Mary Barra still backed the taxes, saying, “For decades now, it has not been a level playing field for us automakers globally, with either tariffs or non-tariff trade barriers. So I think tariffs is one tool that the administration can use to level the playing field.“

However, only 52% of the 2.7 million vehicles GM sold globally last year were “made in the USA.“

Of the Big 3, GM isn't even ahead of Stellantis (57%), a multinational conglomerate based in Europe, in terms of domestic production.

Ford leads the way, with 77% of the cars it sells originating from the States.

Related: Major automaker considers tariff move that customers will hate

But this week, GM announced a move that could change all of that.

GM says it plans to invest $4 billion to move its Mexico production to three plants in the U.S., including the recently closed Orion Assembly plant in its hometown of Detroit.

“We believe the future of transportation will be driven by American innovation and manufacturing expertise,” Barra said in a statement. “Today’s announcement demonstrates our ongoing commitment to build vehicles in the U.S. and to support American jobs. We're focused on giving customers choice and offering a broad range of vehicles they love.”

According to The Detroit News, GM will build full-size SUVs and light-duty pickups at the Orion plant, which closed in 2023.

According to the report, the move is partly due to increased demand for high-margin SUVs and partly due to Trump's tariffs.

Closing plants in Mexico and moving production to the states is a long process, and the shift in production is not expected to take effect until 2027.

Ford also backs Trump tariffs

GM isn't the only company facing a billion-dollar charge from U.S. tariffs.

Ford revealed that the tariffs will shave at least $1.5 billion off the company's EBITDA this year, but CEO Jim Farley also praised Trump's handling of tariffs.

Ford "supports the administration's goal to strengthen the U.S. economy by growing manufacturing."

More automotive news

- Major automaker considers tariff move that customers will hate

- Toyota moves production of popular U.S. sedan to Britain

- Car dealers are worried, and it could be great news for car buyers

One reason Ford supports the tariffs is that it already has a much stronger domestic production base than its domestic competitors.

"Last year, we assembled over 300,000 more vehicles in the U.S. than our closest competitor. That includes 100% of all our full-size trucks," CEO Jim Farley said during the company's last earnings call.

"In this new environment...automakers with the largest U.S. footprint will have a big advantage, and boy, is that true for Ford," he added. "It puts us in the pole position."

Related: Toyota moves production of popular US sedan to Britain