Stock Market Today: S&P 500 hits new highs; China trade deal nears

Stocks push higher based on hopes for trade deals, lower taxes and lower interest rates.

10:10 A.M. ET

Stocks shot higher at the open on Friday as the Standard & Poor's 500 Index broke through to new highs, recovering 100% of its losses after its February 19 peak.

The Nasdaq Composite and Nasdaq-100 indexes hit new 52-week highs, too.

Microsoft (MSFT) and Nvidia (NVDA) reached new 52-week highs, but crypto-exchange giant Coinbase (COIN) slid back after hitting a new high on Thursday.

At 10:20 a.m. ET, the S&P 500 was up 35 points to 6,176. The Nasdaq Composite had added 127 points to 20,295, and the Nasdaq-100 surged 145 points to 22,592.

Not to be outdone, the Dow Jones Industrial Average surged 314 points to 43,701, still below its all-time high of 45,702.. Its 0.8% percentage gain on the day was larger than those of the other indexes.

Catalysts are to be a trade deal with China and India as well, lower corporate taxes on corporations and the possibility the Federal Reserve will cut interest rates later this year.

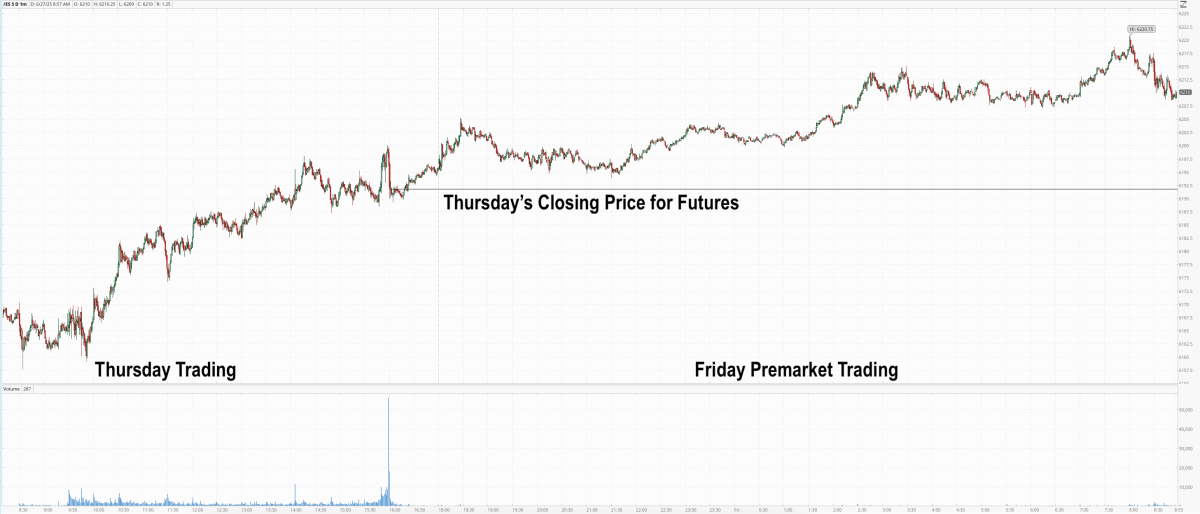

6:10 A.M. ET

Stocks appear set to continue higher today based on three main factors:

- A trade deal with China appears to be close (and maybe with India, too)

- The tax bill would lower taxes on corporations and increase their profits

- Fed rate cuts in 2025

The Fed's preferred gauge of inflation, the PCE, or Personal Consumption Expenditures Price Index, was reported this morning.

According to the Bureau of Economic Analysis, May's PCE rose 0.1%, and 2.3% year-over-year, in line with expectations. However, Personal Income and Personal Spending were weaker than expected, dropping 0.4% and 0.3%.

How did stock futures react? They dropped but remain higher on the day.

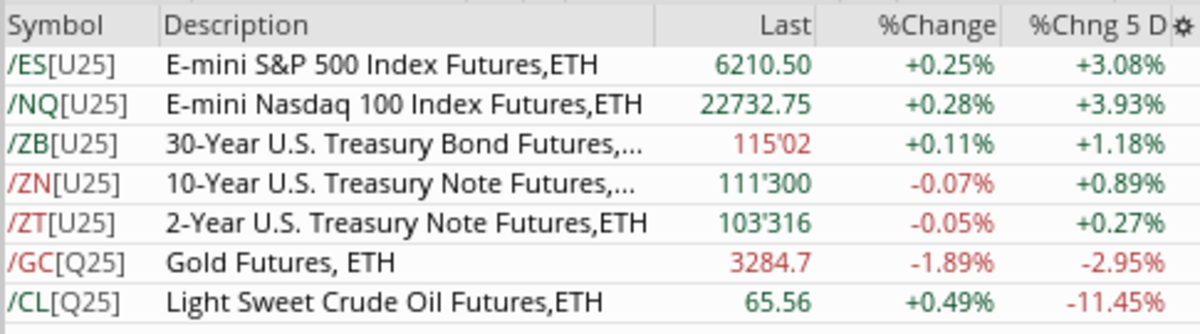

Overall, stock futures are higher, bonds are mixed, and gold is lower.

Crude continues to bounce around the $65 level we've been discussing all week.

Later this morning, the University of Michigan will release its Consumer Sentiment index.