Stock Market Today: Nvidia earnings beat estimates; some Trump tariffs halted

As Doug Kass says, there are so many possible social, policy, political, geopolitical and market outcomes these days.

Happy Thursday!

Wednesday brought us surprises that will have broad effect on today's trading.

We thought the big news would be Nvidia (NVDA) , which reported better-than-expected earnings and revenue. The chipmaker also projected $45 billion in sales for Q2, which is better than analysts feared, given $8 billion in lost sales to the Chinese.

Investors cheered the news and jumped in, pushing NVDA shares up almost 6%. In premarket trading, NVDA is up just over 5%.

Then again, it could be argued that NVDA was the most anticipated news of the day, but not the biggest.

What's been the biggest business news of 2025? President Trump's tariffs. And the U.S. Court of International Trade has just ruled that Trump had exceeded his authority in imposing tariffs using executive orders under the International Emergency Economic Powers Act of 1977.

The panel of three judges, two appointed by Republican presidents and one by a Democrat, ruled that it "does not read IEEPA to confer such unbounded authority..." and that an "unlimited delegation of tariff authority would constitute an improper abdication of legislative power to another branch of government."

A Trump spokesman said in a widely reported statement, "It is not for unelected judges to decide how to properly address a national emergency."

Where do the tariffs stand now? For one thing, this doesn't block sector-level tariffs on steel and autos. Goldman Sachs analysts say that Trump still has other tools at his disposal to levy tariffs.

Between NVDA's strong earnings report and the tariff news, S&P 500 futures were up as much as 1.8% but have been falling since 6am EDT.

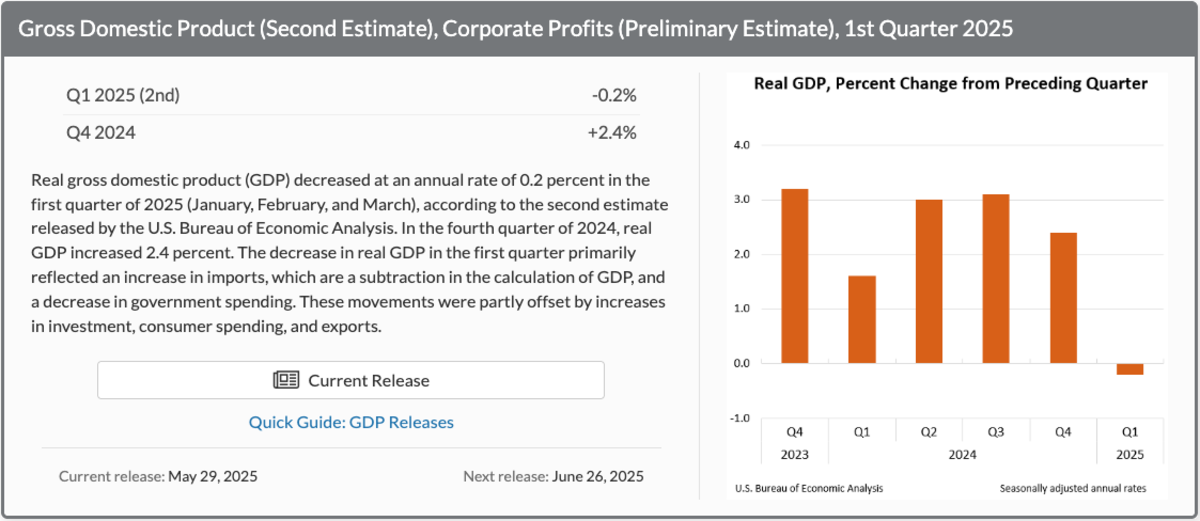

In economic news today, the Bureau of Economic Analysis reports that GDP for the first quarter decreased at an annual rate of 0.2%. This compares with an annualized gain of 2.4% in fourth-quarter 2024.

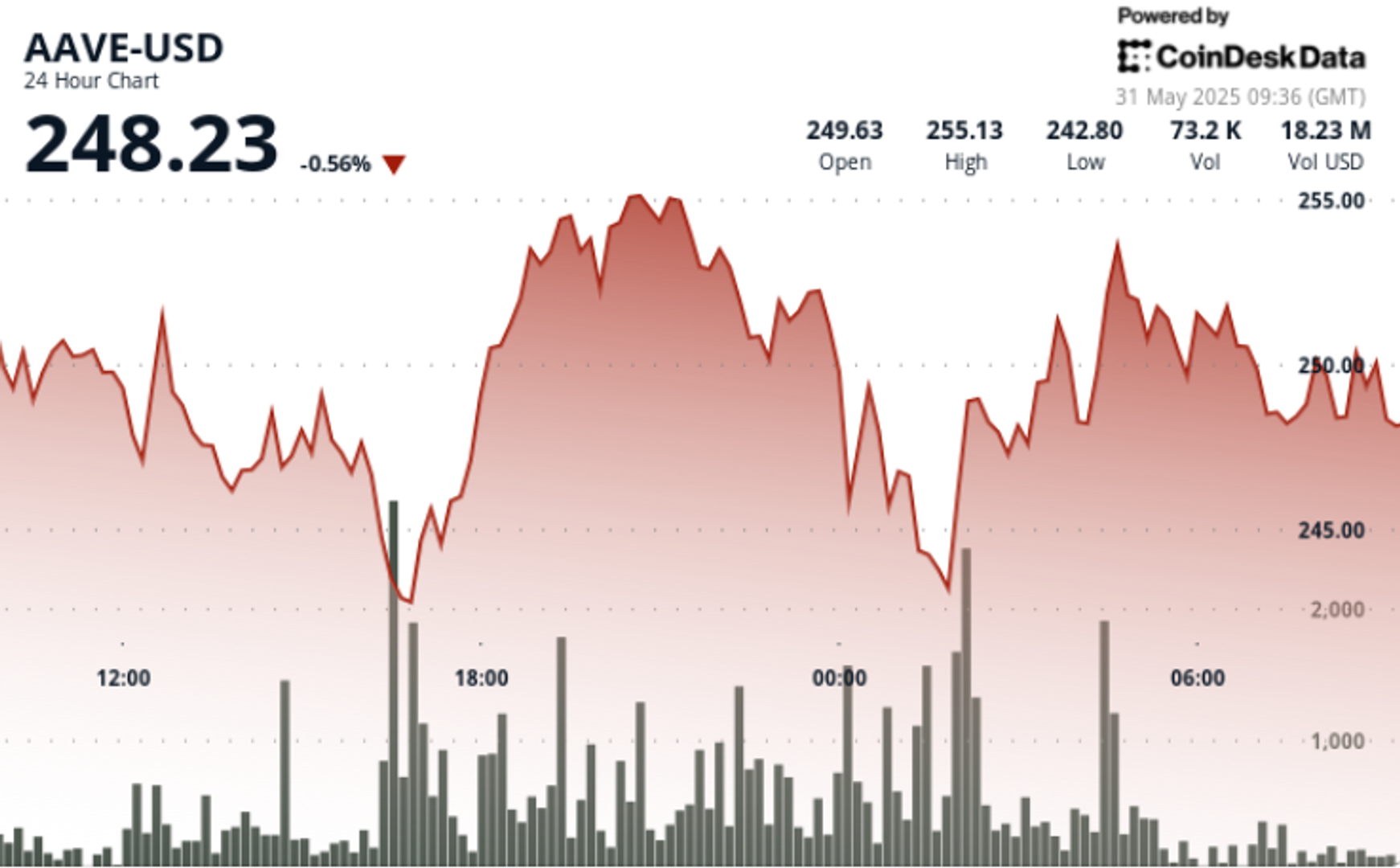

Otherwise, U.S. Treasuries and gold are trading higher. Crude oil is down.