Stock Market Today: Nvidia beats; some tariffs halted; Salesforce off on big volume

As Doug Kass says, there are so many possible social, policy, political, geopolitical and market outcomes these days.

Updated at 10:44 am EDT

S&P lower; Salesforce guidance weighs on shares

Traders took the opportunity of a strong market open to continue the selling from yesterday's close.

The S&P 500 was as high as 5943, or 0.9% above yesterday's close, and has drifted lower by more than 40 points.

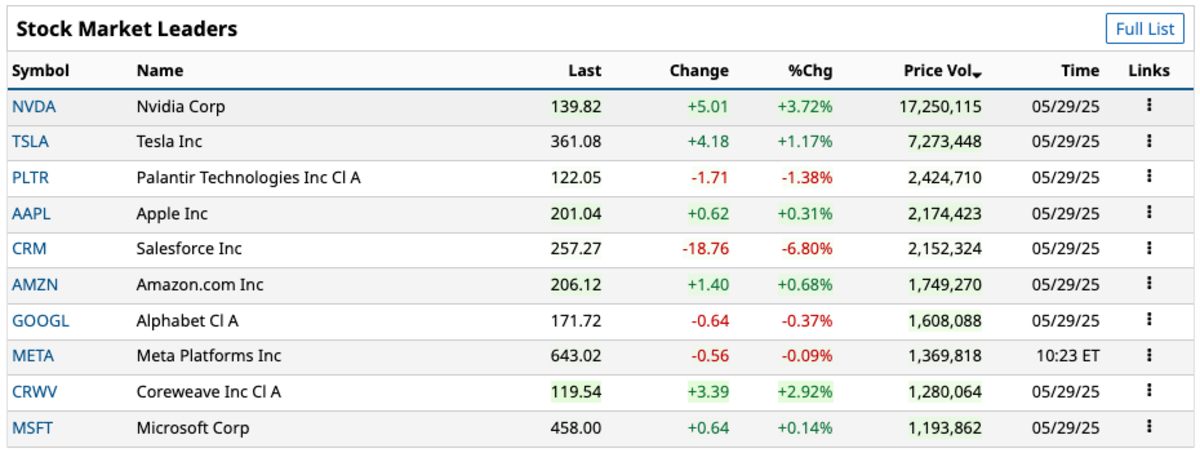

Stock market leaders are mostly higher today, though Salesforce is lower following the software stalwart's poor forward guidance.

Market breadth shows a majority of stocks lower on the day, although among the S&P 500 constituents, breadth appears to be mixed.

Which stocks are trading on interesting (higher than normal) volume today?

Nvidia, of course, is trading three times normal volume. Salesforce (CRM) is hitting eight times normal volume. But so is Uber (UBER) , with the ride-share company's shares falling nearly 5%.

One tweet I wanted to share today was from our friends at Sentimentrader. While this hardly calls into question the current rally and uptrend off the April lows, their study suggests that the rest of 2025 could be rockier than some hope.

Stocks took a beating, then roared back. Both were of a magnitude and speed rarely seen over nearly 100 years.

During the S&P 500's history, there have been 15 periods closely correlated to this pattern.

It's somewhat troubling that the two closest matches in speed and… pic.twitter.com/QM7Usq1R58— SentimenTrader (@sentimentrader) May 28, 2025

And at TheStreet Pro, Doug Kass, a prominent longtime hedge-fund manager, has often said that investors haven't faced the huge number of potential outcomes -- social, political, economic, many more -- as they have in the past year.

The latest uncertainty, he says in The Daily Diary, is the implications arising from the tariff ruling. "Will interest rates rise more swiftly, will the Fed pause in 2025, will proposed tax cuts be reduced and/or what will the administration's reaction be (as Trump goes through other channels to produce his intended policy (e.g. Section 122)?" he asks.

Stock Market Today

Happy Thursday!

Wednesday brought us surprises that will have broad effect on today's trading.

We thought the big news would be Nvidia (NVDA) , which reported better-than-expected earnings and revenue. The chipmaker also projected $45 billion in sales for Q2, which is better than analysts feared, given $8 billion in lost sales to the Chinese.

Investors cheered the news and jumped in, pushing NVDA shares up almost 6%. In premarket trading, NVDA is up just over 5%.

Then again, it could be argued that NVDA was the most anticipated news of the day, but not the biggest.

What's been the biggest business news of 2025? President Trump's tariffs. And the U.S. Court of International Trade has just ruled that Trump had exceeded his authority in imposing tariffs using executive orders under the International Emergency Economic Powers Act of 1977.

The panel of three judges, two appointed by Republican presidents and one by a Democrat, ruled that it "does not read IEEPA to confer such unbounded authority..." and that an "unlimited delegation of tariff authority would constitute an improper abdication of legislative power to another branch of government."

A Trump spokesman said in a widely reported statement, "It is not for unelected judges to decide how to properly address a national emergency."

Where do the tariffs stand now? For one thing, this doesn't block sector-level tariffs on steel and autos. Goldman Sachs analysts say that Trump still has other tools at his disposal to levy tariffs.

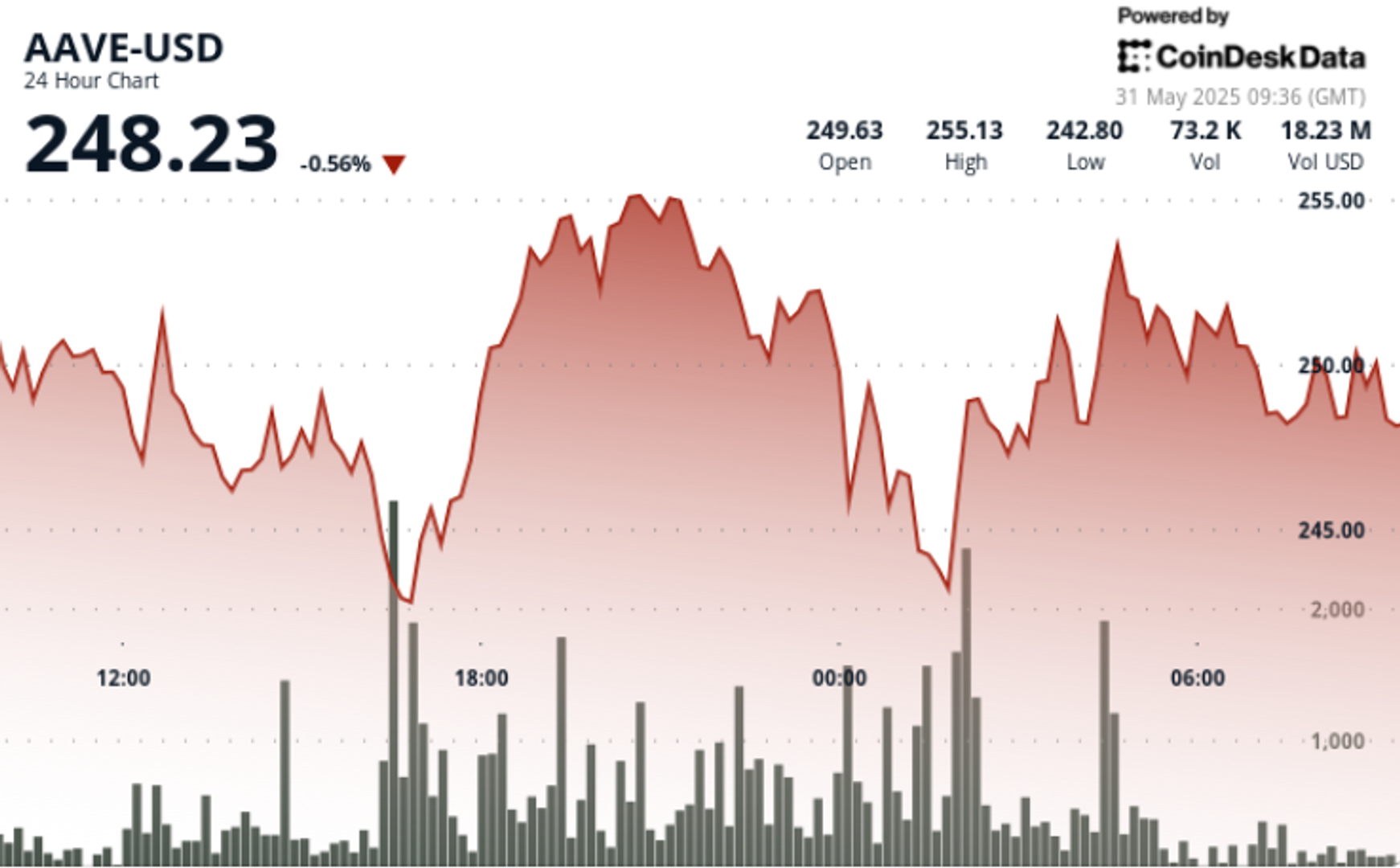

Between NVDA's strong earnings report and the tariff news, S&P 500 futures were up as much as 1.8% but have been falling since 6am EDT.

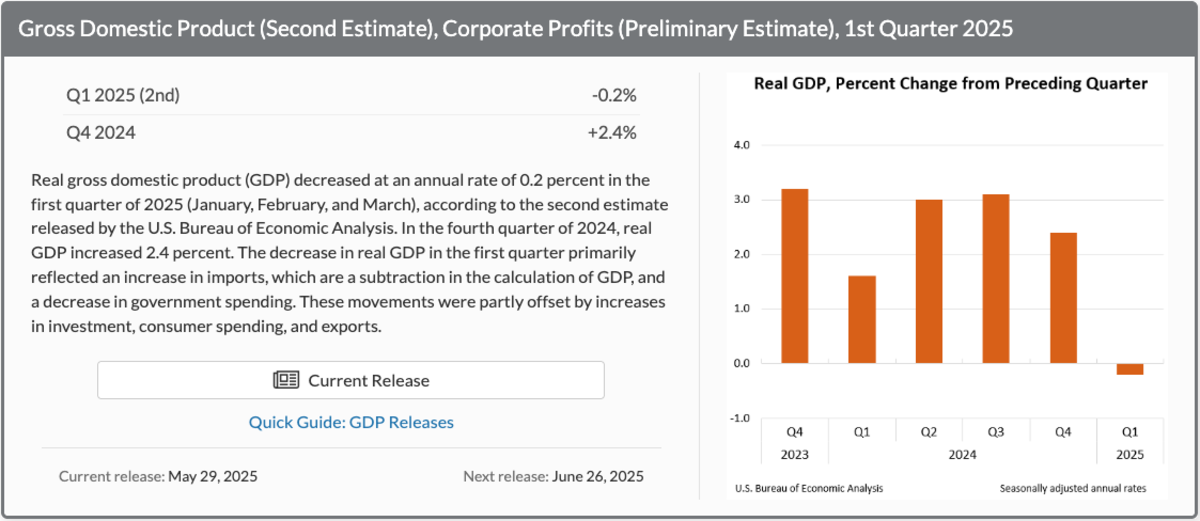

In economic news today, the Bureau of Economic Analysis reports that GDP for the first quarter decreased at an annual rate of 0.2%. This compares with an annualized gain of 2.4% in fourth-quarter 2024.

Otherwise, U.S. Treasuries and gold are trading higher. Crude oil is down.