Stock Market Today: Market higher after jobs numbers; Tesla recoups a bit

A feud between President Trump and Elon Musk remains sharply in focus. Today's employment numbers were better than expected.

Updated 1036 am EDT

Stocks sharply higher; Tesla shares recoup a bit

In the first hour of trading stocks are sharply higher. At last check the Dow 30 were up 1.1%, the S&P 500 added 1.02%, the Nasdaq Composite tacked on 1.19% and the Russell 2000 moved up 1.23%.

The stronger-than-expected jobs numbers are prompting the market move. The S&P has ticked up past 6000 for the first time since late February.

Tesla shares rebounded a bit, 4.2% at last check, from the drubbing they took yesterday as the schism between CEO Elon Musk and President Donald Trump burst wider.

Stock Market Today

Yesterday, the big news was that Best Buddies Elon Musk and President Trump had broken up. That sent markets into a topsy-turvy tailspin, knocking 14% off of Tesla's (TSLA) share price. People seem surprised?

But today is a new day and Trump and Musk are, or are not, scheduled to have a phone call following a cooling-off period overnight. Time will tell.

The big news today is jobs! And the news is good for workers.

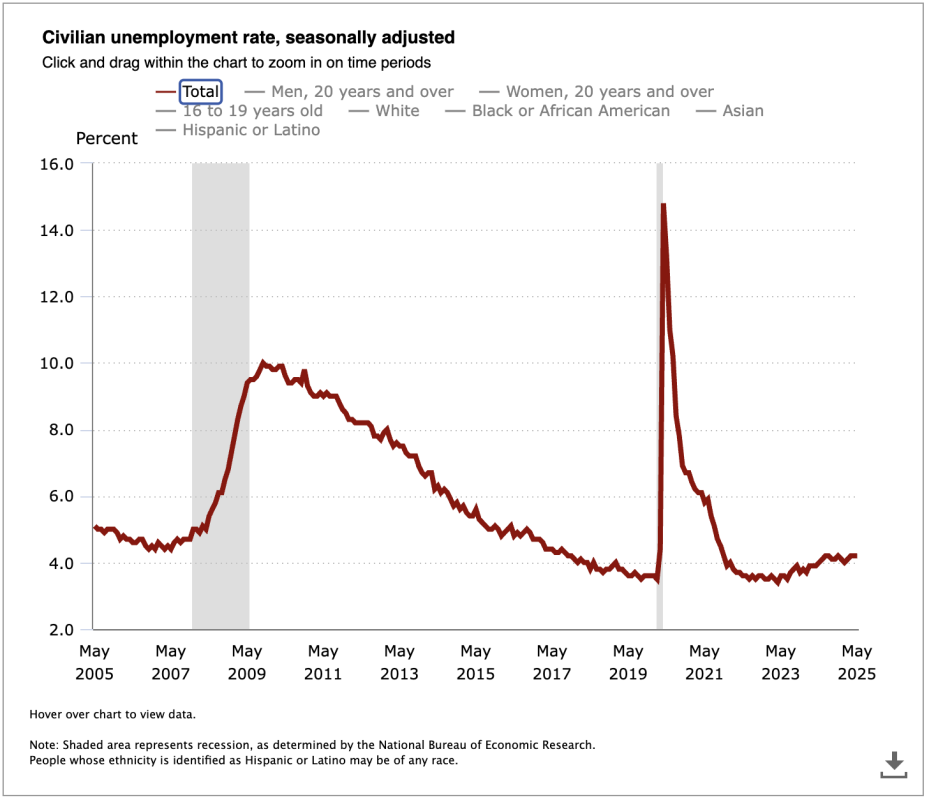

The U.S. Bureau of Labor Statistics reported this morning that payroll employment increased by 139,000 in May, leaving the unemployment rate unchanged at 4.2%.

This was better than expected, though it does show some softening over prior months' growth.

Investors are cheering the news, with stock market futures rallying before the market open. S&P 500 futures are now up nearly 0.8% from yesterday's close and 0.4% since the release of this data.

Gold and crude oil are both higher this morning, although each had a different reaction to the U.S. economic news. Crude oil rallied on economic strength, while gold initially spiked lower, then recouped.

Do you know what's not doing as well? The bond market.

U.S. treasuries are lower across the curve, sending yields, which move in the opposite direction of prices, higher.

Why are investors selling bonds if the news was so good?

The president and others have been calling for the Federal Reserve to lower interest rates. A strong economy suggests that those cuts may not be needed. Chairman Jerome Powell may choose to stay the course and any rate cuts could be pushed out toward year-end.

Which stocks should you be watching today?

Over on TheStreet Pro, Sarge Guilfoyle reports that Lululemon (LULU) and DocuSign (DOCU) are getting pounded after their earnings reports highlighted poor guidance.

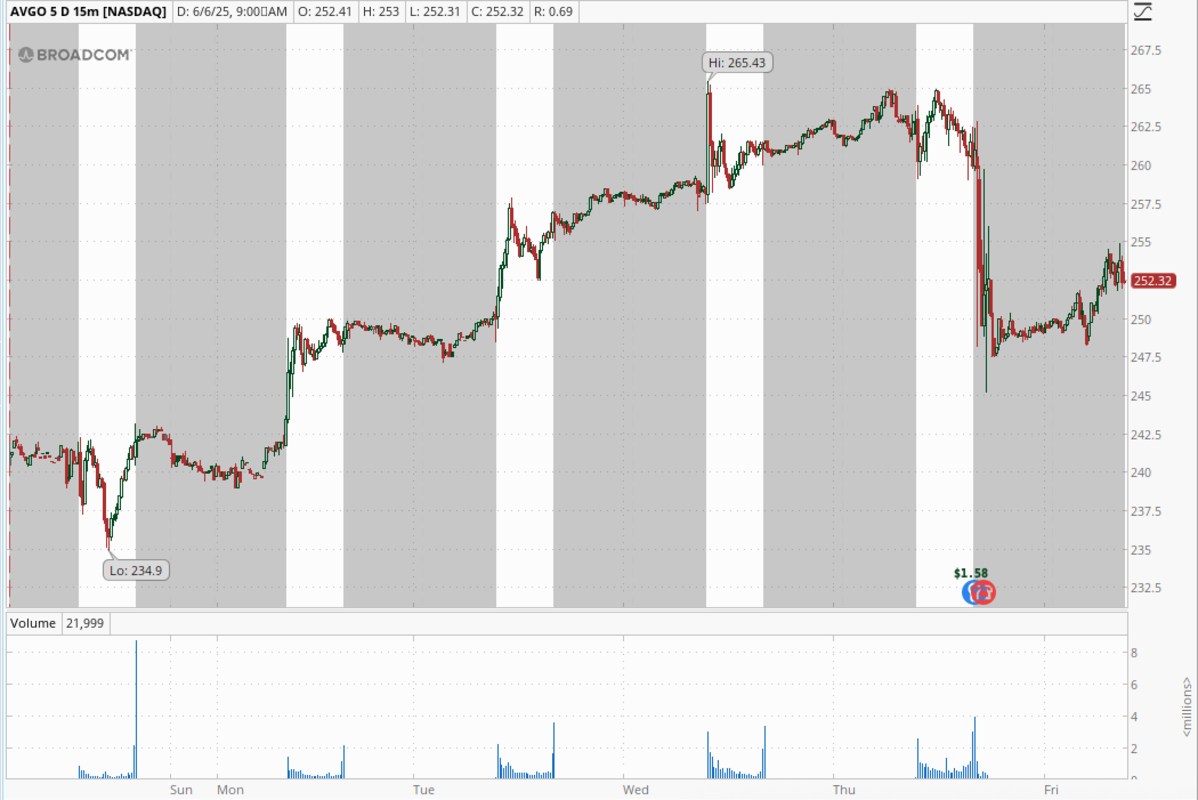

Broadcom (AVGO) provided stronger-than-expected guidance but is now trading around 3% lower.

Here's a chart of Broadcom for the past five trading days, including after-hours action, shown in grey.