Stock Market Today: Elon Musk Speaks Out and the Globe Celebrates TACO Tuesday

A choppy overnight session could lead to more of the same. Let's take a look at Wells Fargo and Build-A-Bear Workshop.

It's been a choppy overnight session in the S&P futures.

Futures rallied 20 points in the early hours only to see them crashing back to even as we get closer to the market open.

The big news is that President Trump took to social media to state that Xi, the Chinese leader, is "extremely hard to make a deal with!!!" The assumption that a call between the two was imminent buoyed futures.

Unfortunately, ADP's report on private sector payrolls showed a weaker than expected payroll increase. Just 37,000 new jobs suggest that the private sector is slowing in the face of so much uncertainty.

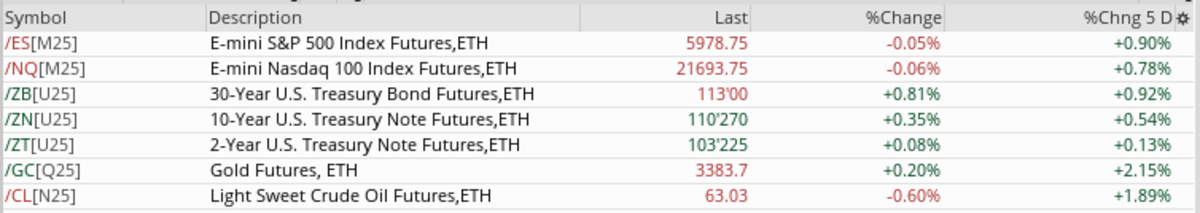

Heading into the market open, here's a look at the futures:

Stocks look set to open down slightly, while bond prices rally, pushing yields lower. Gold is up and crude oil down.

Last night, I mentioned Wells Fargo (WFC) . Its shares remain 2.5% higher following the company's release from the asset growth cap imposed by the Federal Reserve in 2018 as punishment for fraudulent activities committed before the financial crisis.

And Tesla's (TSLA) Elon Musk isn't happy with Trump. The bromance appears to be over. Now that Elon is out of the government, he is speaking out about what Trump calls the Big Beautiful Bill.

I’m sorry, but I just can’t stand it anymore.

This massive, outrageous, pork-filled Congressional spending bill is a disgusting abomination.

Shame on those who voted for it: you know you did wrong. You know it.— Elon Musk (@elonmusk) June 3, 2025

Does this mean that Elon will get back to work at Tesla? In April, I said that Tesla has been a dead investment for the past five years and that the best thing Musk could do was to step down. But I didn't realize that Build-A-Bear Workshop (BBW) had outperformed it! That's so comforting.

Build-A-Bear stock $BBW has now outperformed Nvidia $NVDA, Tesla $TSLA, and Meta $META over the past 5 years pic.twitter.com/UbwQm8EP0h— Caleb Naysmith (@ccnaysmith) June 3, 2025

What else? The Street Pro's Helene Meisler reviews global ETFs in her World Market Update published this morning. She's been bullish on Europe since November.

And while the U.S. market remains a little below all time highs, you know what isn't? The world. The iShares MSCI ACWI ETF (ACWI) hit a new high. I guess investors love TACO Tuesday, too.

TACO Tuesday! Stocks hit all-time highs. pic.twitter.com/iNrrCDR7dn— Mike Zaccardi, CFA, CMT