Stock Market Today: Choppy Market Continues as Musk Speaks Out and Economic Data Worsen

Indexes are up and down and bonds are lower. ISM data suggest a contracting economy. CrowdStrike off after Q1 report.

Final Update

To say that this was an interesting day of trading today would be a gross overstatement. Has summer begun already?

Let's start with the numbers:

Stocks were mixed. The S&P 500 Index of large-cap stocks ended the day nearly unchanged. Small caps had a better time of it, gaining 0.32%. Up or down, the trading occurred on some of the lightest activity in nearly a month.

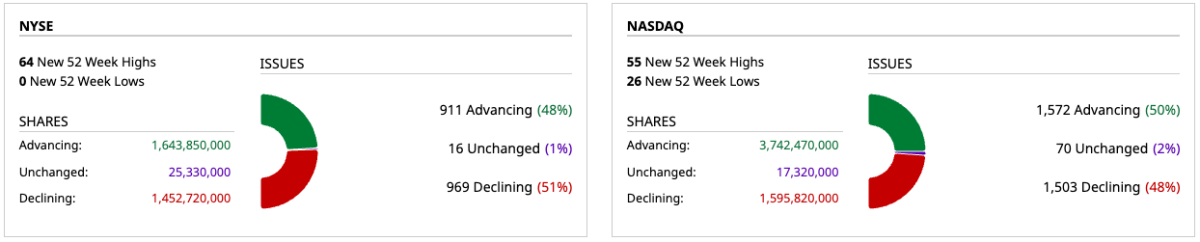

Market breadth was pretty much even, too. Across the NYSE and Nasdaq exchanges, about half of the stocks were up and half were down, although there was higher volume on those stocks that did go up today. In other words, buyer were just a teensy bit more aggressive than sellers.

Here's another view. This is my favorite heatmap, showing performance of S&P 500 constituents.

Among the mega-caps, Meta was the big leader, gaining over 3%. Tesla was the big loser, as mentioned below.

If you look closely at the heat map, you'll notice that Energy and Utilities stocks were the weakest today. Those are in the lower right corner, surrounding Basic Materials. In the middle of the heat map are Communication Services, which, thanks to Meta, Alphabet (GOOGL) , and Netflix (NFLX) , led the market.

I'd like to talk about today's price action, however.

Here's a chart of the S&P 500.

You can clearly see the reaction following the Liberation Day tariff announcement.

What's a little harder to see is the choppiness in the market from November through February. Basically, the market couldn't make up its mind about where it wanted to go. Well, it eventually decided to go lower.

That was a trading range between 5800 and 6100.

The S&P 500 is currently just under 6000, which is an interesting level, only because of how much trading occurred at that price back in the fall and early winter.

And the market seems to have picked this place to chill out for the last couple of weeks.

What's next? I don't know. But the blue box shows how much indecision there is right now. We're about even on up days versus down days. Earnings season is mostly over and investors can get back to focusing on the economy, which, based on today's PMI and jobs numbers, might be softening just a little bit.

Tomorrow, we have a surprise. We'll be sharing one of my favorite daily columns from TheStreet Pro. Please enjoy!

Updated at 1:51 p.m. EDT

Following a higher opening, stocks are back to even on the day. Choppy is the best way to define the trading action as the indexes gyrate up and down.

At last check, the Dow 30 ticked 0.11% into the green at 42566, the S&P 500 was up 0.19% to 5981 while the Russell 2000 index of small-cap companies was flat at 2102. Breadth is even, with just more than half of stocks higher and slightly less than half lower on the day.

Bond yields are lower following weaker-than-expected hiring and services industry data. The 30-year Treasury bond is now priced to yield 4.87%, while the 10-year is at 4.35%.

The Institute for Supply Management reported today that its May 2025 Services PMI stood at 49.9%, which indicates a contracting industry. In other words, executives in services businesses believe that their industries are contracting slightly.

The economist David Rosenberg reports that the combined ISMs are now lower and show an economy in decline:

The combined ISMs have swung from 52.9 a year ago to 51.2 in April to 49.7 in May. With all due deference to the Atlanta Fed, the historical record shows that a combined index at the May level coincided with negative QoQ real GDP growth readings 80% of the time (with the average… pic.twitter.com/McO8Vf7no0— David Rosenberg (@EconguyRosie) June 4, 2025

When I worked at Markit, now part of S&P Global, I did some analysis on its version of the PMI and found that it didn't have a significant impact on stocks, except at the extremes.

When PMI is below 47 or above 55, stock investors need to pay attention. Until then, it's just another data point to include in the weight of the evidence.

Also, President Trump spoke with Russian President Putin today. Russia says it will retaliate against Ukraine's recent attack. Sounds as if we're nowhere near any kind of a peace agreement.

BREAKING: President Trump said he spoke with Putin for 75 minutes and Putin said "very strongly" that he "will respond" to Ukraine's attack on Sunday.

Trump says it was "not a conversation that will lead to immediate peace." pic.twitter.com/9h3pGmfS1p— The Kobeissi Letter (@KobeissiLetter) June 4, 2025

In stock news:

Tesla is down 3.5% on weak sales data and a growing spat between Elon Musk and Trump as well as concerns about the robotaxi launch in Austin following release of a Full-Self-Driving crash video and federal investigation.

CrowdStrike (CRWD) , the Austin cybersecurity provider, swung to a fiscal-Q1 loss of 44 cents a share against net income of 17 cents a share a year earlier. Revenue climbed 20% to $1.1 billion.

The company noted its partnership with GuidePoint Security and said demand for the Falcon platform was surging. Reports said the company's outlook disappointed investors; the company pegged Q2 revenue at $1.14 billion to $1.15 billion, against Wall Street's call for $1.23 billion. At last check the stock was off 6%.

Stock Market Today

It's been a choppy overnight session in the S&P futures.

Futures rallied 20 points in the early hours only to see them crashing back to even as we get closer to the market open.

The big news is that President Trump took to social media to state that Xi, the Chinese leader, is "extremely hard to make a deal with!!!" The assumption that a call between the two was imminent buoyed futures.

Unfortunately, ADP's report on private sector payrolls showed a weaker than expected payroll increase. Just 37,000 new jobs suggest that the private sector is slowing in the face of so much uncertainty.

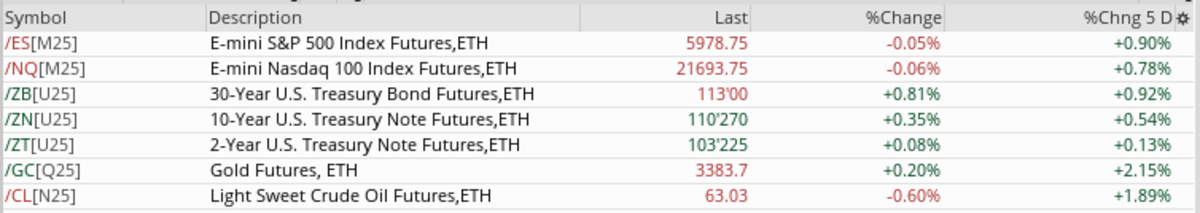

Heading into the market open, here's a look at the futures:

Stocks look set to open down slightly, while bond prices rally, pushing yields lower. Gold is up and crude oil down.

Last night, I mentioned Wells Fargo (WFC) . Its shares remain 2.5% higher following the company's release from the asset growth cap imposed by the Federal Reserve in 2018 as punishment for fraudulent activities committed before the financial crisis.

And Tesla's (TSLA) Elon Musk isn't happy with Trump. The bromance appears to be over. Now that Elon is out of the government, he is speaking out about what Trump calls the Big Beautiful Bill.

I’m sorry, but I just can’t stand it anymore.

This massive, outrageous, pork-filled Congressional spending bill is a disgusting abomination.

Shame on those who voted for it: you know you did wrong. You know it.— Elon Musk (@elonmusk) June 3, 2025

Does this mean that Elon will get back to work at Tesla? In April, I said that Tesla has been a dead investment for the past five years and that the best thing Musk could do was to step down. But I didn't realize that Build-A-Bear Workshop (BBW) had outperformed it! That's so comforting.

Build-A-Bear stock $BBW has now outperformed Nvidia $NVDA, Tesla $TSLA, and Meta $META over the past 5 years pic.twitter.com/UbwQm8EP0h— Caleb Naysmith (@ccnaysmith) June 3, 2025

What else? The Street Pro's Helene Meisler reviews global ETFs in her World Market Update published this morning. She's been bullish on Europe since November.

And while the U.S. market remains a little below all time highs, you know what isn't? The world. The iShares MSCI ACWI ETF (ACWI) hit a new high. I guess investors love TACO Tuesday, too.

TACO Tuesday! Stocks hit all-time highs. pic.twitter.com/iNrrCDR7dn— Mike Zaccardi, CFA, CMT