Stock Market Today: Attacks in Middle East Batter Stocks; Oil and Gold soar; Bitcoin Off

Here's how markets are reacting to Israel's attack on Iran.

Updated: 10:50 a.m. ET

Investors in search of safe havens as tensions rise

Stocks were sinking broadly Friday as investors sought safety in the aftermath of Israel's attack on Iran late Thursday.

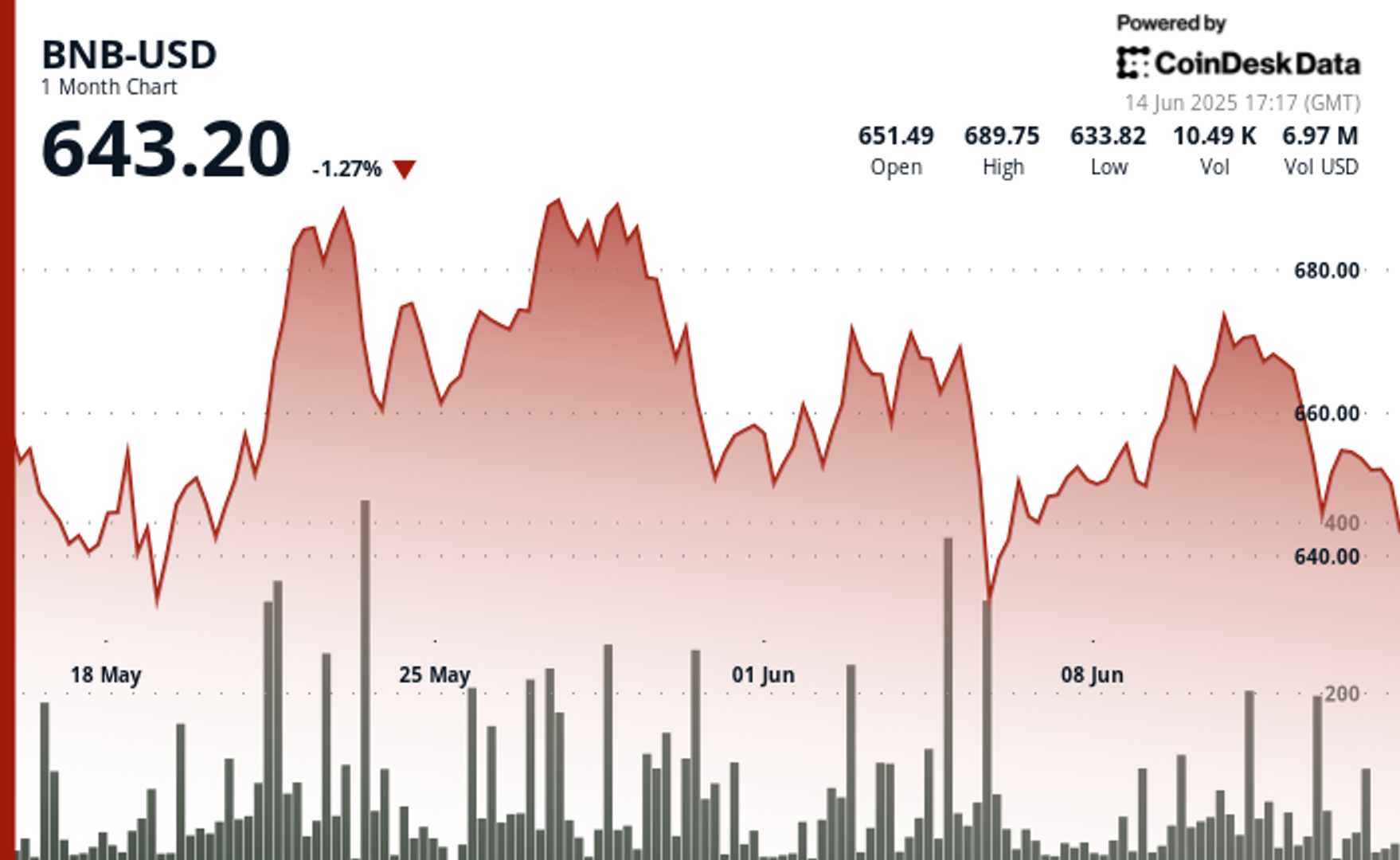

Gold, crude oil and interest rates were higher. Bitcoin tumbled more than 2%.

The Dow Jones Industrial Average had fallen as many as 700 points but was down 683 points, or 1.6%, to 42,285 by 10:48 a.m. ET. The Standard & Poor's 500 Index was off 60 points, or 1% to 5,984.

The Nasdaq Composite Index had fallen 229 points, or 1.2%, to 19433.12. The tech-concentrated Nasdaq-100 Index was off 189 points, or 1.1% to 21,681.

Ten of 11 S&P 500 sectors are lower. Energy is the one winner.

Gold was up $53.40 to $3,456 per troy ounce. Crude added $5.16 to $73.21 per barrel. The 10-year Treasury yield, a key determinant of mortgage rates, rose to 4.42%.

Bitcoin was not behaving like a safe haven. The cryptocurrency was down $2,612 to $104,216 after reaching as high as $110,545 in Tuesday trading. It's now off 0.4% in June. It is still up 11.8% for the year and 27% for the second quarter.

Updated: 10:00 a.m. ET

Stock Market Today

Investors had two reactions to Israel's broad attack on Iran late Thursday: They sold stocks broadly and bought crude oil and gold.

The Dow Jones Industrial Average opened down 600 points to 42382 by 10 a.m. ET. The Standard & Poor's 500 Index was off 57 points to 5,988

The Nasdaq Composite Index had fallen 178 points to 19484. The tech-concentrated Nasdaq-100 Index was off 189 points to 21,722.

Futures trading had suggested stocks would fall broadly.