SSP maintains upbeat forecast for full year after Q1 sales climb +14%

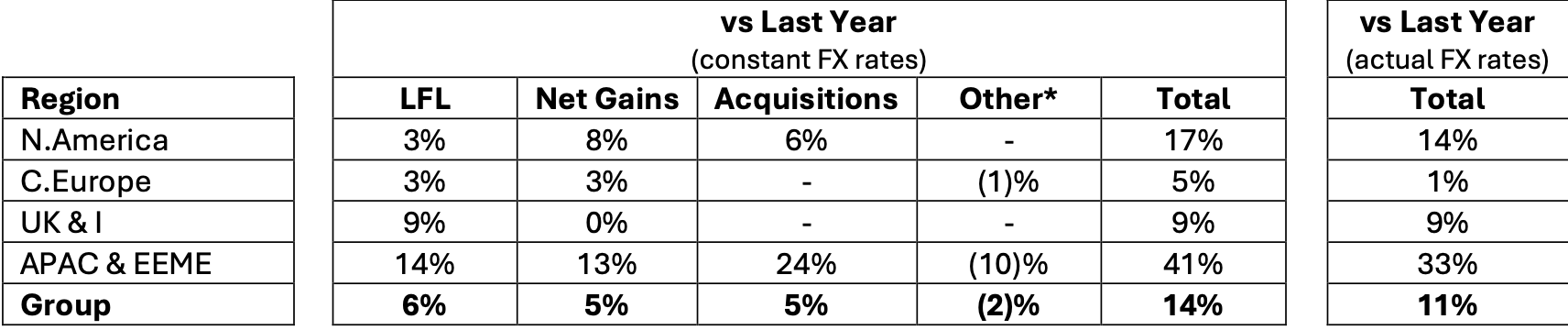

The quarterly sales increase included like-for-like sales growth of +6%, net contract gains of +5% and a contribution from acquisitions of +5%.

UK/INTERNATIONAL. Leading travel food services company SSP Group has reported “positive trading momentum” through the first three months of its latest financial year.

In a Trading Update for the quarter to 31 December 2024, group sales climbed +14% on the same period last year, on a constant currency basis, including like-for-like sales growth of +6%, net contract gains of +5% and a contribution from acquisitions of +5%.

On a constant currency basis, in North America sales grew by +17% year-on- year. The acquisitions of the Midfield Concessions business in Denver and ECG in Canada reached their first anniversary in the quarter and were treated as like-for-like from November and December respectively.

In Continental Europe, sales growth of +5% reflected a solid performance notwithstanding an impact of -1% from the previously announced exit of 13 unprofitable MSA (motorway) sites in Germany, with further exits expected through the year as part of the regional recovery plan.

In the UK, sales rose by +9%, driven by a strong like-for-like sales performance, reflecting good passenger numbers in the air sector and a lower incidence of industrial action in the rail sector compared with last year.

In APAC and EEME, sales increased by +41%, with strong like-for-like growth across the region, driven by increasing passenger numbers, and a benefit from acquisitions – most notably ARE in Australia, which was acquired in May last year. These factors more than offset a sales impact of -10% in the region reflecting the deconsolidation of the AAHL joint venture in India, now accounted for as an associate, as previously announced.

Positive outlook

SSP said its planning assumptions for the full year, on a constant currency basis, remain unchanged. These include revenue within the range of £3.7-3.8 billion, with a corresponding underlying pre-IFRS 16 operating profit within the range of £230-260 million, and EPS within the range of 11.5- 13.5p.

If current currency spot rates were to continue through 2025, the impact on planning assumptions would be -0.2% on revenue and -0.7% on operating profit. SSP anticipates a split of operating profit between the first and second halves of FY25 which is consistent with that reported in FY24.

SSP Group CEO Patrick Coveney said: “We have made a good start to the new financial year. Our tightened agenda with a focus on driving returns from recent investments and enhancing efficiency to drive profitability is progressing well. Performance in the structurally growing and higher returning regions of North America and APAC & EEME, where we continue to invest, was particularly pleasing in the quarter. We are confident in our prospects for the balance of FY25 and beyond.”

In other news, SSP said that plans to list its joint venture in India with Travel Food Services on the Indian Stock Exchanges is proceeding as planned. Completion remains targeted for the Spring, depending on market and other conditions, the company noted in its trading statement.

Note: The Moodie Davitt Report publishes the FAB Newsletter, which features highlights of openings, events and campaigns from around the world of airport and travel dining.

Please email Kristyn@MoodieDavittReport.com for your complimentary subscription.

![[DEALS] iScanner App: Lifetime Subscription (79% off) & Other Deals Up To 98% Off – Offers End Soon!](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

.png)

![‘Companion’ Ending Breakdown: Director Drew Hancock Tells All About the Film’s Showdown and Potential Sequel: ‘That’s the Future I Want for [Spoiler]’](https://variety.com/wp-content/uploads/2025/02/MCDCOMP_WB028.jpg?#)