S&P 500 (NYSEARCA: SPY) Live: Markets Surrender Ground on US Debt Downgrade

Live Updates Live Coverage Updates appear automatically as they are published. Retail Earnings on Deck 10:28 am by Gerelyn Terzo With the earnings season still in full swing, corporate America takes center stage this week. Investors await reports from major retailers including Home Depot (NYSE: HD), Target (NYSE: TGT), and TJX Companies (NYSE: TJX), the […] The post S&P 500 (NYSEARCA: SPY) Live: Markets Surrender Ground on US Debt Downgrade appeared first on 24/7 Wall St..

Live Updates

Retail Earnings on Deck

With the earnings season still in full swing, corporate America takes center stage this week. Investors await reports from major retailers including Home Depot (NYSE: HD), Target (NYSE: TGT), and TJX Companies (NYSE: TJX), the latter boasting an 11% year-to-date increase in its stock price. A key focus will be comparable store sales, offering a pulse on consumer spending as elevated interest rates persist despite indications of easing inflation.

This article will be updated throughout the day, so check back often for more daily updates.

The stock market continues its seesaw pattern, experiencing another downturn. Today’s negative catalyst was a credit rating on U.S. debt by rating agency Moody’s, lowering it one step to Aa1. This move followed a positive week fueled by optimism around U.S.-China trade developments in which the S&P 500 was positive for five straight trading sessions, resulting in a 5% gain.

Moody’s said the downgrade was due to a combination of the budget deficit and high interest rates. President Trump clapped back, saying the rest of the world remains confident in the U.S. economy. The credit downgrade triggered a rise in Treasury yields, with the 30-year Treasury breaching the 5% mark, and subsequently pressured stocks downward. The SPY ETF is down fractionally. Each of the three major stock market averages are narrowing their losses this morning.

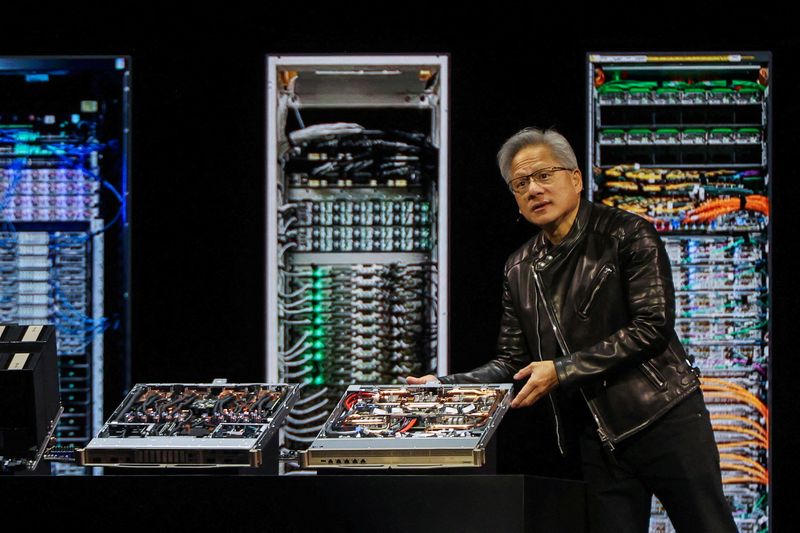

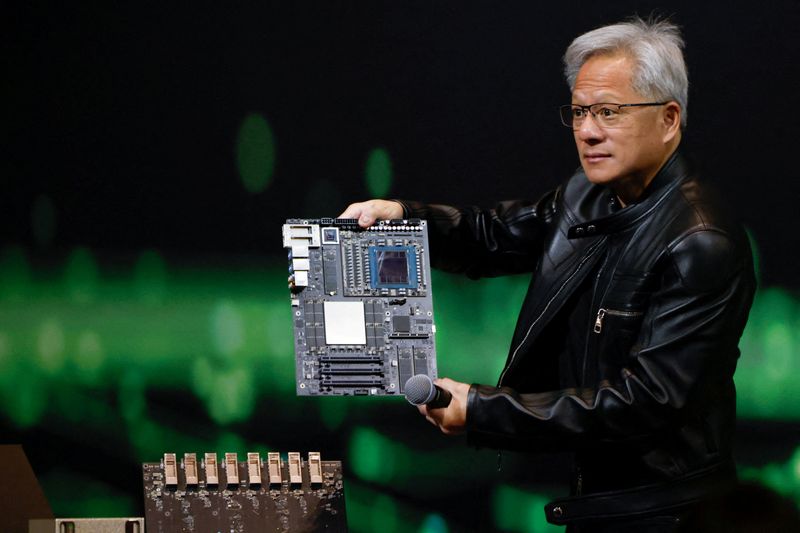

Most sectors of the economy are facing headwinds, including a 1.4% dip in technology. The influential Magnificent Seven stocks are largely in negative territory, with Apple (Nasdaq: AAPL) falling 2.8% amid scrutiny of its potential AI partnership with China’s Alibaba.

Here’s a look at where the markets stand:

Dow Jones Industrial Average: Down 34.77 (-0.06%)

Nasdaq Composite: Down 90.60 (-0.45%)

S&P 500: Down 17.72 (-0.30%)

Market Movers

After Walmart (NYSE: WMT) announced impending price hikes due to tariffs, Treasury Secretary Scott Bessent countered, suggesting the retailer would “absorb some of the tariffs.” WMT shares are currently down 2.3%.

Palantir Technologies (Nasdaq: PLTR) is down 3.8% but remains near its recent record peak of $130.18.

Bucking the trend, Novavax (Nasdaq: NVAX) surged 25.9% today after receiving regulatory approval for its COVID-19 vaccine.

Reddit (NYSE: RDDT) shares are trading lower by 4.4% following an analyst downgrade.

Take-Two Interactive Software (Nasdaq: TTWO) is climbing 3.7% higher today. Wedbush Securities analysts lifted their price target on the stock to $269 from $253 per share with an “outperform” rating attached.

The post S&P 500 (NYSEARCA: SPY) Live: Markets Surrender Ground on US Debt Downgrade appeared first on 24/7 Wall St..