S&P 500 (NYSEARCA: SPY) Live: Markets Stage Comeback on Mideast Hopes

This article will be updated throughout the day, so check back often for more daily updates. The markets are feeling optimistic today, trading higher across the board on hopes that Middle East tensions won’t intensify. This calmer outlook has prompted WTI crude oil prices to retreat after Friday’s rally, though crude continues to hover above […] The post S&P 500 (NYSEARCA: SPY) Live: Markets Stage Comeback on Mideast Hopes appeared first on 24/7 Wall St..

This article will be updated throughout the day, so check back often for more daily updates.

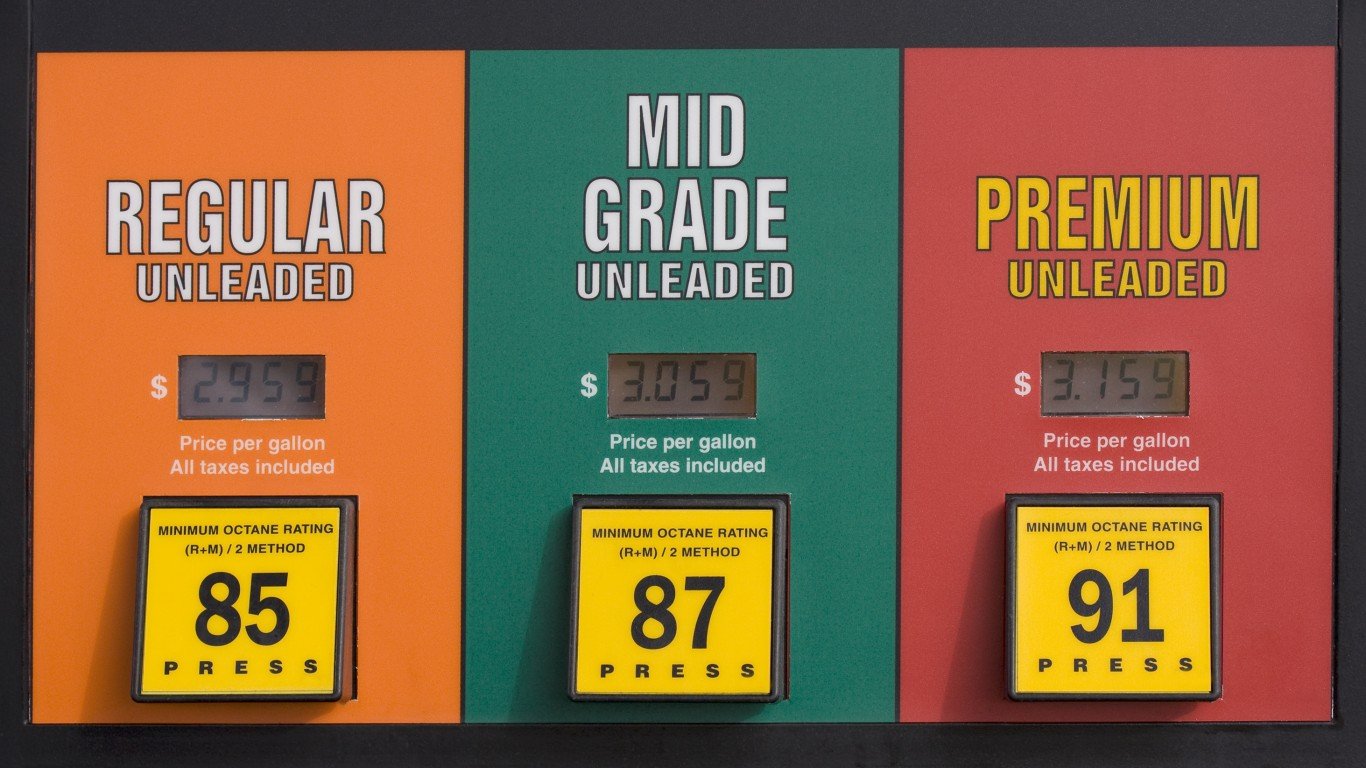

The markets are feeling optimistic today, trading higher across the board on hopes that Middle East tensions won’t intensify. This calmer outlook has prompted WTI crude oil prices to retreat after Friday’s rally, though crude continues to hover above the $71 per barrel mark. The SPDR S&P 500 ETF is tacking on 1.1% to start the week.

All three major stock averages are climbing, with the Nasdaq Composite leading the charge, up 1.5%. Every sector of the economy is in positive territory, sparked by a 1.1% advance in technology. Even the Magnificent Seven stocks are seeing green today, spearheaded by a 2% jump in Meta Platforms (Nasdaq: META), which has plans to roll out advertisements on its WhatsApp platform.

This week, all attention turns to the Federal Reserve as the FOMC prepares for its two-day meeting to decide the near-term trajectory of interest rates. President Trump has openly urged Fed Chairman Jerome Powell to initiate rate cuts, and recent cooling inflation data could indeed sway policymakers. Despite this, economists at Wells Fargo anticipate the Fed will maintain current rates, describing the situation as a “holding pattern.”

Here’s a look at the performance as of morning trading:

Dow Jones Industrial Average: Up 481.67 (+1.16%)

Nasdaq Composite: Up 290.53 (+1.5%)

S&P 500: Up 69.33 (+1.1%)

Market Movers

Quantum computing stocks are holding the spotlight, energized by the recent endorsement from Nvidia CEO Jensen Huang. The latest development sees Roth Capital raising its price target on D-Wave Quantum (Nasdaq: QBTS) by $6 to $18 per share, reiterating its “buy” rating. This optimistic outlook is fueled by greater revenue potential, pushing QBTS closer to its all-time high share price of over $19 per share.

Separately, U.S. Steel is up 5% today after President Trump officially approved its substantial $14.9 billion merger with Nippon Steel.

The post S&P 500 (NYSEARCA: SPY) Live: Markets Stage Comeback on Mideast Hopes appeared first on 24/7 Wall St..